Global e-commerce auctioneer eBay Inc. (NASDAQ:EBAY) has outperformed earnings expectations for seven out of eight consecutive quarters according to MarketBeat. The stock is selling at an attractive low multiple of less than 8 times earnings compared to a global average of over 17 times for the retail cyclical industry. GuruFocus gives the company a GF Score of 88 and a target share price of $57.51, a 29% increase over the current share price as of this writing.

EBay’s trailing 12-month operating margin is over 7 times that of Amazon’s (NASDAQ:AMZN) and its ROE is 50%. However, industry analysts are lukewarm on the stock with an overall hold consensus, citing uphill battles against e-retail gargantuans Amazon, Alibaba (NYSE:BABA) and Walmart (NYSE:WMT), all of which are well positioned to capture market share.

This discussion will give a history of the adherence to the strategy that has given eBay good returns and the ability to continue its reign as the premier global e-auctioneer in a sea of e-retailers, including huge, formidable competitors like Amazon, Alibaba, JD.com (NASDAQ:JD) and Walmart. I will also give a brief perspective of why the stock has such cool analyst and investor sentiment.

Please note that I am not a financial advisor, and this article is intended only for informative purposes.

EBay margins compared to those of competitors (TTM ending of 09/30/2023)

|

Company |

EBAY |

AMZN |

WMT |

BABA |

JD |

ETSY |

|

Gross Margin |

72.13% |

46.24% |

24.27% |

37.61% |

14.69% |

70.56% |

|

Operating Margin |

20.83% |

4.76% |

3.96% |

13.81% |

2.68% |

11.19% |

|

Profit Margin |

26.99% |

3.62% |

2.55% |

14.47% |

2.22% |

12.30% |

|

Free Cash Flow Margin |

24.90% |

3.87% |

2.02% |

19.63% |

3.47% |

24.90% |

E-eommerce retail and online auctions

EBay is part of the highly competitive e-commerce retail industry. Its particular focus is online auctions or re-commerce as commonly known in the online retail and auction communities. The company’s e-commerce retail categories consist of primarily business-to-consumer and consumer-to-consumer merchandise versus the larger e-commerce environment that also involves business-to-business and business-to-government merchandise and transactions.

Compared to traditional brick-and-mortar stores, online retailers traditionally have lower start-up costs and capital expenditures that remove barriers to entry and increase competition. Disadvantages include the reliance on hosting providers and the threat of lost revenue or income when websites crash.

The global e-commerce market is expected to reach $6.7 trillion this year according to a report by Research and Markets. The online auction component of the global e-commerce market has an estimated compound annual growth rate of 12.36% until 2028. EBay is the dominant player in this space.

Focused business model

EBay’s mission is to connect people and build communities to create economic opportunity for all.

Its main business model revolves around providing marketplaces for third-party sellers and primarily business-to-consumer and consumer-to-consumer customers. The company makes money mainly through listing, transaction and advertising fees and takes no inventory. Even parts of its fulfillment process is managed by third-party partners. This allows the company to keep overhead lower than that of its competitors. This model has been robust enough to allow eBay to establish a first-mover advantage, expand globally and develop into a household name.

The company also takes great measures to create a network of loyal users by honing a community environment that targets small business and entrepreneurial sellers and value-oriented buyers and collectors. Operating expenditures are devoted to beefing up fraud detection and developing infrastructure and easy-to-use tools to facilitate user transactions and communication.

The industry shake-out after the dotcom bust was pivotable for eBay. Competition in the e-retail space, propelled solely by venture funding, quickly evaporated when funds dried up. Even Amazon, with its go-large growth philosophy during the late 90’s, had not achieved profitability by 2000 and almost collapsed. In contrast, eBay, with a streamlined business model, had achieved solid profits by that time. Also, its established B2C and C2C buyer and seller community and its market for used merchandise appealed to consumers in uncertain times and gave the company remarkable resiliency.

Although business model adherence has been strong throughout its history, eBay has made some miscalculations. The company has segued into other e-commerce and auction offerings that have deviated somewhat from its main strategy, including big-ticket items, classified and listing services and e-commerce site development services for brick-and-mortar retailers.

Problematic acquisitions, partnerships and diversions

Part of eBay’s growth strategy is through company acquisitions. The company has made over 70 acquisitions throughout its lifetime. Generally, these acquisitions have been well-intended and have been focused on obtaining synergies for the company, but not all have been congruent with eBay’s overall business strategy or have been easily assimilated into eBay’s corporate culture.

Offline sales of big-ticket items

In 1999, eBay acquired Butterfield & Butterfield to foray into big-ticket collectibles. The company also hoped to benefit from Butterfield’s appraisal and authentication services. However, customers were reluctant to purchase big-ticket items online and the softened economy in 2000 had reduced the demand for luxury items. The company sold Butterfields to Bonhams in 2002 for an undisclosed amount that analysts estimated was far below the initial purchase price. At that time, approximately 70% of Butterfield’s transactions occurred offline.

EBay also purchased Kruse International, which specialized in collector automobile auctions. Kruse International was an additional effort to reach the market for high-end items. By the fall of 2002, Kruse’s revenue had dropped by 50% from the time of purchase and eBay selected to sell the business back to its original owner to focus on its core online business.

Payment systems

EBay’s failed acquisition list also included prominent payment solution providers. The company bought Billpoint in 1999, but struggled to compete with PayPal (NASDAQ:PYPL), which had established a first-mover advantage in person-to-person payments. Further, its C2C user community eyed the integration of Billpoint with skepticism since eBay was so dominant at the time in marketplace transactions. The Billpoint service battled with PayPal for three years, when eBay finally ceded and reluctantly bought PayPal in 2002 and dismantled Billpoint.

In 2015, PayPal was spun off as a separate company.

Global expansion into Asia

By 2000, eBay had expanded into Europe and Australia, but hit roadblocks when expanding into the Asian market due to cultural clashes and Yahoo Auctions’ presence in Japan. EBay withdrew from Japan in 2002. Its China penetration attempt included the acquisition of EachNet, China’s largest online marketplace at the time, in 2003 for $180 million, but eBay’s entrance into the market was quickly trounced on by TaoBoa, owned by Alibaba. In 2007, eBay withdrew from the Chinese market as well.

Classifieds and listing services

EBay has also forayed into the online classifieds arena with the purchase of some companies like mobile.de and OpusForum.org in Germany, Marktplaats.nl in the Netherlands, LoQUo in Spain and Gumtree in the U.K. In addition to establishing eBay’s online classifieds business, these acquisitions also helped to establish its foothold in the global marketplace and broaden expansion in automobile categories. However, the company had problems with integrating various online classified stakes due to business or global culture differences.

The company bought a 28.4% stake in Craigslist in 2004 for $32 million to assist in building out its advertising listing business. EBay was initially planning a buyout of Craigslist, but the relationship between the two companies soured almost immediately when shortly after the deal, the New York Attorney General’s office began an antitrust investigation into the transaction, triggering Craigslist’s management to distance themselves from eBay to avoid antitrust litigation.

Further contentions occurred when eBay launched its Kijiji advertising listing service in the U.S. in 2007, which competed directly with Craigslist (Kijiji, started in 2005, was already an established listing service in Canada by that time). Craig Newmark and Jim Buckmaster, Craigslist’s founder and CEO, requested that eBay sell their shares back to the company, but eBay was unwilling to comply. After consulting outside council, Craigslist adopted a rights plan and sent eBay a letter giving it 90 days to resolve competitive activity before revoking its rights related to its share of the company. EBay filed an action with the Supreme Court of Delaware, accusing Craigslist of implementing a poison pill. Craigslist countersued, accusing eBay of unfair competition, misappropriation of trade secrets, false advertising, trademark infringement, and other wrongs. The court sided with eBay and the antagonistic relationship continued until 2015, when eBay decided to sell the shares back to Newmark and Buckmaster and dismiss litigation between the two companies.

EBay also purchased Rent.com in 2004 for a huge premium to gain ground in the real estate market and enhance its classified listing business. Analysts doubted that it was a good strategic move as the company was not aligned with eBay’s core business. Rent.com did not achieve profitability, and eBay sold the company in 2012 to PRIMEDIA at a $375 million loss from the original purchase price.

Video chat services

EBay bought Skype in 2005 for $2.6 billion, intending to use the service to enhance its community features between buyers and sellers, but its customer base did not embrace the service’s video chat features when conducting online transactions. The company took a $1.4 billion write-down on its acquisition in 2007 and divested 65% of the company two years later to a group of private investors for an estimated loss of approximately $700 million to focus on its commerce business. Microsoft (NASDAQ:MSFT) picked up Skype two years after the sale for $8.5 billion.

Brick and mortar e-commerce services

In 2011, eBay acquired GSI Commerce, a leading provider of e-commerce and interactive marketing services, for approximately $2.4 billion, a 51% premium, to expand its e-commerce and multichannel retailing capabilities. The acquisition continued to operate as a separate business unit and was rebranded as eBay Enterprises in June 2013.

At the same time, eBay divested most of its holdings in the unit’s e-retail specialty businesses to GSI’s founder and former CEO Michael Rubin for an undisclosed amount. By the end of 2015, the company decided to sell eBay Enterprises to a consortium of three investment companies for $925 million, a decrease of nearly $1.5 billion from the original purchase price. EBay’s shares dropped 6% after the announcement of the sale.

Current environment

Since 2019, eBay has restructured to refocus on its Marketplace business, but this is not the company’s first rodeo. It has made recommitments to this strategy in 2002 and 2009 in addition to this latest claim. Although its classified listing and StubHub business units were thriving, it sold classifieds to Adevinta for $9.2 billion and StubHub to viagogo. In addition, the company sold eBay Korea LLC to Emart for approximately $3 billion. Revenue streams now consist of the Marketplace and advertising and a standalone business unit, TCGplayer, which the company bought in 2022. The company also holds minority interests in Adeventa, Adyen warrant, Kakao Bank and Gmarket totaling $4.6 billion. EBay also recently invested in COMC, a marketplace for game card collectors. The proceeds from recent divestitures have allowed the company to maintain a healthy cash flow and implement a stock buyback program designed to increase shareholder value. Its investment in payment system integration, called Managed Payments, has improved the company’s take rate (the amount of revenue eBay gains per transaction.) This is a sound business strategy, but investors’ tentativeness is likely due to its growth uncertainty based on its erosion of market share against larger competitors.

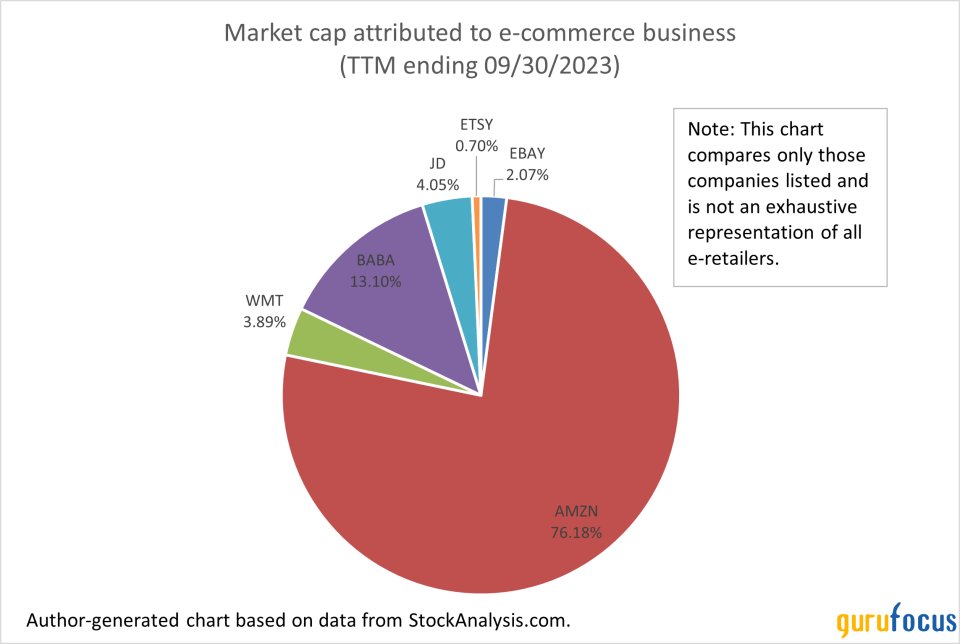

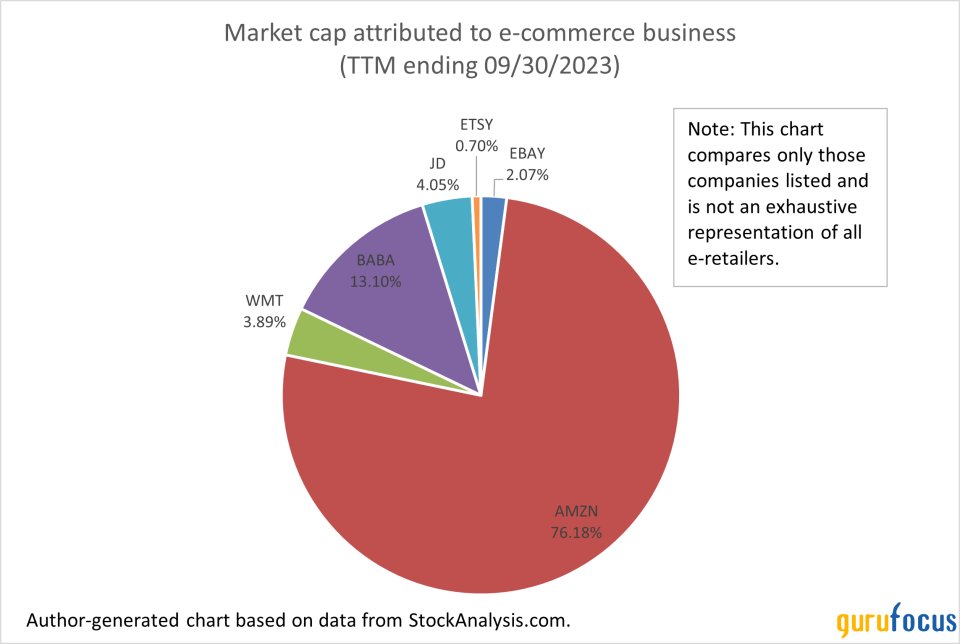

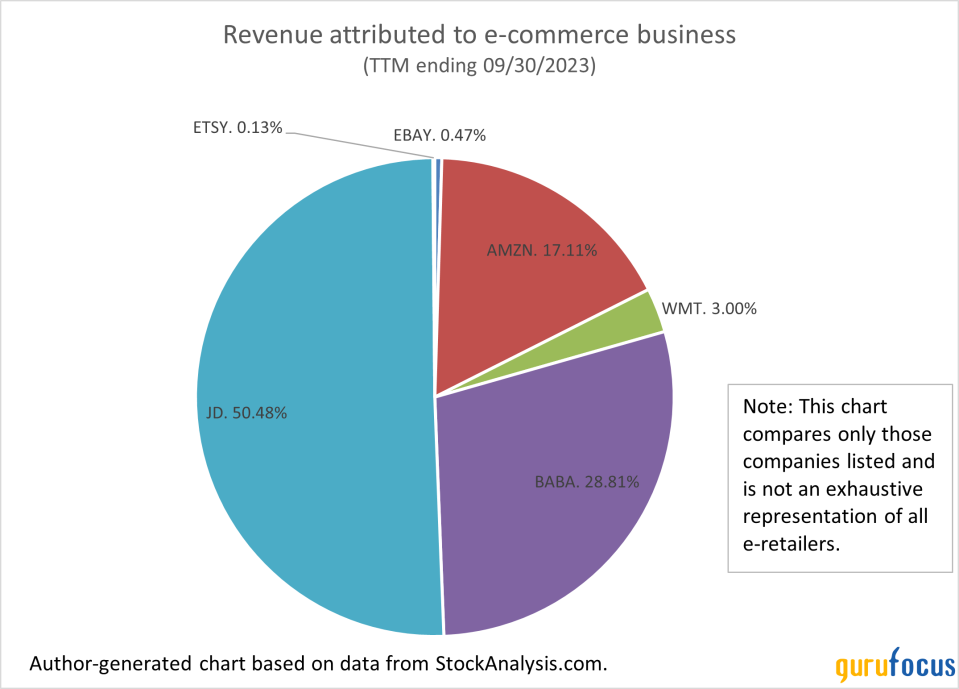

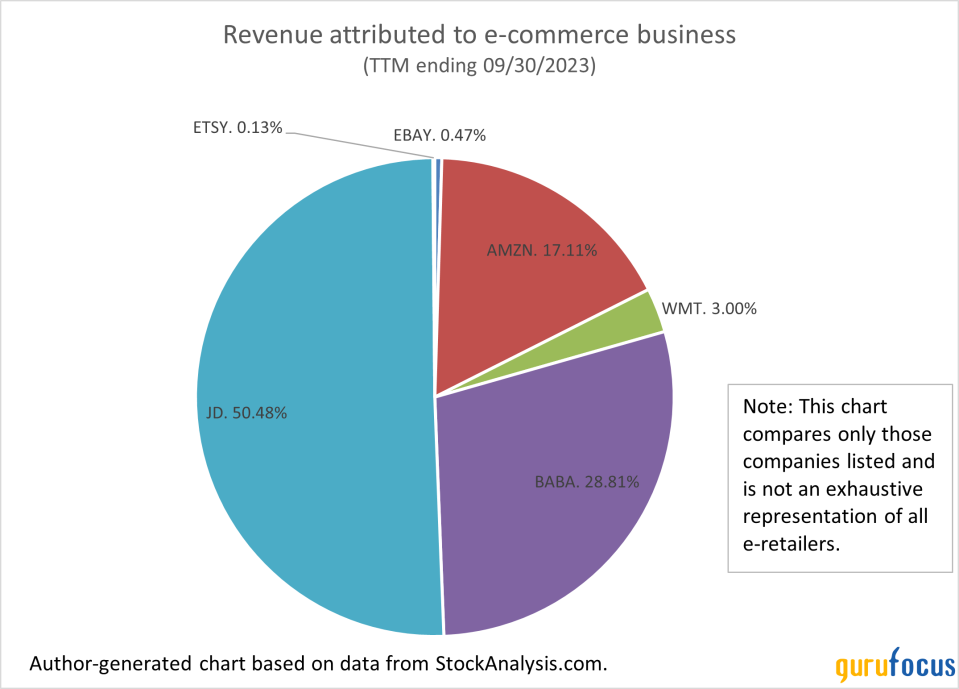

Amazon has approximately 40% of the online e-commerce retail market and over twice as many user visits as eBay. JD.com and Alibaba have dominated the Chinese fortress, and Walmart is gaining ground. Currently, 10% of Walmart transactions are done online. The charts below reflect eBay’s share of the e-commerce marketplace compared to those of competitors in terms of market capitalization and revenue.

As can be seen above, eBay’s position is minuscule compared to those of Amazon, Alibaba and JD.com. Amazon clearly dominates the e-retailer market in terms of market capitalization, indicating the stock still has strong investor sentiment despite selling for over 80 times earnings. JD.com dominates the field in terms of revenue, but sales are mostly confined to China. In that sense, Alibaba and JD.com are anomalies compared to other companies that have established a global presence. Most analysts anticipate additional erosion of eBay’s market share to its largest competitors. EBay lost its foothold as a dominant player in the global e-commerce market during the 2010s. Another concern is that eBay’s user base is aging. Users are typically older than those of other marketplaces and the site tends to be most popular among 55 to 65-year-old users, but the site has captured the attention of some younger users as well. The site is also touting its image as a sustainable commerce company that impacts the global environment by encouraging the reuse of existing products. EBay’s market share is strongest in the U.S., UK and Germany and the company has room to capture additional users in those two latter markets.

When viewed in this light, we can understand why investor and analyst sentiment is cool. EBay has carved out a niche in the wider market, but its future as a value play or a value trap depends on its ability to capture additional share in a mature, declining market. The current list of acquisitions includes Sneaker Con’s authentication business in 2021; KnownOrigin, TCGplayer and MyFitment Group in 2022; and Cetilogo in 2023. KnownOrigin is a marketplace for non-fungible token collectors. TCGplayer is an online marketplace for trading card games that is operated autonomously from eBay. MyFitment Group (consisting of myFitment LLC and Illumaware LLC) provides technology that allows users to ensure the proper fit for vehicle parts bought on eBay’s platform. Certilogico provides artificial intelligence-powered apparel and fashion goods authentication technology. EBay claims these acquisitions are aligned with Marketplace focus and will help build out its collectibles categories. Some of these acquisitions appear to be legitimate offshoots, but they could also become a replay of past failed buyouts. The bright spot is eBay has accumulated a vast amount of experience surrounding acquisitions and partnerships and appears to act quickly when business units go awry, thus avoiding sunk costs. With sound financials, eBay should be able to weather any storms of a softening market or its declining market position.

Conclusion

EBay’s success can be attributed to its niche business strategy focusing on the third-party trading market that generates good capital returns and brand success. For these reasons, the company is a stable investment that can continue to generate returns for its shareholders. Unfortunately, it is a mature company that’s market is declining.

In the past, eBay has attempted to gain synergies and capture additional users through seemingly aligned acquisitions and partnerships, but has made some miscalculations along the way. Its continued success and value to shareholders will depend on its ability to capture additional share of prospective markets without going too far off course.

This article first appeared on GuruFocus.