Here are the takeaways from today's Morning Brief. sign up Every morning you will receive the following message in your inbox:

Getting older sucks, and I don't like it one bit.

My hair is getting thinner. I don't have the intense energy to wake up at 1:45 a.m. every day and get hooked on the markets and stocks. I try to eat red meat three times a month. Because people told me it was the right thing to do at this point in my life.

As far as I'm concerned, the only benefit that comes with getting older is experience.

And my experience with over a decade of analyzing and reporting on markets and leaders tells me that investors are completely caught up in the AI-fueled tech bubble.

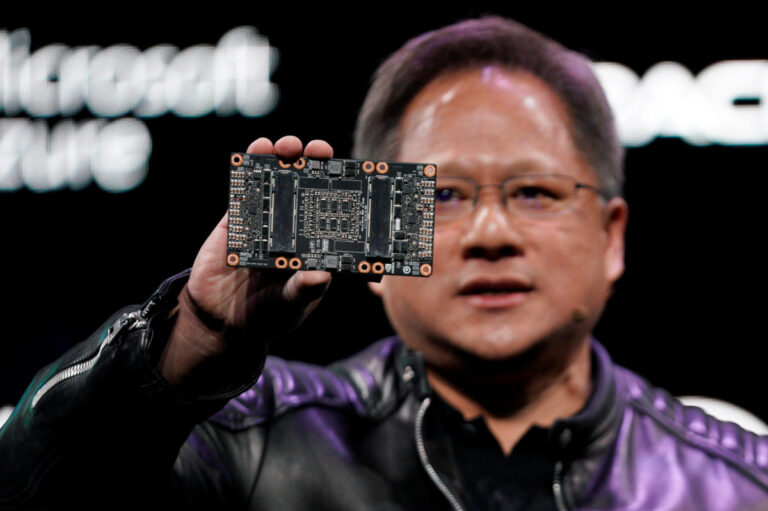

To be fair, this is similar to the cannabis and crypto stock bubbles of the past, as big tech companies like Nvidia (NVDA) and Microsoft (MSFT) have business models that mint real money. feels like a much different bubble. Their leaders are not inexperienced narcissists either (see Cryptospheric Villains of the Last Two Years).

But don't get me wrong. We are in a bubble that could end badly at some point.

Here are some factors that seem to support this view.

Everything comes together, but should it?

Nvidia stock rose 15% last Thursday following the results. The report also sent the overall market soaring.

Nvidia rivals AMD (AMD) and Arm (ARM) had strong bids. The new hot Yahoo Finance ticker Super Micro Computer (SMCI) has soared his 36%. Even Intel (INTC) got a tailwind from Nvidia. Additionally, the stock price of Meta (META), which has been at the forefront of acquiring NVIDIA chips, soared.

Isn't this all insane and akin to blind buying by FOMO traders?

Nvidia's surprising performance in a well-functioning market is bad news for competitors like AMD and Intel. Nvidia is selling more of its chips, which means fewer sales opportunities for rivals. Shouldn't their stocks go down?

Just because Meta owns and is using some new Nvidia chips, how will that positively impact its revenue and cash flow over the next four quarters? Will it really?

The point is, investors are behaving irrationally as NVIDIA releases eye-popping financial numbers and the hype machine descends on social media. It makes sense until it doesn't, and that's classic bubble action.

Justification of overestimation

Still not convinced that this is an AI-powered tech bubble?

Now look at the typical Wall Street behavior of justifying increasingly high valuation multiples for stocks.

“It is estimated that by 2024 it will be 29 times more [earnings per share]”Nvidia trades at lower multiples compared to peers Intel and AMD,” one analyst wrote in a note following Nvidia's surging earnings. Nvidia remains the frontrunner. ”

I'm not saying NVIDIA shouldn't be valued highly in the market. I didn't say that at all, so please don't cut me into pieces over email.

What I am asking you to do is dismantle the above commentary that is increasingly creeping into technology reporting.

In this case, analysts believe that 1) higher price multiples for slow-growing Intel and AMD are OK because AI is, or appears to be, very popular, and 2) Nvidia's stock price is about 33% higher than its stock price. The company rationalized that it deserved to trade at a premium of 50%. The S&P 500's P/E ratio is already high.

NVIDIA's valuation isn't surprisingly compelling considering earnings estimates are through the roof. This is the absolute perfect tech stock.

But in a tech bubble, anything goes, right?

I thought I couldn't stop it

Nothing says “investment bubble” like unbridled confidence. It's the feeling that no matter what stock you buy, at any price, at any time, it will only rise forever. This makes you feel like an investing genius and makes you more inclined to take risks.

Here are some insights that point to the mass overconfidence prevalent in the market.

Consistent with its bullish stance, financial services firm Charles Schwab announced this week that traders' confidence in their own decisions had reached the highest level since it began tracking trader sentiment. From a sector perspective, traders are the most bullish on information technology (shocking). They are very optimistic about his AI stock in particular (shocking).

Newsflash: You are not an investing genius. The best thing you can do now to increase your wealth is recognize that it's time to lay the foundations to start protecting the wealth created by the tech bubble.

Rely on your investment experience and all that.

Brian Sozzi I'm the executive editor of Yahoo Finance. Follow Sozzi on Twitter/X @BrianSozzi And even more linkedin. Have a tip about a deal, merger, activist situation, or more? Email brian.sozzi@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance