(Bloomberg) – Expectations about monetary policy are driving markets. Asian stocks were mixed, with U.S. and European stocks marginally lower as traders awaited the Federal Reserve's meeting later Wednesday.

Most Read Articles on Bloomberg

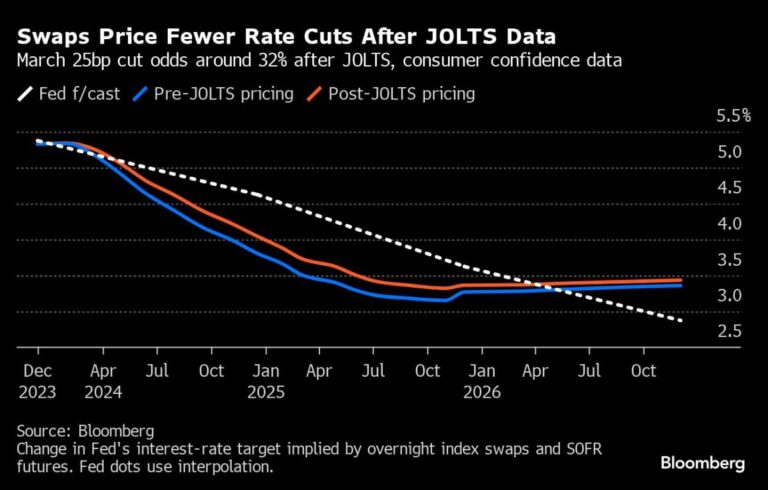

Bond traders have lowered their bets that U.S. interest rates will fall this year, reducing the odds of a rate cut in March by about a third. Weak economic data from China and four consecutive quarters of declining profits at Samsung Electronics, the world's largest memory chip maker, also dampened sentiment, compounded by disappointing U.S. tech company earnings.

Yields on Japanese government bonds rose as the Bank of Japan's summary suggested it was close to the first interest rate hike since 2007, with one committee member even warning against missing the opportunity to act.

Steve Englander, Head of Global G10FX, said: “Even though the risk of policy rate changes at the January 31st FOMC meeting is very small, the conclusions investors have drawn from the FOMC and Chairman Powell's medium-term guidance are , which could induce volatility in asset markets.” He discussed Standard Chartered Bank's research and North American macro strategy in a note.

Australian shares closed at record highs as weak inflation data strengthened expectations for monetary easing. The local dollar and government bond yields fell. Signs that the Bank of Japan may move to abolish negative interest rates boosted lenders' optimism about profitability, and Japanese stocks also rose.

Shares in China and Hong Kong widened their losses after data showed factory activity in the country contracted for another month. Mainland stocks nearly erased gains caused by hopes of stronger support from authorities.

resilient market

The dollar strengthened against all 10 countries in the group. Yields on two-year and 10-year U.S. Treasuries fell in Asian trading.

Swap contracts referencing the date of the next March Fed meeting this week are currently showing a decline of about a third of 25 basis points. A quarter-point rate cut in March was fully priced in, reflecting hopes late last year of a cooling labor market that did not materialize.

The number of job openings in the U.S. unexpectedly rose in December, hitting a three-month high, while fewer Americans are leaving their jobs. This data has launched a number of releases that provide insight into the current state of the labor market. A report released Wednesday is expected to point to easing in hiring costs at the end of 2023, while Friday's government jobs report showed U.S. employers added about 185,000 positions in January. It is expected that the addition will be shown.

Novo Nordisk A/S said in company news that sales and profits will soar again this year as it continues to roll out its blockbuster anti-obesity product Wegovy around the world. Samsung Electronics said its profits fell 74% in the last three months of the year as a long-awaited recovery in demand for chips and electronics yielded little profit. Alphabet fell after reporting lower-than-expected revenue from its core search advertising business.

Elsewhere, oil prices rose for the first time since September, as escalating attacks on ships in the Red Sea prompted the diversion of tanker traffic and raised concerns about further conflict in the Middle East.

This week's main events:

-

Boeing releases financial results on Wednesday amid U.S. government safety investigation

-

Fed interest rate decision and Fed Chairman Jerome Powell's Wednesday press conference

-

U.S. Treasury Quarterly Refunds Wednesday

-

China Caixin Manufacturing PMI Thursday

-

Eurozone S&P World Manufacturing PMI, CPI, Unemployment Rate, Thursday

-

US productivity, construction spending, ISM manufacturing, new unemployment claims, Thursday

-

Apple, Amazon, Meta, Deutsche Bank, BNP Paribas earnings, Thursday

-

Bank of England interest rate decision Thursday

-

US employment statistics, University of Michigan consumer sentiment, factory orders, Friday

The main movements in the market are:

stock

-

As of 6:46 a.m. London time, S&P 500 futures were down 0.4%.

-

S&P/Australian Stock Exchange 200 futures little changed

-

Hong Kong's Hang Seng fell 1.4%.

-

Shanghai Composite falls 1%

-

Euro Stoxx50 futures fell 0.1%

-

Nasdaq 100 futures fell 0.9%

-

Australia's S&P/ASX 200 rose 1.1%

currency

-

Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.2% to $1.0818.

-

The Japanese yen fell 0.1% to 147.82 yen to the dollar.

-

The offshore yuan remained almost unchanged at 7.1900 yuan to the dollar.

-

The Australian dollar fell 0.6% to $0.6565.

-

The British pound fell 0.2% to $1.2675.

cryptocurrency

-

Bitcoin fell 1.4% to $42,952.26.

-

Ether fell 2% to $2,332.39.

bond

-

The 10-year Treasury yield fell 1 basis point to 4.02%.

-

Japan's 10-year bond yield rose 2.5 basis points to 0.730%.

-

The Australian 10-year bond yield fell 13 basis points to 4.01%.

merchandise

-

West Texas Intermediate crude oil fell 0.3% to $77.60 a barrel.

-

Spot gold fell 0.1% to $2,034.21 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Tassia Sipahutar and Rob Verdonck.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP