(Bloomberg) — South Korea's exports continued to rise last month on strong demand for semiconductors and other technology equipment, underscoring policymakers' confidence that the economy will remain strong in the first quarter.

Most Read Articles on Bloomberg

Average daily shipments increased by 9.9% year-on-year, according to data released by the Trade Ministry on Monday. Without adjusting for working days, total exports increased by 3.1%, but total imports decreased by 12.3%. The trade surplus was $4.3 billion.

South Korea is one of the world's largest exporters of goods and a leader in global trade. The country has become a barometer of technology demand, thanks in part to its dominance in memory chips and smartphones. The latest figures show the continued recovery in global demand, particularly in the semiconductor sector.

According to the ministry, South Korea's chip exports in March increased 35.7% from the previous year to $11.7 billion, making it the largest monthly total since March 2022. Exports of displays rose 16.2% and computer sales rose 24.5%, highlighting the momentum driven by technology demand.

“Exports this year will be driven by technology,” said Lee Jae-yoon, a researcher at the Korea Institute of Industry, Economy and Trade. He said artificial intelligence and high-performance memory chips are among the reasons chip shipments are increasing rapidly, raising hopes that growth this year will be strong enough to make up for last year's losses. Stated.

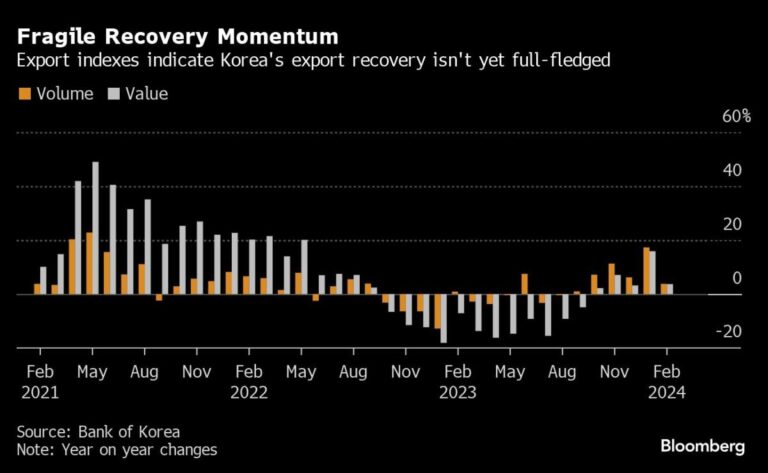

Export growth is fueled by strong semiconductor sales that have continued this year, one reason why authorities expect South Korea's economy to expand faster in 2024 than last year.

According to the Ministry of Trade, total exports in the first quarter totaled $163.7 billion, an 8.3% increase from the same period last year, resulting in a trade surplus of $9 billion.

Bloomberg Economics speaks…

“Our forecast is for economic growth in Q1 2024 to be 0.5% sequentially, building on 0.6% growth in Q4 2023. Trade statistics indicate that growth could exceed our expectations. It suggests that there is a sex.”

— Hyosung Kwon, Economist

Click here to read the full report

Still, in addition to a recovery in chips, exports of other products such as cars, steel and petrochemicals will also need to recover more strongly for authorities to be confident that economic growth will exceed 2% as estimated. .

According to the ministry, the latest report shows that car shipments in March decreased by 5% compared to the same month last year, and machinery shipments decreased by 10%. Petroleum products rose 3.1%.

KIET's Lee said steel exports, which fell 7.8% last month, are likely to particularly struggle due to competition from China amid weak demand.

Although global trade is gradually recovering, many risks to the outlook remain. The World Trade Organization's Goods Trade Barometer reached 100.6 last month, just above the trend baseline, indicating weaker upward momentum.

“Goods trade should continue to recover gradually in the early months of 2024, but the increase could easily be derailed by regional conflicts and geopolitical tensions,” the international organization said last month. .

With China as its largest trading partner and the United States as its biggest security ally, South Korea is one of the countries most vulnerable to geopolitical conflicts that could strain international trade momentum. . While U.S. consumer sentiment and spending remain strong, demand from China has been overwhelmingly weak as the world's second-largest economy struggles to emerge from a real estate recession.

Exports to the United States rose 11.6% in March compared to the same month last year, exceeding exports to China, with automobiles and semiconductors leading the way, according to data from the Department of Trade.

South Korea's total exports to China in March totaled $10.5 billion, an increase of 0.4% from the same month last year, recovering from a decline. This comes as China's manufacturing activity recovered last month, ending five months of decline.

A series of elections scheduled this year in large parts of the world, including the United States, are adding to the risks, resulting in protectionist policies that will hurt trade-dependent economies like South Korea. there is a possibility.

The country itself is scheduled to hold parliamentary elections later this month, and the vote could influence the extent to which it recalibrates its relationship with China in the long term.

(Adds economist's comments, regional breakdown, and total exports for the first quarter)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP