As popular as pets are, it seems like pet stock is stuck in the toilet and can't get out. This landscape is littered with broken stocks like (I kid you not) online e-commerce retailers. Chewy Inc. (NYSE: CHWY) The stock price fell 56%; PetMed Express Inc. (NASDAQ: PETS) It has decreased by 71.7%. Petco Health and Wellness Inc. (NASDAQ: WOOF) Last year it was down 75%. However, one name stands out to him in the consumer staples sector. Fresh Pet Co., Ltd. (NASDAQ: FRPT). Freshpet stock is up 24% year-to-date (year-to-date). Their business is expanding rapidly and their stock price reflects that.

high quality pet food

Freshpet is a manufacturer of high quality refrigerated pet food. Their products are minimally processed and formulated with the highest quality real meats, vegetables, grains, and fruits. Additionally, it is kept refrigerated to ensure freshness. The meat is farm-raised and steam-cooked to preserve nutrients. It is sold under a variety of brands including VITAL, Nature's Fresh, Homestyle Creations, Spring & Sprout, and Deli Fresh. Please note that the food is refrigerated, not frozen. You can find them in the refrigerated section of your pet store.

Fresh Pet meets the growing demand for fresh, high quality premium pet food. The company's distribution network includes major grocery chains, warehouse clubs, and online sales. Their products can be found at: Target Corporation (NYSE: TGT), Kroger Co. (NYSE:KR)Petco, Safeway, ShopRite, Amazon.com Inc (NASDAQ: AMZN)).

Shatters expectations for Q4 2023

Freshpet reported Q4 2023 EPS of 31 cents, three times and 23 cents above consensus analyst estimates of 8 cents. Net income was $15.3 million, compared with a net loss of $2.9 million in the year-ago period. Adjusted EBITDA was $31.3 million, compared with $18.8 million in the prior-year period. Sales were $215.4 million, an increase of 29.9% year over year, compared to the consensus estimate of $204.93. Freshpet has exceeded company plans for the sixth consecutive year. The company ended the year with cash and cash equivalents of $296.9 million.

Full year 2023 financial highlights

Net sales in 2023 were $766.9 million, an increase of 28.8% from the previous year. Net loss was $33.6 million, compared to his $59.5 million in the year-ago period. Adjusted EBITDA was $66.6 million (versus $20.1 million in the prior year period). Gross profit was $250.9 million, or 32.7% of net sales, compared with $186 million, or 31.2% of net sales, in the prior year period. Gross margin growth was driven by improved factory expense leverage, lower quality costs and lower input costs, partially offset by depreciation and amortization.

Training guidance

The company raised its full-year 2024 revenue outlook to at least $950 million, compared to the consensus estimate of $948.17 million. Revenues should increase by at least 24% year over year. Adjusted EBITDA is expected to be between $100 million and $110 million, with capital expenditures expected to be approximately $210 million.

CEO insights

Freshpet CEO Billy Seale believes the company has reached a turning point on its path to becoming a large and profitable business in the emerging fresh pet food sector. Stated. The Feed the Growth strategy implemented in 2017 was driven by the belief that fresh pet food is a scale-driven business and needs to take advantage of first-mover advantages. The company has significantly increased its retail presence in the stores of its retail partners. The number of new refrigerators installed increased to a record high of 5,251, giving retail stores a total of 34,274 refrigerators, or more than 1.7 million cubic feet of retail space. Fresh Pet Food is sold in 26,777 stores in the United States, with more than 22% of stores having multiple refrigerators.

A long runway to growth

Cyr noted that digital sales are up 58% year over year, with net order value expected to exceed $100 million in 2024. The entire pet food category is a $52 billion industry, of which $36 billion is dog food. Freshpet contains 3% of that and has a long way to grow. The household penetration rate increased by 19% from the previous year to 11.55 million households in 2023. Gen Z consumers are experiencing the fastest growth in housing penetration. “In summary, we had a very good year. Our increased focus and focus, as well as our disciplined capital management, have enabled us to reach the pinnacle of profitability with greater scale and efficiency,” said Mr. Syle. I believe it,” he concluded.

Freshpet Analyst Ratings and Target Prices It's on Market Beat. The stocks of Freshpet's peers and competitors are MarketBeat Stock Screener.

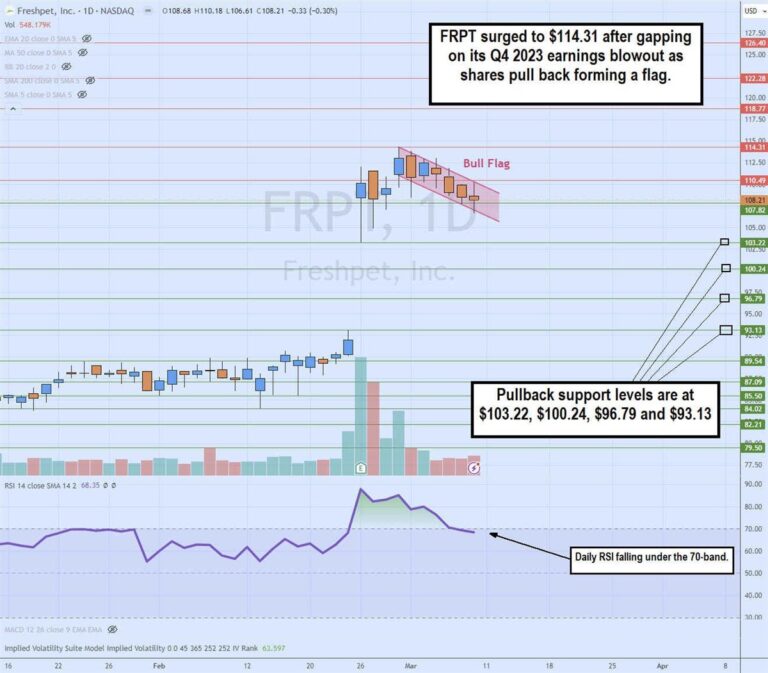

daily bull flag

The daily candlestick chart of FRPT shows a bull flag pattern. The flagstick base formed a swing low of $84.02 and surged to $103.22 on the earnings price differential. The peak of his rise at $114.31 on February 29, 2024 began a flag decline consisting of parallel range lows and highs. A bullish flag breakout is triggered when the Daily Relative Strength Index (RSI) rebounds and FRPT breaks through the resistance at $110.49. Pullback support levels are $103.22, $100.24, $96.79, and $93.13.

SOURCE Market Beat