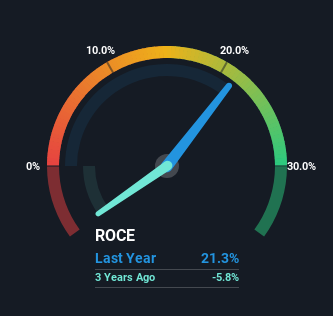

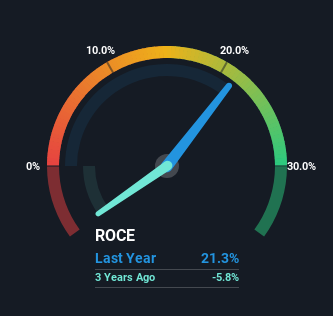

Finding a business with significant growth potential isn't easy, but it's possible if you focus on a few key financial metrics. One common approach is to look for companies that: Return value Capital employed increasing with growth (ROCE) amount of capital employed. After all, this shows that this is a business that is increasing its profitability and reinvesting its profits. With that in mind, the trends we see are: Rhymes Schlossklinikens (ETR:LIK) looks very promising, so let's take a look.

About Return on Capital Employed (ROCE)

For those who have never used ROCE before, it measures the “return” (pre-tax profit) that a company generates from the capital employed in its business. Analysts use the following formula to calculate LIMES Schlosskliniken.

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.21 = 4.8 million euros ÷ (27 million euros – 3.9 million euros) (Based on the previous 12 months to June 2023).

therefore, LIMES Schlosskliniken's ROCE is 21%. In absolute terms, this is a significant gain, even better than the healthcare industry average of 5.9%.

Check out our latest analysis for LIMES Schlosskliniken.

Although the past does not represent the future, it can be helpful to know how a company has performed historically. That's why I created this graph above. If you're interested in finding out more about LIMES Schlosskliniken's past, check out this free A graph covering LIMES Schlosskliniken's past earnings, revenue and cash flow.

What can we learn from LIMES Schlosskliniken's ROCE trend?

We are pleased to see that LIMES Schlosskliniken has profited from its investment and is generating some pre-tax profits. The company was in the red five years ago, but now has a profit of 21%, which is eye-watering. On top of that, LIMES Schlosskliniken is employing 182% more capital than before, which is not surprising for a company trying to ensure profitability. This indicates that the company has plenty of reinvestment opportunities that can generate higher returns.

LIMES Schlosskliniken's ROCE Conclusion

Simply put, we are pleased to see that LIMES Schlosskliniken's reinvestment efforts have paid off and it is now profitable. The impressive total return of 179% over the past three years shows that investors are expecting even better things to happen in the future. With that in mind, we think LIMES Schlosskliniken is worth considering further, as it could have a bright future ahead if it can maintain these trends.

In the end, we found that 2 warning signs for LIMES Schlosskliniken Note (1 is a concern).

If you want to see other companies making high profits, check us out. free Here is a list of companies with strong balance sheets and high profits.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.