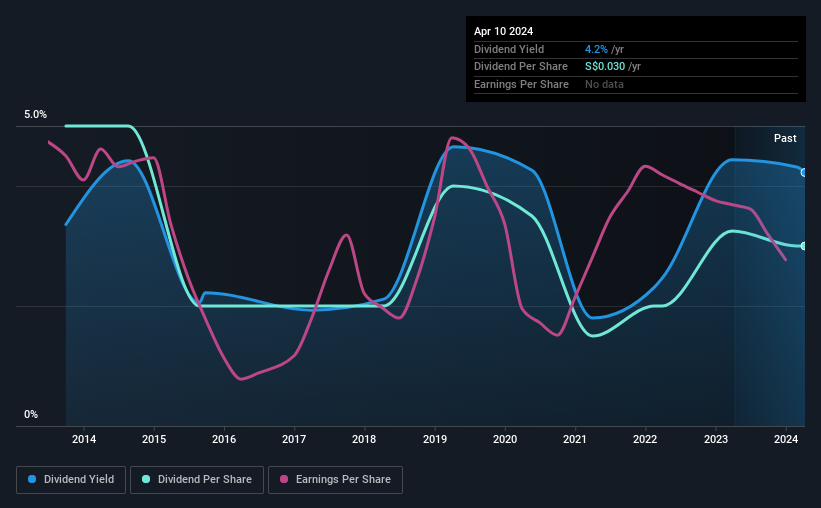

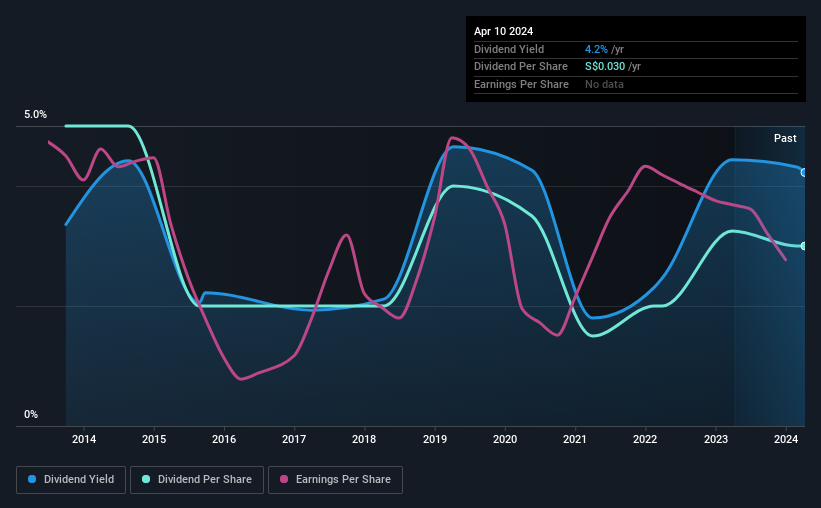

Singapore Finance Co., Ltd. (SGX:S23) announced that it will pay a dividend of S$0.03 per share on May 10. Based on this payment, the company's stock has a dividend yield of 4.2%, an attractive boost to shareholder returns.

Check out our latest analysis on Singapore Finance.

Singapore Finance's dividend is fully covered by profit

Even if you can maintain a high dividend yield for several years, it doesn't mean much if you can't maintain it. Based on the last payment, Singapura Finance very comfortably earned enough income to cover its dividend. This indicates that a significant portion of the profits are invested in the business.

If recent trends continue, EPS is expected to decline by 4.4% over the next twelve months. If the dividend continues in line with recent trends, we expect the payout ratio could be 72%. This is considered very comfortable as most of the company's profits are left for future business growth.

Dividend volatility

The company has a long history of paying dividends, but it has cut its dividend at least once in the past 10 years. Since 2014, dividends totaled S$0.05 to S$0.03 per year. This amounts to a decline of approximately 5.0% per year over that time. Dividend declines aren't usually something we look at, as it could indicate that the company is facing some challenges.

Dividend increases may be difficult to achieve

With a relatively unstable dividend, it's even more important to see if earnings per share are growing. Singapore Finance has seen its earnings per share decline at an annual rate of 4.4% over the past five years. If a company's earnings decline over time, it stands to reason that its dividend payments must also be reduced.

Our thoughts on Singapore Finance's dividend

Overall, I don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company generates a lot of cash and could potentially maintain its dividend for some time, but its track record hasn't been very good. You'll probably look elsewhere for more profitable investments.

Market movements prove how highly valued a consistent dividend policy is compared to a more unpredictable dividend policy. Still, investors need to consider more factors than dividends when analyzing a company. For example, we chose Two red flags in Singapore Finance Investors should consider this.Is Singapore Finance the opportunity you've been looking for? Why not check it out? Selection of high dividend stocks.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.