There are currently seven companies in the world with a market capitalization of over $1 trillion.keep it for saudi aramcothey are active in the technology field.

Warren Buffett's investment conglomerate berkshire hathaway (NYSE: BRK.A) (NYSE: BRK.B), with a market capitalization of approximately $870 billion, is the 8th most valuable company in the world. Berkshire's stock price has increased about 29% over the past year. This is roughly in line with the stock price growth rate. S&P500.

Let's take a closer look at why Berkshire is such a powerful company and how it can next join the exclusive club of multi-trillion dollar companies.

slow and steady wins the race

Buffett's investment style is very simple. He identifies businesses that generate consistent growth, with a special focus on profitability. Additionally, Oracle of Omaha tends to hold stocks for long periods of time, often decades.

This disciplined and patient approach allows Buffett to multiply his wins over time and benefit from the power of compound interest. More specifically, as his company grows, he may implement share buybacks or dividends. Both are ways that shareholders can reap huge benefits from top-quality companies.

This is great for Buffett, but how does it benefit investors? Now, Buffett invests primarily through Berkshire Hathaway. Because Berkshire is a publicly traded company, investors can gain exposure to the holding company for their investment portfolios.

A treasure trove of solid business

Berkshire Hathaway has companies across a variety of industries, including technology, energy, financial services, consumer staples, and healthcare.

Buffett's most notable holdings include: apple, american express, coca cola, western oil, american bankand chevron. Many of these companies are the best brands in their respective industries, but one thing I find particularly unique about Berkshire is its position among the leading exchange-traded funds (ETFs). Vanguard S&P 500 ETF.

In my opinion, this is a pretty smart move. Essentially, Buffett supplements his individual stock selections with broader market exposure. In a sense, this acts as a hedge, keeping losses relatively insulated even if one of his larger positions goes down.

What will drive Berkshire Hathaway's stock price higher in 2024?

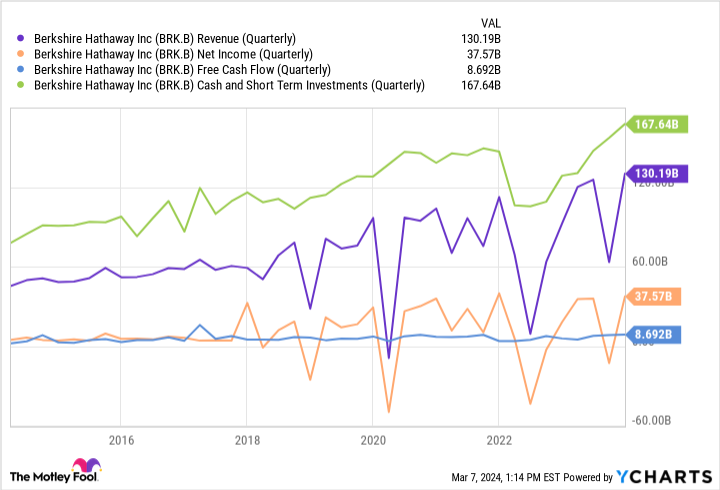

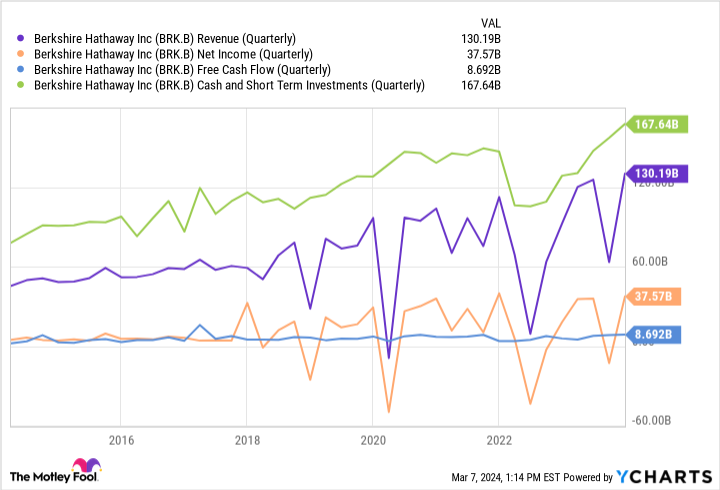

The chart below shows some important financial indicators. Investors understand that Berkshire has rebounded sharply from the pandemic-induced decline several years ago.

But what I think is most important is the company's growing cash pile. As of Dec. 31, Berkshire had $167 billion in cash and short-term investments on its balance sheet.

One of the ways Buffett was able to accumulate so much cash is through dividends. In fact, just six of his large stock portfolios account for nearly $4.7 billion in annual dividend income. But with so much cash on hand, you might wonder why Buffett isn't actively buying new businesses at the moment.

My guess is that he's watching to see how the Federal Reserve will do this year. In fact, investors are being given some indications that a rate cut is coming in 2024. But Chairman Jerome Powell and his constituents need to tread carefully, given that inflation remains above the Fed's long-term goal of 2%. The pros and cons of whether to cut interest rates too soon or too late, and by how much.

These variables will have a dramatic impact on the broader macroeconomy and capital markets. I wouldn't be surprised to see Mr. Buffett make some interesting moves this year, but it seems to me that he's exhibiting patience — which comes naturally to him.

Berkshire's financial horsepower should continue to improve as revenue and profits increase. It's unclear what move Buffett will make, but his long-term track record speaks for itself. Given that Berkshire does business with so many large companies across a variety of industries, and given that the market is trading at record highs, the company could easily reach the $1 trillion milestone sooner rather than later. think. Now may be a unique opportunity to acquire stocks from one of the most respected and well-known portfolios of all time.

Should you invest $1,000 in Berkshire Hathaway right now?

Before buying Berkshire Hathaway stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors should buy right now…and Berkshire Hathaway wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

Bank of America is an advertising partner of The Motley Fool's Ascent. American Express is the Motley Fool's advertising partner for his The Ascent. Adam Spatacco has a position at his Apple. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, Chevron, and Vanguard S&P 500 ETFs. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

The original article “Prediction: This Warren Buffett stock will become the next trillion-dollar company” was published by The Motley Fool.