(Bloomberg) — Thanks in part to a recovery in digital asset markets, crypto companies are hiring again, at least for now, albeit in a more subdued manner than during the last crypto boom.

Most Read Articles on Bloomberg

Coinbase Global Inc. recently returned to profitability and is looking to fill 200 positions around the world. Rival exchanges Kraken, Binance, and Gemini are hiring as well, as are traditional companies like Fidelity, which is expanding its efforts in the space. Many crypto startups are now able to raise funding again and can finally afford to hire new employees, according to a number of professional job sites that are experiencing a surge in demand.

CryptocurrencyJobs.co announced a 50% year-on-year increase in job openings from January to February, and a further 45% increase in March. So far in March, the number of job ads has nearly doubled compared to a year ago, according to CryptoJobsList. He has more than 1,700 posts on the Blockchain Association's list, which represents more than 100 of the industry's biggest companies, up from less than 1,000 a year ago. At the peak of the 2021 bull market, there were over 3,000 ads running.

“Things are looking up,” said Dan Speller, the association's senior director of industry, with the economy starting to recover late last year. “I expect the rest of this year, and certainly next year, to be very strong. Our industry is unique and often correlated with the overall market.”

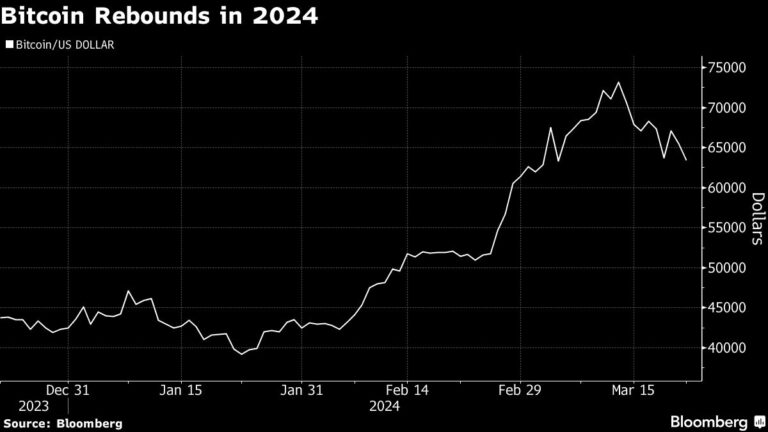

Industry bellwether Bitcoin hit a series of new highs this month, capping a rise of more than 50% since January. Business is picking up across exchanges as retail investors are returning to the market, lured by soaring profits once again. Coinbase stock closed at $262 on Thursday, a 52-week high.

Pranesh Antapur, chief human resources officer at the exchange, said: “Kraken has successfully weathered several bull and bear markets while preparing us to expand in time for real inflection.” Ta. “The recent surge in the cryptocurrency market reinforces the existing theory that 2024 is the right time to grow to meet the demand at hand.” The exchange is currently hiring. There are over 100 job openings posted on the site.

Fidelity is hiring for 22 crypto-related positions, including a digital asset trader and vice president of crypto investment risk. BlackRock, the world's largest asset management company, which launched an exchange-traded fund that invests directly in Bitcoin in January, mentions digital assets in dozens of job ads, including those for vice president of digital assets and ETF lawyer. are doing.

Business development jobs, which were among the first to be laid off during the last recession, are now among the first to accelerate, according to Spler of the Blockchain Association.

Many of the companies currently hiring, such as Coinbase, have experienced at least one layoff during the crypto recession of the past two years and have vowed not to overhire in the future.

“We plan to make modest investments in headcount in 2024,” Coinbase Chief Financial Officer Alecia Haas said in a February interview.

After years of falling prices and the collapse of a number of crypto businesses, including Sam Bankman Fried's FTX exchange and financial firms Genesis and Celsius Networks, the jobs recovery remains fragile. Indeed and LinkedIn say crypto-related job ads are still down from last year's levels.

What is certain is that there will be no shortage of applicants for the job, and some of them will be able to pay their employees in cryptocurrencies.

The site's founder, Daniel Adler, said: “With so many people looking for jobs and interest in working in cryptocurrencies increasing due to the bull market, many listings for crypto jobs are “We've received hundreds of applications,” he said. “The market is still an employer market.”

–With assistance from Elijah Nicholson-Messmer.

(A graph has been added to the job information.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP