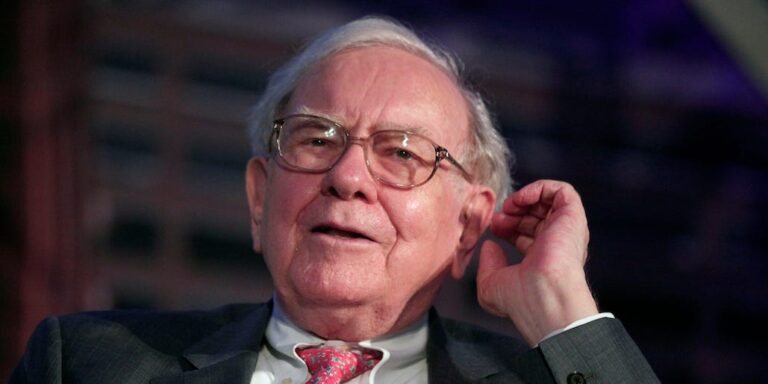

- Warren Buffett's Berkshire Hathaway is the result of an incredible turnaround, says Jacob McDonough.

- The author said the company started with three failed businesses, so it was unlikely to succeed.

- Historians praised Pilot's attractive brand and real estate, now wholly owned by Berkshire.

The rise of Warren Buffett's Berkshire Hathaway is a remarkable turnaround story, said the company's early chronicler.

“Berkshire as we know it today all started with three failed businesses,” Jacob McDonough, author of Capital Allocation: The Financials of a New England Textile Mill 1955 – 1985, told Business Insider. Told.

He was referring to Diversified Retailing, Blue Chip Stamp and Berkshire, then a textile company that Mr. Buffett bought in 1965.

Mr. Buffett and his late business partner Charlie Munger merged their first two companies into Berkshire in 1978 and 1983, respectively, after their retail and trading stamp businesses declined. They shut down Berkshire's struggling textile business in 1985.

As a result, Buffett and Munger found themselves in a situation where, just 20 years later, the three companies they had bet heavily on were virtually worthless. Still, “Buffett not only recovered his investment in these three businesses, but turned them into one company with a valuation approaching $1 trillion,” McDonough said.

“It would have been amazing just to have survived alone to this day if I had been entrusted with the trade in textiles, trade stamps and department stores, but the success achieved despite this hardship is even more difficult to understand,'' he says. added.

Mr. McDonough believed that Berkshire's unexpected success speaks to the flexibility and adaptability of its management team. Mr. Buffett and Mr. Munger pivoted from business to business as needed. They eventually created a vast web of subsidiaries across insurance, energy, railroads, manufacturing, retail, services, and other industries.

Berkshire currently owns billions of dollars worth of stock in companies such as Geico and Dairy Queen, as well as Apple, Kraft Heinz and other publicly traded companies.

praise to the pilot

Mr. McDonough praised Berkshire's latest deal, the acquisition of the last 20% of Pilot Travel Centers. His chain of truck stops generated approximately $70 billion in revenue in 2022. That's more than Nike, Coke, and Netflix.

The founder and portfolio manager of McDonough Investments highlighted Buffett's comments about pilot real estate at Berkshire's annual meeting last year. Berkshire's CEO said the company's “hundreds of locations along the interstate” are “unmatched.”

“They're not going to move the interstate two miles to the right,” Buffett added.

“People will probably continue to use the highways for decades, and Pilot would be well placed to serve those customers,” McDonough said. “This is a lasting advantage that will be difficult to undermine.”

He also pointed to Pilot's strong brand and the consistently high quality experience it provides compared to other truck stops.

Buffett, who is famous for his emphasis on the “moat” — a durable barrier to competition — of assets such as brands and real estate, may have bought Pilot in part because of its strength in that regard. expensive.