key insights

-

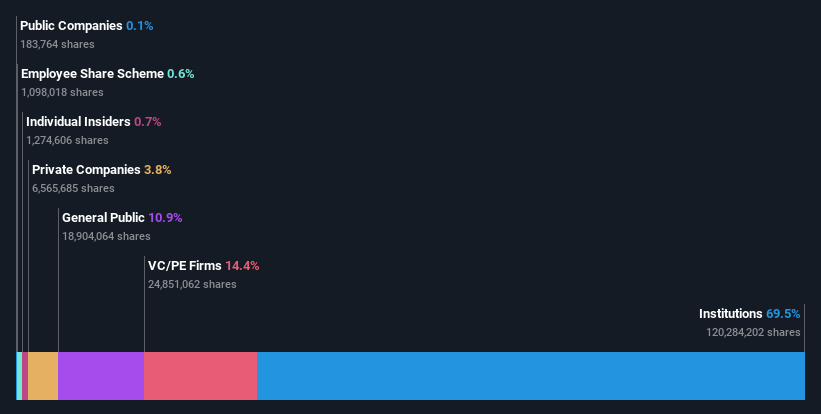

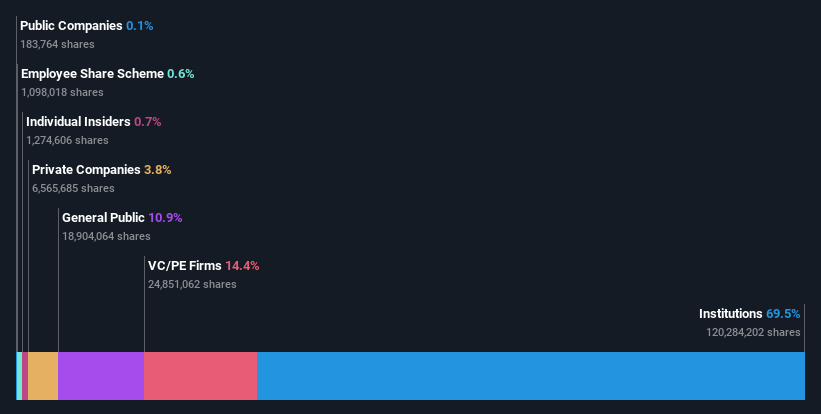

The fact that institutional investors own a large amount of Molten Ventures means that they have a large influence on the company's stock price.

-

A total of nine investors hold a majority stake in the company, with an ownership interest of 52%.

-

Insiders have recently bought

If you want to know who really controls Molten Ventures Plc (LON:GROW), you'll have to take a look at the makeup of its share registry. We can see that institutional investors hold the majority, with their 69% ownership in the company. In other words, the group will receive the maximum benefit (or maximum loss) from its investment in the company.

Because institutional investors have access to large amounts of capital, their market trends tend to be closely monitored by retail and retail investors. Therefore, a significant portion of institutional funds invested in a company is usually a huge vote of confidence in the company's future.

Let's delve deeper into each type of owner at Molten Ventures, starting from the image below.

Check out our latest analysis for Molten Ventures.

What does institutional ownership tell us about Molten Ventures?

Institutions typically measure a stock against a benchmark when reporting to their own investors, so enthusiasm for a stock often increases once it's included in a major index. We would expect most companies to have some institutions on their register, especially if they are growing.

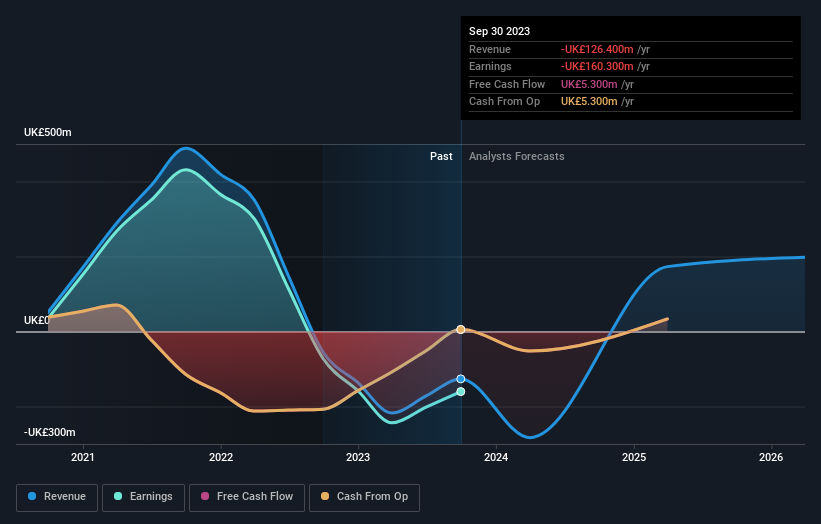

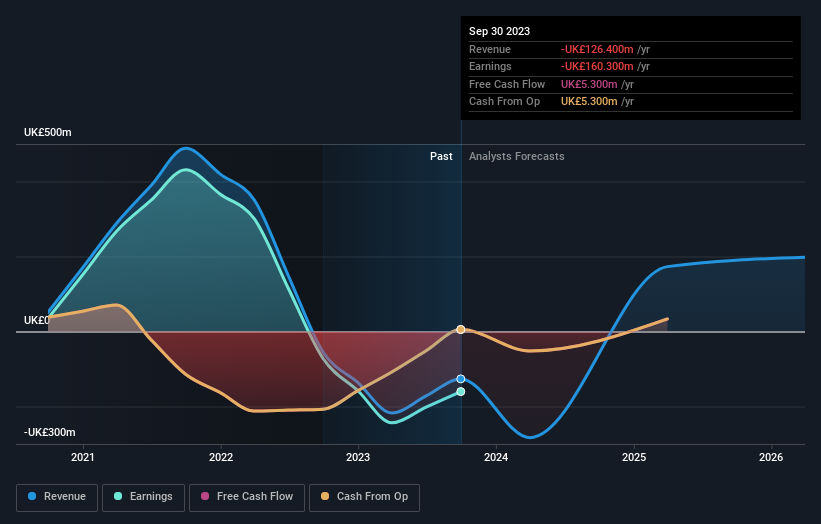

As you can see, institutional investors have a fair amount of stake in Molten Ventures. This suggests some credibility among professional investors. But we can't rely on that fact alone because institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. If such a trade goes wrong, multiple parties may compete to sell stock quickly. This risk is higher for companies without a history of growth. You can see Molten Ventures' historic earnings and revenue below, but keep in mind there's always more to the story.

Institutional investors own more than half of the outstanding shares, so the board will need to pay attention to their preferences. Hedge funds don't have many shares in Molten Ventures. The company's largest shareholder is Ireland Strategic Investment Fund, with an 8.1% stake. Meanwhile, the second and third largest shareholders hold 8.0% and 6.9% of the shares outstanding, respectively.

We also observed that the top 9 shareholders account for more than half of the shareholder registry, with a few small shareholders balancing the interests of the large shareholders to some extent.

Researching institutional ownership is a good way to assess and filter a stock's expected performance. The same can be done by studying analyst sentiment. There is some analyst coverage of the stock, but not a lot. Therefore, there is room for more coverage.

Insider ownership in Molten Ventures

The definition of a company insider can be subjective and varies by jurisdiction. Our data reflects individual insiders, and at least captures board members. The answers of company management to the board of directors and the latter must represent the interests of shareholders. In particular, top-level managers may serve on the board themselves.

Insider ownership is positive when it signals leaders are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative depending on the situation.

Our data suggests that insiders own less than 1% of Molten Ventures Plc in their own names. However, they may have an indirect stake through a corporate structure that we do not address. It appears that the board owns approximately UK£3.1m worth of shares. This equates to a market capitalization of his 426 million British pounds. Many people tend to prefer boards with larger stakes. As a next step, we recommend checking out this free overview of insider buying and selling.

Public ownership

The general public, including retail investors, owns 11% of the company, so they can't be easily ignored. Although this size of ownership is significant, it may not be enough to change company policy if the decision is not aligned with other large shareholders.

private equity ownership

Private equity firms hold a 14% stake and may influence Molten Ventures' board of directors. Some investors may be encouraged by this, as private equity may be able to encourage strategies that help the market recognize a company's value. Alternatively, those holders may withdraw from their investment after the initial public offering.

Private company ownership

Private companies appear to own 3.8% of Molten Ventures shares. It's hard to draw any conclusions from this fact alone, so it's worth finding out who owns these private companies. Insiders and other parties may have an interest in the stock of a public company through another private company.

Next steps:

I think it would be very interesting to see who exactly owns the company. But to really gain insight, you need to consider other information as well. For example, consider the ever-present fear of investment risk. We've identified 3 warning signs for you We are affiliated with Molten Ventures (obnoxious because there are at least two of them) and understanding them should be part of your investment process.

If you want to know what analysts are predicting in terms of future growth, don't miss this free Report on analyst forecasts.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.