Spectaire Holdings Inc., a global leader in air quality monitoring and emissions reduction technology, has announced significant developments to address the growing financial and environmental challenges posed by rising carbon taxes in Canada.

Spectaire specializes in providing effective solutions to help businesses reduce their carbon footprint, with a focus on creating high-quality carbon credits.

The company is proud to announce the successful implementation of its breakthrough AireCore technology in several of Canada's prominent trucking fleets. This strategic initiative aims to provide sustainable solutions in line with the national goal of reducing carbon emissions. It also provides a means to reduce the economic burden placed on the trucking industry by tax laws.

Driving change: Spectaire’s AireCore revolutionizes carbon monitoring

The trucking sector stands as a key pillar of Canada's transportation supply chain. With an extensive road network spread across the country, trucks serve as the primary mode of transport for transporting goods across the country. Additionally, the trucking industry plays a vital role in facilitating trade with the United States, Canada's largest trading partner.

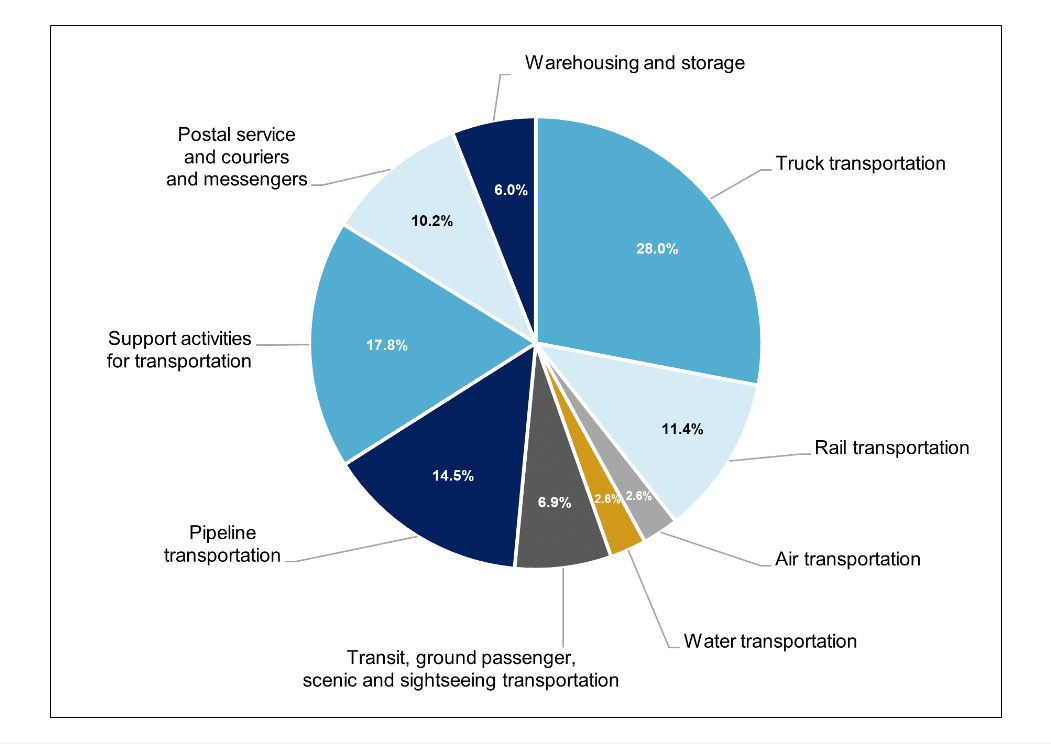

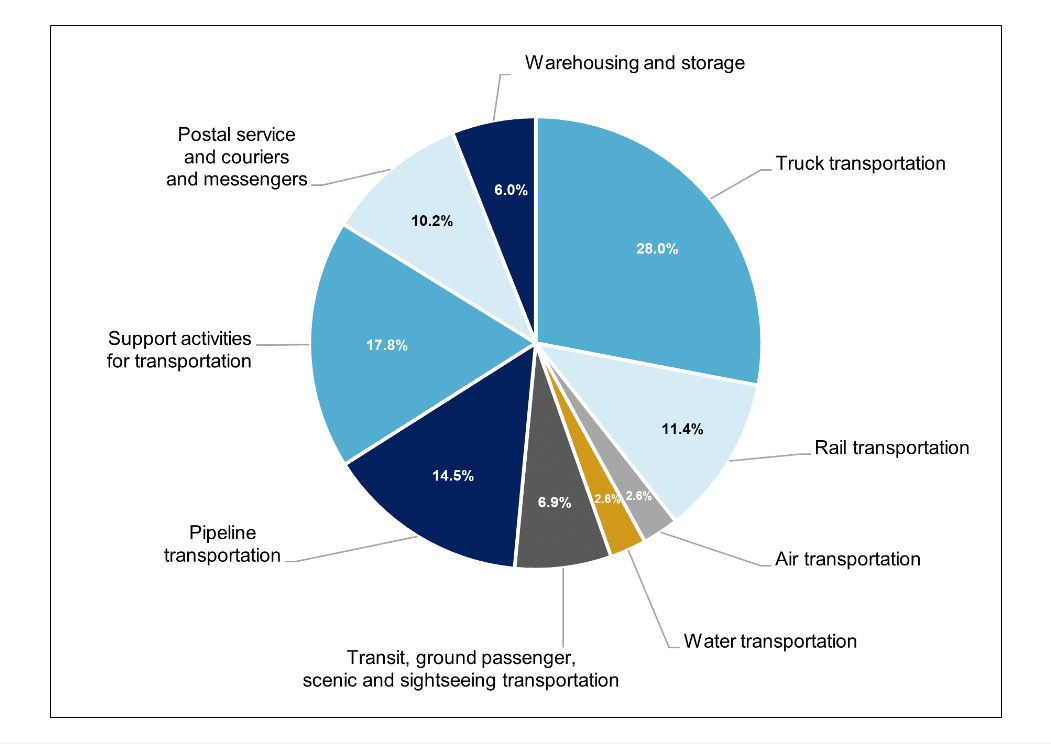

In 2021, the transportation and warehousing sector plays an important role in the national economy, contributing 3.6% to gross domestic product (GDP) and employing more than 5.2% of the workforce. Within this GDP sector, trucking is the primary means of moving goods, accounting for more than 28% of the sector's activity.

Distribution of the 3.6% share of the transportation and warehousing sector in Canada's GDP

However, the trucking industry is also subject to Canada's carbon pricing regulations. It may be due to the following facts: In the transportation sector, recent data on emissions across Canada shows a continued upward trend in greenhouse gas (GHG) emissions from medium- and heavy-duty vehicles (MHDVs).

-

These emissions account for 37% of total emissions from transportation.

The Canadian Trucking Alliance, the country's largest trucking alliance, told the government: Stop excise tax on diesel. CTA President Steve Laskowski said the agency is doing its best to decarbonize the sector. Still, diesel engines remain the dominant vehicle in this sector.

In the U.S., trucking companies are taking steps to: Transitioning to hydrogen fuel for long-distance travel. Companies like Nikola are investing in hydrogen technology to overcome infrastructure challenges and meet the growing demand for low-carbon energy. They believe a revolution is underway, with hydrogen promising a sustainable energy transition.

In Canada, the alliance is also calling for a trucking-related adjustment to the federal carbon price, in response to the government's proposal for the CTA to exempt home heating oil from carbon taxes in certain regions for three years.

Related: Saskatchewan to eliminate carbon tax on natural gas and electric heating

Addressing the rapid increase in carbon taxes on trucking

As of April 2024, Canadian trucking companies experienced a notable increase in carbon prices, increasing by 30% to $65/tonne. This adjustment equates to an additional carbon tax payment of approximately 17 cents per liter of diesel fuel.

Susan Ewart, executive director of the Saskatchewan Trucking Association, highlighted the specific impact the carbon tax will have on truck drivers. She noted that drivers with trucks with 300-gallon tanks would pay about $193 more per fill-up. Ewart averages 106 fills per year, and estimates she pays more than $20,000 in annual carbon taxes per truck.

Spectaire's approach is aimed at accelerating industry-wide emissions reductions in line with federal and provincial carbon tax increases across Canada. The rollout of AireCore highlights his Spectaire's dedication to providing innovative solutions to the environmental and economic challenges facing the sector.

Spectaire CEO Brian Semkiw acknowledged the financial pressures facing the trucking industry. Here, his AireCore's ability to measure tailpipe emissions during transport provides a solution.

The technology's capabilities allow companies to reduce emissions while providing financial relief through carbon offset programs and enhanced tax reporting mechanisms.

See how this technology is installed and works here.

Spectaire allows truckers to create technology-based carbon credits that are both permanent and incremental using AireCore.

Purifying the air and transforming sustainability in the trucking industry

Danny Bucciarelli, General Director of G&S Direct, highlighted the operational and financial benefits offered by AireCore. He further emphasized this.

“Our collaboration with Spectaire through AireCore not only demonstrates our commitment to environmental stewardship, but also strengthens our competitiveness, facilitates potential tax incentives and enables the generation of carbon credits. Masu.”

Carbon credits are essential to emissions reduction infrastructure, but the market faces challenges due to insufficient accuracy and auditability of credits. AireCore addresses this issue by allowing you to audit each credit and exactly when and where the reduction was made.

This allows stakeholders to track changes in emissions and which specific gases are affected. Management expects the specificity and traceability of Spectaire's carbon offsets to deliver lasting value to consumers through measured carbon credits.

Spectaire cited AireCore's ability to provide accurate, actionable emissions data as the basis for sustainability strategies in the trucking industry, and shared a shared commitment to leveraging cutting-edge technology for meaningful emissions reductions. emphasized.

Spectaire's implementation of AireCore represents a significant advancement at the intersection of technology, environmental management and economic strategy in the Canadian trucking industry. This initiative focuses on the innovative capabilities of companies in this sector. More importantly, it will establish a new benchmark for how the sector can effectively address carbon tax challenges and environmental compliance.