Investors are excited about this S&P500 It has reached new highs and is expected to go even higher. It takes time, but the goal of investing is long-term compounding. However, if economic trends continue to be positive this year, the market could end 2024 even higher.

In the short term, investors are waiting for more positive news from the companies they are watching. SoFi technology (NASDAQ:SOFI) was a knockout in 2023, finishing the year with a 116% return. SoFi stock could soar once January ends.

Why is SoFi so popular?

SoFi is an all-digital financial services platform that started as a student loan cooperative. With this as a baseline, you can scale with younger and novice customers in mind, and people love the easy-to-use interface that eliminates many pain points in managing their financial activities.

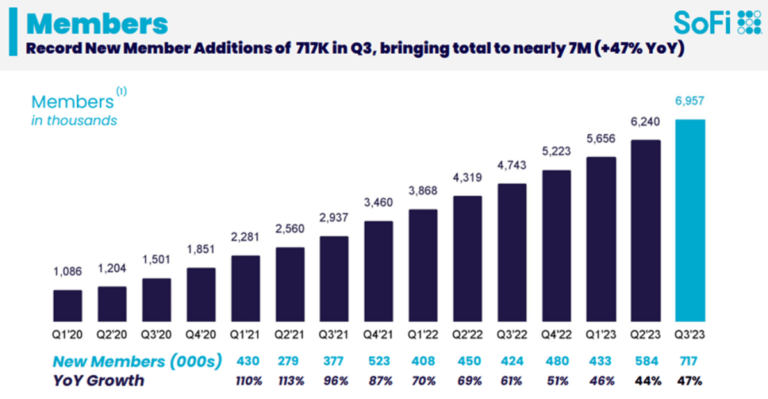

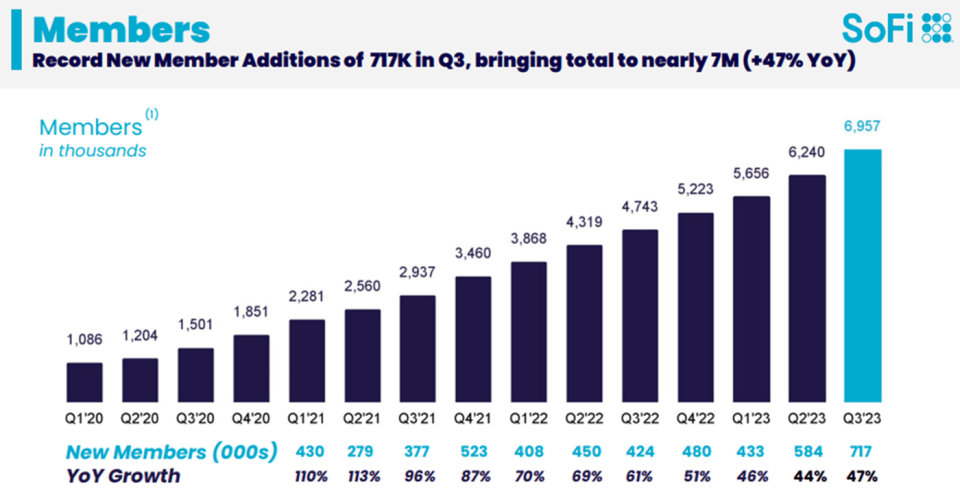

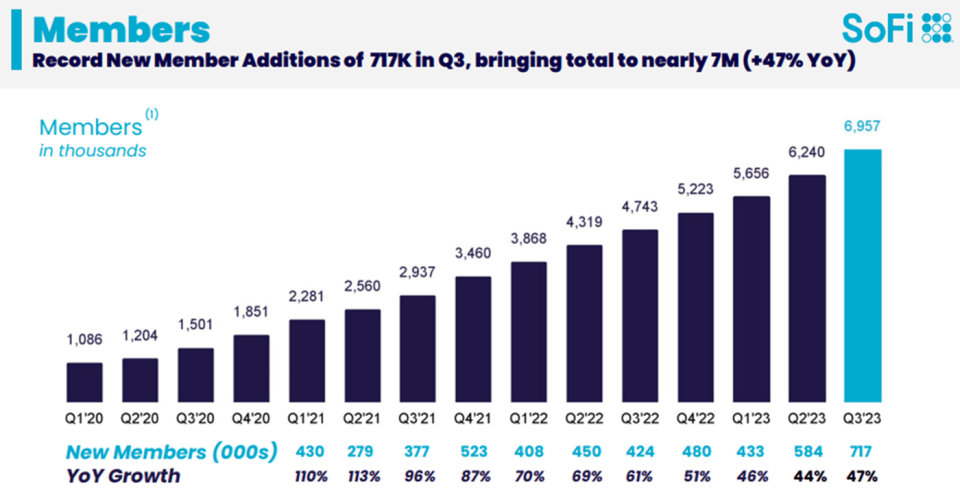

The company continues to onboard new members at a rapid pace, with momentum accelerating in the third quarter of 2023, with 717,000 new members and over 1 million new product adoptions.

High interest rates can affect banks, leading to higher default rates and higher loss provisions, as well as lower loan originations. However, it may also have a positive impact by increasing the net interest margin. For small digital banks like SoFi, tough economic times present an opportunity to attract new customers looking for better interest rates and an upgraded experience. While SoFi has been successful in attracting new demographics and generating higher profit margins, its lending arm is also currently performing well.

The student loan business, which was severely impacted by the loan moratorium, is benefiting as loan payments recover and borrowers convert their loans to new providers with better terms. Student loan originations in the third quarter more than doubled compared to the same period last year.

SoFi's acquisition of Golden Pacific Bancorp in 2022 marked a turning point in its trajectory. More than just a lender, SoFi has become a full-service financial services company with diversified businesses. There are two main reasons why this is important to SoFi. One is new opportunities to benefit from all kinds of products and services through increased sales. The second is how all these segments work together to grow your business without adding high costs.

Management calls this the financial services productivity loop, which leads to greater scale and higher profits. All three of SoFi's segments (Lending, Technology Platforms and Financial Services) reported positive contribution margins for the first time in the third quarter.

the best is yet to come

SoFi is still a young company, figuring out its future direction, and benefiting from high growth. Third-quarter sales increased 27% year over year, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased 121% to $98 million. The company's growth strategy is working and the runway for growth is long.

SoFi has not yet reported net income, but management is guiding for a positive net income in the fourth quarter of 2023. The government has reiterated that guidance many times. However, as the fourth quarter results approached, SoFi stock plummeted, dropping 23% in 2024. This is mainly due to analyst downgrades, but it is not uncommon for stocks that have been rising to fall before earnings are announced.

SoFi is scheduled to report its fourth quarter results on Monday, and if it shows strong revenue growth and profits, the company's stock is expected to soar. But don't buy SoFi stock for that reason alone. SoFi has executed a good business model and is gaining market share. It has incredible long-term potential and could become a top growth stock in 2024.

Should you invest $1,000 in SoFi technology right now?

Before buying SoFi Technologies stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors can buy right now…and SoFi Technologies wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor The service has more than tripled S&P 500 returns since 2002*.

See 10 stocks

*Stock Advisor will return as of January 22, 2024

Jennifer Saibil works at SoFi Technologies. The Motley Fool has no position in any stocks mentioned. The Motley Fool has a disclosure policy.

Want to invest in the bull market? This Stock Could Soar Before January Is Even Over was originally published by The Motley Fool