US Venture Capital Market Health Tech Venture Funding

DUBLIN, Feb. 22, 2024 (Globe Newswire) — The “US Venture Capital – Market Share Analysis, Industry Trends and Statistics, Growth Forecasts 2020-2029” report has been added. ResearchAndMarkets.com Recruitment.

The US venture capital market size in terms of assets under management will grow from USD 1.3 trillion in 2024 to USD 1.94 trillion by 2029, at a CAGR of 8.25% during the forecast period (2024-2029). is expected to grow.

Venture capital is typically raised from wealthy investors, investment banks, and other financial institutions. However, it does not necessarily take the form of money, but can also come in the form of technical or managerial expertise. Venture capital is typically allocated to small businesses that have exceptional growth potential or that appear poised to grow rapidly and continue to expand. Due to COVID-19, the number of VC rounds in the US has decreased by 44%. Venture capital funding to US-based companies has been strong, hitting new highs in 2020 and hitting new highs again in early 2021.

Venture capital funds operate similarly to private equity funds, with portfolios of companies invested in specific sectors. For example, a venture capital fund specializing in healthcare might invest in his portfolio of 10 companies focused on innovative healthcare technologies and devices. Venture capital funds are typically structured as partnerships, with the venture capital firm acting as the general partner and the investors acting as limited partners.

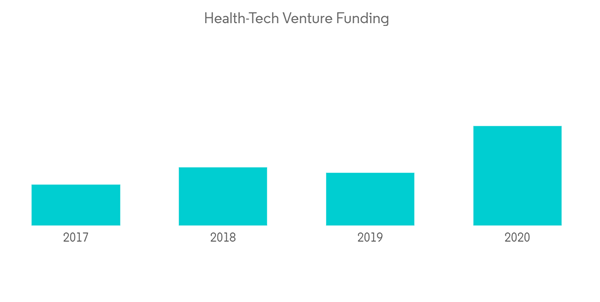

Health tech trends for record year

At the intersection of healthcare and technology, health tech innovators hold a unique position in the future of health. Investors, especially his CVC, can support innovators and the industry as a whole. Innovators can bring innovative business models and consumer-centric approaches. It is essential for investors, including industry incumbents, to mentor innovators, support them with industry and regulatory expertise and capital, and accelerate towards the future of health together.

Increases in venture capital funding to health tech innovators reached record levels during the year of the pandemic and continued unabated in 2021. Last year, venture capital funding to health tech innovators exceeded record returns. Venture funding for these innovators nearly doubled from the previous year, even as economies and industries, including the healthcare industry, were disrupted by the effects of the COVID-19 pandemic.

Number of venture capital investment deals increases to record high in 2021

Venture capital is a temporary equity investment in young, innovative, private companies. Although these companies do not have current earning power, they have above-average growth potential, making them attractive investment opportunities. Recently, the stage of investment has changed. In many cases, seed, early, and late-stage investing are now separate sub-industries within VC. A successful VC ecosystem requires healthy activity at each investment stage. Because each investment stage plays an essential role in the growth of a company. The VC investment landscape has changed over the past 20 years. VC megadeals more than doubled in 2021 compared to 2020. Many of these megadeals are for unicorns, as they tend to be skewed in size and are often late in their growth cycles.

Some of the companies mentioned in this report include:

For more information on this report, please visit https://www.researchandmarkets.com/r/h3m95f.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900