(Bloomberg) — Stocks and bonds fell around the world as strong economic data and rising commodity prices fueled speculation that major central banks would continue to raise interest rates for an extended period of time.

Most Read Articles on Bloomberg

The “good news is bad news” trade is back, with stocks weighed down by better-than-expected data on U.S. jobs and factory orders. The rise in the 10-year Treasury yield to its highest level in 2024 also weighed on the stock market. For the past few months, the stock market has ignored the re-pricing of interest rate cuts amid a wild rally begging for a rebound.

“As yields rise, stock bulls may find it difficult to justify buying stocks at such high levels,” said Fawad Razaqzada of City Index and Forex.com. Stated. “Rising oil prices pose further risks to the inflation outlook. Additionally, numerous employment reports are expected throughout this week. Trading could be volatile.”

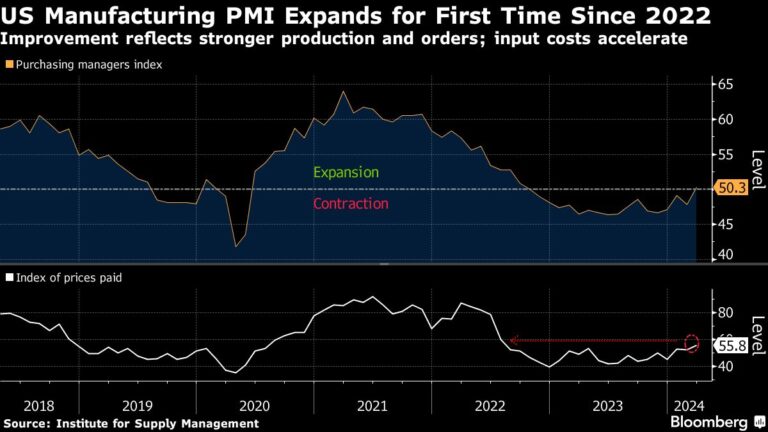

Citigroup's Economic Surprise Index, which measures the difference between actual announcements and analysts' expectations, is currently hovering near its highest level in nearly a year, following better-than-expected data from around the world. ing. Just this week, data from the world's two largest economies, the United States and China, also showed higher-than-expected factory activity.

The S&P 500 fell below 5,200, the Nasdaq 100 fell 1.5%, and Tesla Inc. led the losses among mega-cap stocks. The small-cap gauge fell 2%. The VIX, Wall Street's favorite volatility measure, rose above 15, and the yield on the 10-year U.S. Treasury rose 5 basis points to 4.37%. Crude oil rose to about $85 a tonne, copper rallied above $9,000 a tonne and gold hovered near record highs. Bitcoin has crashed.

The latest jobs figures, ahead of Friday's pay figures, suggest labor demand remains high and stable. Thorsten Slok, chief economist at Apollo Global Management, said the low number of jobless claims, combined with the low number of jobless claims, meant the March jobs report was likely to “unexpectedly pick up again.”

“The ability of the U.S. economy to resist headwinds is remarkable,” said Mark Hamrick of Bankrate. “The timing of rate cuts remains uncertain.”

Signals of economic strength certainly sparked hopes for the Fed's first rate cut. The odds of the central bank cutting interest rates at its June meeting are currently a coin toss. Swap traders currently expect interest rates to fall by about 65 basis points this year, less than the 75 basis points indicated in the Fed's latest “dot plot” forecast.

“Our base case is that the Fed attempts a soft landing and begins cutting rates in the second half of this year,” said Gargi Chaudhry of BlackRock. “Downside risks to economic growth have diminished, so the risk of just two Fed rate cuts now appears to be higher than the risk of four cuts,” he said.

Mislav Matejka of JPMorgan Chase & Co. said the market assumes economic growth will help, but earnings expectations for 2024 have yet to rise. Meanwhile, the firm's fixed-income strategists expect bond yields to fall in the second half of the year, and Matejka also said there is “a lot of complacency in the bond market” regarding inflation risks.

Investors who are selling stocks because the Fed might scale back its rate-cutting plans are missing the point. Morgan Stanley Investment Management's Andrew Slimmon said the move could bode well for the economy and, by extension, the stock market.

“I think a patient Fed is proving that the economy is strong,” Slimmon said in an interview on Bloomberg TV on Tuesday. “That's better for the stock.”

HSBC strategists say stocks are poised for a strong rebound if the Fed and other central banks cut interest rates, as “real money investors remain in a near-neutral position across virtually all asset classes.” It is said that everything is in place.

One risk that could put pressure on assets is that the Fed does not cut interest rates to 2.5%, has to pause them midway through, or is forced to stop them entirely immediately after several cuts. Yes, but that will be a problem in the second half of the year at the earliest. Max Kettner's team wrote in a memo: A downside to the improving global economic growth backdrop is the upside risk of inflation, but it is premature to make this an issue now, they write.

And despite this week's drop in stocks, the market is still avoiding major declines at a historic pace.

According to JPMorgan Asset Management data dating back to 1980, the maximum drawdown for the S&P 500 so far in 2024 is close to 2%, and if this continues through this year, it would be the lowest drawdown in history. It is expected that they will become one. The year that holds the record for the lowest maximum drawdown was 1995, at about 3%. This is probably the only time in more than half a century that the Fed has successfully made a soft landing.

Since 1950, there have been 11 times since 1950 when the S&P 500 index rose at least 10% in the first quarter, according to Keith Lerner of Trust Advisory Services. Shares rose 10 out of 11 times over the rest of the year, for an average gain of 11%, according to the trust's data. The only exception was 1987, the year after the Black Monday crash in October of that year.

Company highlights:

-

Tesla delivered 386,810 vehicles in the first three months of this year, missing Bloomberg's average forecast by the largest margin in data from seven years ago.

-

Health insurance stocks fell after U.S. regulators did not increase payments for private Medicare plans as the industry had expected.

-

Autodesk fell after announcing an internal investigation into its accounting practices and postponing the release of its annual financial report.

-

PVH Corp.'s stock price fell the most since the Black Monday crash of 1987 after the company announced lower-than-expected full-year sales forecasts.

-

SLB has agreed to buy rival oilfield service provider Champion The move is to expand SLB's technology portfolio as it encourages more spending.

-

Airbus SE is working to increase production and reach its annual delivery target of 800 aircraft, delivering around 145 aircraft in the first three months of this year.

-

Verve Therapeutics' stock price fell over safety concerns over the company's suspension of enrollment in a study of a gene-editing treatment for people with high cholesterol, a setback for a promising new medical field.

This week's main events:

-

China Caixin releases PMI on Wednesday

-

Eurozone CPI, unemployment rate, Wednesday

-

Japanese services PMI, Wednesday

-

US ADP Employment, ISM Services, Wednesday

-

Federal Reserve Chairman Jerome Powell speaks on Wednesday

-

Fed's Austan Goolsby, Adriana Kugler and Michelle Bowman will also speak Wednesday.

-

Eurozone S&P Global Services PMI, PPI, Thursday

-

U.S. new jobless claims, Challenger layoffs, Thursday

-

Fed's Loretta Mester, Albert Moussallem, Thomas Barkin, Patrick Harker and Austan Goolsby speak Thursday

-

European Central Bank releases report on March interest rate decisions on Thursday

-

Eurozone retail sales Friday

-

U.S. unemployment rate, nonfarm payrolls, Friday

-

Fed's Michelle Bowman, Thomas Barkin and Laurie Logan speak on Friday

The main movements in the market are:

stock

-

As of 12:14 p.m. New York time, the S&P 500 was down 1.1%.

-

Nasdaq 100 fell 1.4%

-

The Dow Jones Industrial Average fell 1.3%.

-

MSCI World Index falls 0.7%

currency

-

The Bloomberg Dollar Spot Index fell 0.1%.

-

The euro rose 0.2% to $1.0767.

-

The British pound rose 0.2% to $1.2572.

-

The Japanese yen remained almost unchanged at 151.58 yen to the dollar.

cryptocurrency

-

Bitcoin fell 6.3% to $65,340.88.

-

Ether fell 7.2% to $3,244.53.

bond

-

The 10-year Treasury yield rose 6 basis points to 4.37%.

-

Germany's 10-year bond yield rose 10 basis points to 2.40%.

-

The UK 10-year bond yield rose 15 basis points to 4.08%.

merchandise

-

West Texas Intermediate crude rose 1.3% to $84.84 per barrel.

-

Spot gold rose 0.2% to $2,255.39 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Jessica Mentone, Michael Musika, Carter Johnson, Alexandra Semenova, and Farah Elbalawy.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP