With its share price down 12% over the past month, it's easy to ignore Shangri-La Hotels (Malaysia) Berhad (KLSE:SHANG). Since a company's long-term performance usually drives market outcomes, we decided to examine the company's financials to determine if the downward trend continues. In particular, today I would like to pay attention to Shangri-La Hotels (Malaysia) Berhad's ROE.

ROE or return on equity is a useful tool for evaluating how effectively a company can generate returns on the investment it receives from its shareholders. In other words, ROE shows the return that each dollar of a shareholder's investment generates.

Check out our latest analysis for Shangri-La Hotels (Malaysia) Berhad.

How do you calculate return on equity?

ROE can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, Shangri-La Hotels (Malaysia) Berhad's ROE is:

2.2% = RM20 million ÷ RM912 million (Based on trailing 12 months to December 2023).

“Return” is the profit over the past 12 months. This means that for every RM1 of shareholders' equity, the company generated RM0.02 in profit.

What is the relationship between ROE and profit growth rate?

So far, we have learned that ROE is a measure of a company's profitability. Depending on how much of these profits a company reinvests or “retains”, and how effectively it does so, we are then able to assess a company's earnings growth potential. Generally, other things being equal, companies with high return on equity and profit retention will have higher growth rates than companies without these attributes.

A side-by-side comparison of Shangri-La Hotels (Malaysia) Berhad's revenue growth and ROE 2.2%

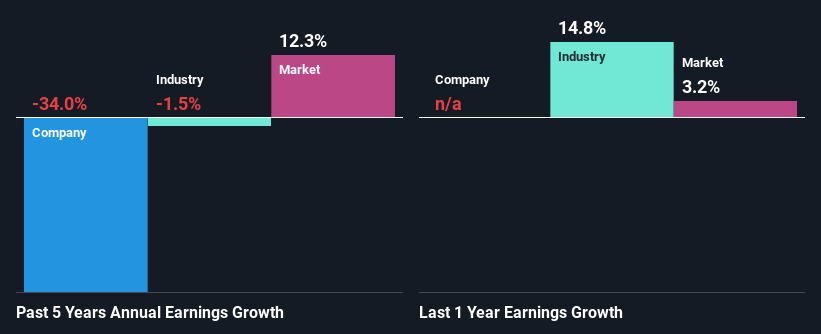

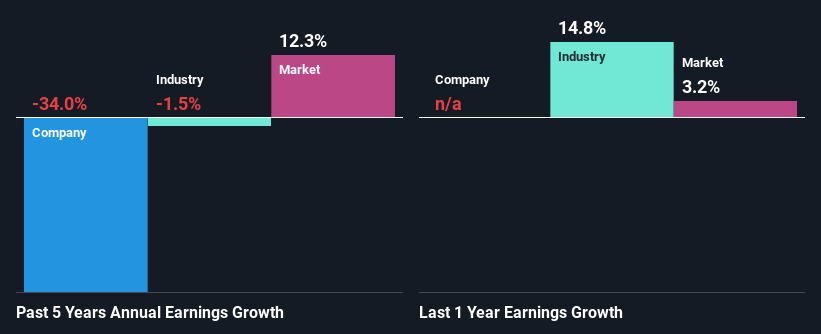

It's clear that Shangri-La Hotels (Malaysia) Berhad's ROE is quite low. Not only that, but his ROE for the company is not at all impressive, even when compared to his industry average of 3.9%. Considering the circumstances, it is not surprising that in the past five years, Shangri-La Hotels (Malaysia) Berhad's net profit has decreased by his 34%. We believe that other factors may also be at play here. For example, a company's capital allocation is inadequate, or a company's dividend payout ratio is too high.

Next, we find that Shangri-La Hotels (Malaysia) Berhad's performance remains quite bleak when compared to an industry whose profits have shrunk at a rate of 1.5% over the same five-year period. Revenues are shrinking faster than the industry.

Earnings growth is an important metric to consider when evaluating a stock. The next thing investors need to determine is whether the expected earnings growth is already built into the stock price, or the lack thereof. That way, you'll know if the stock is headed for clear blue waters or if a swamp awaits. Is Shangri-La Hotels (Malaysia) Berhad significantly rated compared to other companies? These 3 rating scales can help you decide.

Is Shangri-La Hotels (Malaysia) Berhad making good use of its profits?

Shangri-La Hotels (Malaysia) Berhad's very high three-year median payout ratio of 192% over the past three years suggests that the company is paying out more to shareholders than it is earning, which is why This explains the company's shrinking profits. Paying dividends above your means is usually not feasible in the long term. Visit our website to learn about the two risks he has identified for Shangri-La Hotels (Malaysia) Berhad. risk dashboard It is available for free on this platform.

Furthermore, Shangri-La Hotels (Malaysia) Berhad has been paying dividends for at least 10 years, suggesting that management must have known that shareholders wanted dividends more than profit growth.

conclusion

Overall, you should think carefully before deciding on any investment action regarding Shangri-La Hotels (Malaysia) Berhad. His ROE in particular is very disappointing, not to mention the lack of proper reinvestment in the business. As a result, revenue growth was also very disappointing. So far, we've only briefly covered the company's revenue growth. You can do your own research on Shangri-La Hotels (Malaysia) Berhad and see its past performance by viewing it for free. Detailed graph Analysis of past profits, revenue, and cash flows.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.