(Bloomberg) — Stocks rose as investors awaited cues on near-term trades in a busy week of inflation data and policy decisions from the U.S. Federal Reserve and Japan.

Most Read Articles on Bloomberg

S&P 500 and Nasdaq 100 futures rose after Bloomberg reported that Apple is in talks to put Google's Gemini artificial intelligence engine in iPhones. Google's parent company Alphabet rose as much as 3% in pre-market trading, while Apple rose as much as 0.8%. European stocks rose slightly.

British policy decisions and inflation data are due later in the week, but expectations are growing that the Bank of Japan will end its negative interest rate policy at Tuesday's meeting. The main focus will be on Wednesday, when Fed policymakers meet to make decisions that could set the tone for global stocks in the next quarter.

While Fed Chairman Jerome Powell has signaled that the central bank is mostly confident it will cut rates, bond traders appear to have painfully surrendered to the reality of a long period of high prices. The 10-year Treasury yield remained near a three-week high on Monday and rose more than 20 basis points last week. The dollar exchange rate was stable.

“While the Fed may have less confidence in inflation than it has in the past, it remains confident in the disinflationary trend,” Bank of America economists, including Michael Gapen, wrote in a note to clients. said.

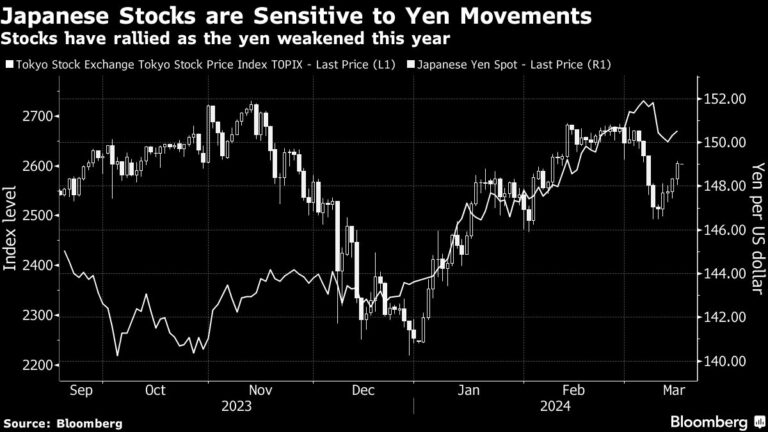

In Japan, the Nikkei stock average rose by the most in a month and the yen weakened against the dollar on signs that markets were pricing in a possible rate hike.

“Japanese stocks are rising on the back of a weaker yen and expectations that the currency won't appreciate even if the central bank raises interest rates,” said Charu Chanana, a strategist at Singapore-based Saxo Capital Markets. Stated.

Elsewhere this week, the Reserve Bank of Australia is expected to extend its interest rate suspension, while Bank Indonesia and the Bank of England are also expected to make policy decisions. Eurozone inflation statistics and Reddit's initial public offering are also scheduled.

FedEx and Nike give clues to the economy: U.S. earnings a week ago

In the commodity market, crude oil prices hit a four-month high, the most in a month, as China's macroeconomic indicators exceeded expectations and geopolitical risks increased due to Ukraine's attack on a Russian refinery. recorded a weekly increase.

This week's main events:

-

Eurozone CPI, Monday

-

Australian interest rate decision Tuesday

-

Japan interest rate decision, Tuesday

-

Canadian inflation Tuesday

-

China loan prime rate Wednesday

-

Indonesia interest rate decision Wednesday

-

UK CPI, Wednesday

-

US interest rate decisions Wednesday

-

Brazil interest rate decision Wednesday

-

ECB President Christine Lagarde speaks on Wednesday

-

New Zealand GDP Thursday

-

Taiwan rate decision, Thursday

-

Swiss interest rate decision Thursday

-

Norwegian interest rate decision Thursday

-

UK interest rate decision Thursday

-

Mexico interest rate decision Thursday

-

European Union summit in Brussels on Thursday

-

Japan CPI, Friday

The main movements in the market are:

stock

-

Stoxx Europe 600 little changed as of 9:50 a.m. London time

-

S&P 500 futures rose 0.3%

-

Nasdaq 100 futures rose 0.7%

-

Dow Jones Industrial Average futures little changed

-

MSCI Asia Pacific Index rose 0.9%

-

MSCI Emerging Markets Index rose 0.3%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0899.

-

The Japanese yen fell 0.1% to 149.20 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2061 yuan to the dollar.

-

The British pound was almost unchanged at $1.2737.

cryptocurrency

-

Bitcoin fell 0.5% to $67,957.01.

-

Ether fell 1.7% to $3,571.05.

bond

-

The 10-year government bond yield was almost unchanged at 4.30%.

-

The yield on German 10-year bonds rose 1 basis point to 2.45%.

-

UK 10-year bond yield remains unchanged at 4.10%

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Michael G. Wilson.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP