Huawei declined to comment on the matter.

“No matter what semiconductor processing technology we have, there are limits, but it is possible to build very large systems by integrating many of these chips,” Huang said.

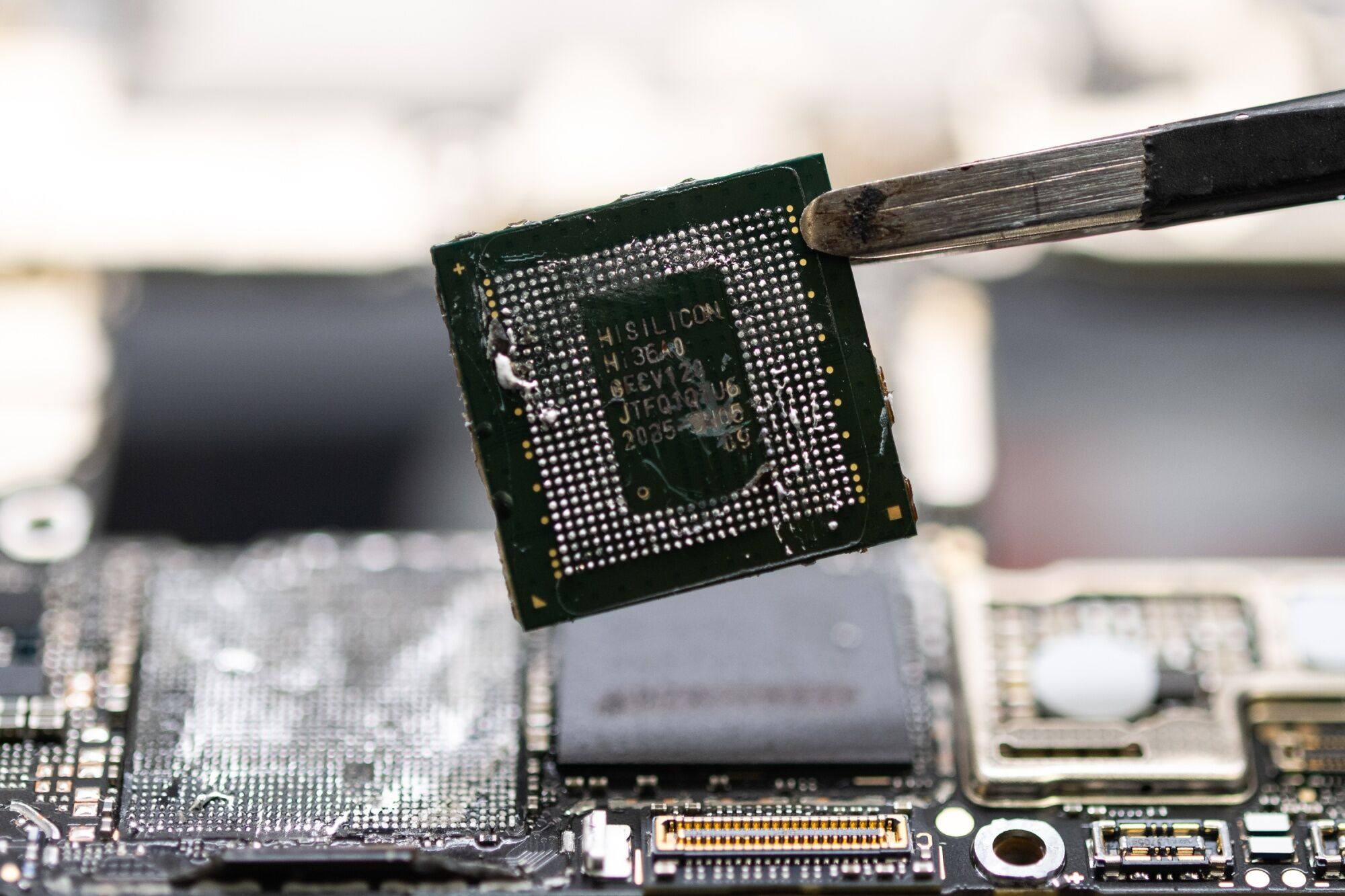

Reuters reported last month that Huawei and SMIC have allocated more production capacity to AI chips as generative AI gains increased attention and US sanctions tighten over the past year.

One GPU distributor, who asked not to be named due to the sensitivity of the issue, said the Ascend 910B is “available to order, but supply is very tight at this time.”

Amid industry transformation, Huawei and ZTE showcase AI prowess at MWC Barcelona

Amid industry transformation, Huawei and ZTE showcase AI prowess at MWC Barcelona

The server, which is used for AI training and includes eight Ascend 910B cards, costs about 1.5 million yuan ($208,395), according to another person familiar with the matter, which was quoted through black market channels. The price is about the same as the A100 server. also refused to be named.

Many analysts and industry experts are hesitant to comment on the Nvidia-Huawei showdown, but the U.S. chip designer has depth in GPUs and hopes developers will unlock the semiconductor's full potential. He pointed out that it benefits from the software ecosystem CUDA, a computing platform that enables. .

“CUDA is resilient, and Nvidia has done all this hard work on its own and is reaping the benefits,” said Brian Colello, technology equity strategist at Morningstar. “Huawei and its software partners will need to build a comparable ecosystem.” [to Nvidia’s CUDA] When it comes to tools to build AI models. ”

SMIC and Huawei to be top beneficiaries of Chinese government funding this year

SMIC and Huawei to be top beneficiaries of Chinese government funding this year

Despite lagging behind CUDA's 2 million-strong registered developer list, Huawei is a key player in Ascend, a platform that connects hardware and software essential to unlocking AI computing power. It has its own computing architecture for neural networks.

Colello said Huawei may have to make something similar. [big] Invest in mainland China to strengthen software capabilities. He added that while Huawei will focus on chip design, other companies will likely work on software libraries.

“Huawei's strength is not in its software stack,” said a Shanghai-based tech investor, who requested anonymity. “U.S. sanctions are limiting chip performance and production yields.”