(Bloomberg) – U.S. stock futures fell after weaker-than-expected U.S. inflation data on Tuesday reinforced expectations that the Federal Reserve might not cut interest rates as quickly as expected. showed a slight rebound.

Most Read Articles on Bloomberg

S&P 500 contracts rose 0.2% after the worst inflation day decline since September 2022, while contracts in the tech-heavy Nasdaq 100 rose 0.4%. The dollar held steady as traders reduced expectations for an early Fed rate cut, while U.S. Treasury yields regained some of their gains from the previous day. U.S. inflation data erased the last remnants of the global bond rally that began in December on hopes that the Fed was finally easing.

Coming soon: Sign up for the Hong Kong edition for an inside guide to the money and people rocking Asia's financial hub.

There was good news on Wednesday for UK traders looking forward to policy easing from the Bank of England. UK inflation is lower than expected in January, and underlying price pressures have not risen as much as markets and the BoE had feared. The pound reversed its earlier gains and British government bonds rebounded in response to the data.

Europe's Stoxx 600 index was firm as investors assessed the latest earnings news. Heineken NV fell 6.5% after warning that persistent inflation and economic concerns will weigh on beer demand in 2024. ABN AMRO Bank NV has rebounded after announcing a new share buyback with the participation of the Dutch government as part of its planned sale of financial institutions.

Stock prices in South Korea, Japan, and Australia fell, with Asian stocks mainly falling. Hong Kong indexes reversed early losses as trading resumed after the Lunar New Year holiday, with investors focused on what more the Chinese government can do to stem the collapse. Chinese markets remain closed.

The yen rebounded slightly from Tuesday's selloff after Japan's top foreign exchange official, Masato Kanda, warned that recent movements have been rapid and that authorities are prepared to take action if necessary. His comments were immediately reinforced by Finance Minister Shunichi Suzuki. Japan's 10-year government bond yield rose to its highest level since December.

“The authorities' comments probably put a cap on the dollar-yen today, but it wasn't strong enough to change the direction of the dollar-yen,” said Yukio Ishizuki, senior currency strategist at Daiwa Securities. A slight decline in the dollar and a rebound in the yen have halted the decline in US bond yields and Japanese stocks in Asia. ”

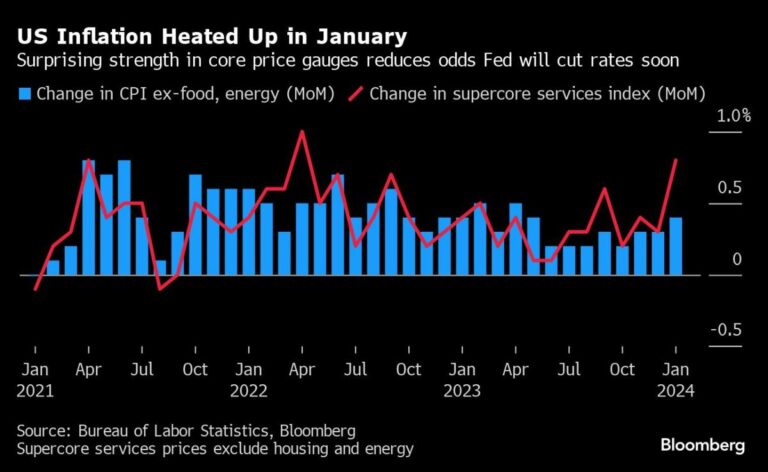

U.S. consumer price index (CPI) data was a disappointment for investors, after recent downward pressure on prices had raised hopes for interest rate cuts this year. The numbers also lent credence to the wait-and-see approach emphasized by Chairman Jerome Powell and the chorus of Fed speakers. Swaps traders are gradually lowering their expectations for Fed rate cuts through July, while the stock market's “fear gauge” VIX index ended above 15 for the first time since November.

Swap contracts that referenced Fed policy meetings (as recently as mid-January fully priced in a May interest rate cut and 175 basis points of easing through the end of the year) were in disarray. The probability of a rate cut in May has fallen to about 32% from about 64% before the inflation data was released, and expectations for a rate cut this year are less than 90 basis points.

Consumer prices rose 4% in January from a year earlier, the Office for National Statistics said on Wednesday, at the same pace as in December. The BOE and private economists had expected inflation to rise to 4.1%.

The inflation data triggered a repricing of BOE interest rate bets, with traders resuming bets on three quarter-point cuts this year. Money markets had priced in about 72 basis points (bp) of easing in 2024, compared to 61 basis points (bp) the previous day.

Oil prices firmed up after mixed U.S. inventory reports, but OPEC and the IEA offered contrasting outlooks for global oil markets. Gold is trading in a narrow range after falling below $2,000 an ounce for the first time in two months, while Bitcoin is trading around $50,000.

This week's main events:

-

Eurozone industrial production, GDP, Wednesday

-

BOE Governor Andrew Bailey testifies before the House of Lords Economic Committee on Wednesday

-

Chicago Fed President Austan Goolsby speaks Wednesday

-

Fed Vice Chairman for Supervision Michael Barr speaks on Wednesday

-

Japan's GDP, industrial production, Thursday

-

US manufacturing industry, number of new unemployment insurance claims, industrial production, retail sales, business inventories, Thursday

-

ECB President Christine Lagarde speaks on Thursday

-

Atlanta Fed President Rafael Bostic speaks Thursday

-

Fed Director Christopher Waller speaks Thursday

-

ECB Chief Economist Philip Lane speaks on Thursday

-

U.S. Housing Starts, PPI, University of Michigan Consumer Sentiment, Friday

-

San Francisco Fed President Mary Daley speaks on Friday

-

Fed Vice Chairman for Supervision Michael Barr speaks on Friday

-

ECB board member Isabel Schnabel speaks on Friday

The main movements in the market are:

stock

-

As of 8:12 a.m. London time, the Stoxx European 600 was up 0.1%.

-

S&P 500 futures rose 0.2%

-

Nasdaq 100 futures rose 0.3%

-

Dow Jones Industrial Average futures little changed

-

MSCI Asia Pacific Index falls 0.5%

-

MSCI Emerging Markets Index falls 0.2%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0701.

-

The Japanese yen rose 0.2% to 150.46 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2299 yuan to the dollar.

-

The British pound fell 0.3% to $1.2552.

cryptocurrency

-

Bitcoin rose 0.5% to $49,796.51

-

Ether rose 0.7% to $2,652.49

bond

-

The 10-year Treasury yield fell 3 basis points to 4.29%.

-

Germany's 10-year bond yield fell 3 basis points to 2.37%.

-

UK 10-year bond yields fell 8 basis points to 4.07%.

merchandise

-

Brent crude oil remains largely unchanged

-

Spot gold fell 0.2% to $1,988.38 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Yumi Teso and Rob Verdonck.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP