STORY: U.S. stocks closed higher on Monday as investors looked ahead to this week's mega-cap earnings and the Federal Reserve's monetary policy meeting.

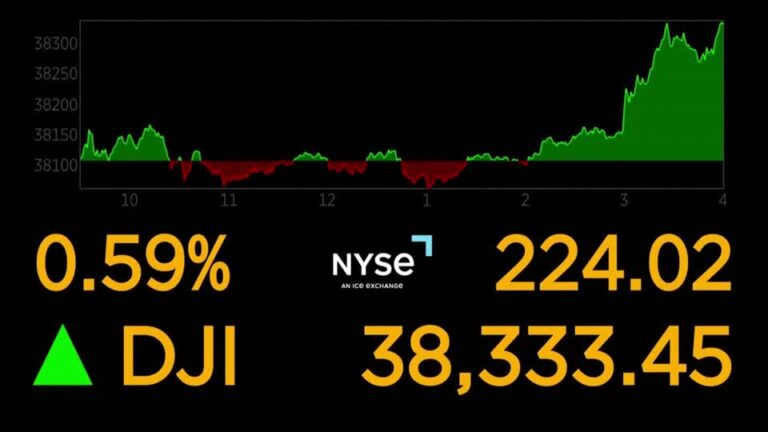

The Dow rose six-tenths of a percent, the S&P 500 rose more than seven-tenths and the Nasdaq rose more than 1%.

The S&P 500 hit a record high for the sixth time this year. The labeled index has increased by 3.3% so far in 2024.

The Fed's two-day policy meeting concludes on Wednesday. Investors will be looking for further clues about the timing of the central bank's first rate cut.

Chris Carey is a portfolio manager at Carnegie Investment Advisors.

“Some analysts think there won't be any rate cuts this year. I've also seen comments that rate hikes are a possibility. We're in an optimistic position that it's impressive relative to the rest of the world. I think we'll probably see at least one or two rate cuts, but there's still a lot of decisions to be made and a lot of data that has to go to the Fed. ”

Three important reports on the state of the labor market will be released this week, as well as a flurry of earnings reports from high-profile tech companies.

Shares of Meta Platforms, which will report earnings on Thursday, rose more than 1.5% after brokerage firm Jefferies raised its price target on the stock to $455 from $425.

Tesla shares rose more than 4% after the electric car maker unveiled capital spending plans.

Shares in robotic vacuum cleaner maker iRobot also fell nearly 9% after the company and Amazon scrapped a planned merger in the face of opposition from EU antitrust regulators.