scott olson

Back in August, I gave Shake Shack a “hold” rating (New York Stock Exchange: Shaq), said that while the company's long-term outlook looked solid, there were some short-term headwinds that needed to be addressed first. Since then, the stock price has risen about 10%. It is on par with S&P during the same period.

Company Profile

As a reminder, SHAK owns and licenses upscale quick service restaurants in the United States and abroad. Although the company is best known for its premium burgers, it also sells other products such as milkshakes, chicken sandwiches and bites, fries, hot dogs, and frozen custard. Some locations also serve alcohol.

At the end of the third quarter, the company had 495 locations. In the United States, he owns and operates 280 restaurants, and domestically he licenses 39 restaurants. It also had 176 internationally licensed restaurants around the world. SHAK receives an initial territory fee, an opening fee, and a recurring fee. Sales-based royalty fees from licensed restaurants.

opportunities and headwinds

When I first wrote about SHAK in August, I was worried about the price decline and the impact on the macro environment. So far, concerns about the macro environment are unfounded. The U.S. economy continues to perform well despite inflationary pressures and white-collar layoffs in sectors such as technology.

Meanwhile, restaurant sales remain strong. We celebrated our 10th anniversary in December.th Industry sales rose for the second consecutive month as consumers remain focused on experiences rather than products post-pandemic. Even after adjusting for inflation, industry sales increased by 4.2% over the past 10 months.

Meanwhile, the fourth quarter, which has not yet been reported, will move from high-single-digit price increases to more traditional low-single-digit price increases. Despite this, same-store sales remained strong at 3.5% through the start of the October quarter. The company also reiterated its fourth-quarter guidance in December, expecting third-quarter same-restaurant sales to be in the low single digits.

However, the company has not completely stopped raising prices. In mid-January, SHAK acknowledged a 5% increase in prices for third-party distribution. Third-party delivery app prices are often higher as restaurants try to offset the third-party delivery app's fees. Delivery has been a great growth driver for the quick-service industry, and consumers have historically been willing to pay higher menu prices for the convenience of third-party delivery.

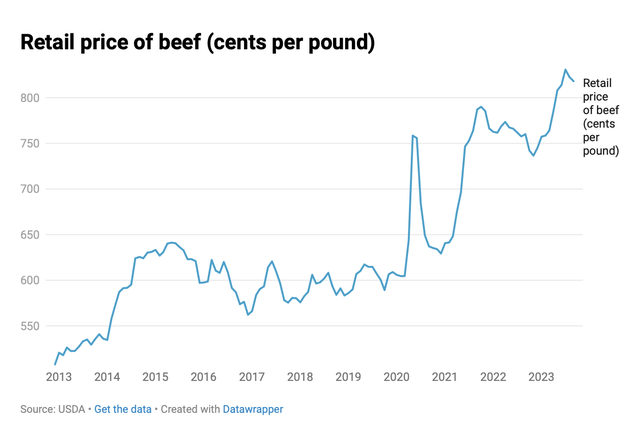

While most of these potential headwinds have passed, others are emerging. One of the biggest is food inflation, especially with respect to beef. Beef accounts for 25-30% of total food costs, and costs are expected to rise by mid-teens in the fourth quarter.

USDA

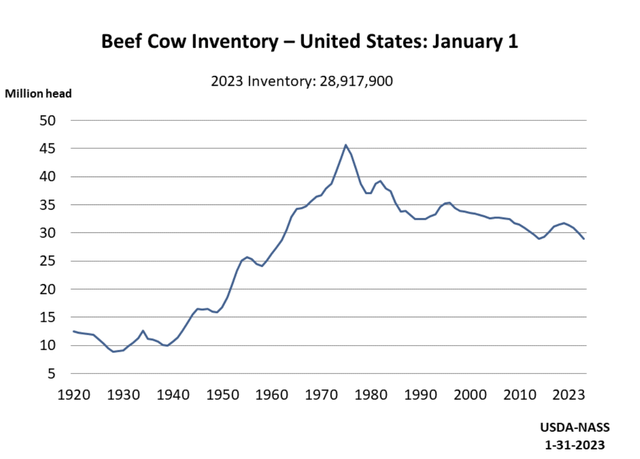

Beef prices are expected to continue rising in 2024 due to supply and demand. Even after the pandemic, consumer appetite for beef continues, and the number of beef cattle is increasing. On the other hand, it takes years to grow a herd.

USDA

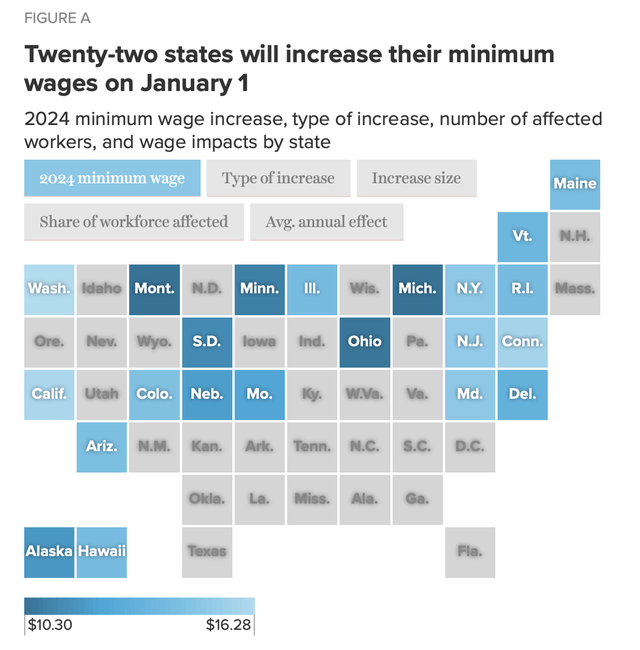

Rising minimum wages also continue to be a headwind for the industry. 22 states increased their minimum wage in 2024. Meanwhile, fast-food workers in California at companies with 60 or more U.S. stores saw their wages increase to $20 an hour in April. There are approximately 44 Shake Shack's in California. 13% of locations.

EPI

On the positive side, business expansion remains a major driver for SHAK. In 2023, the company opened approximately 40 new company-owned stores and licensed approximately 40 additional locations. The company expects both stores to open at the same rate in 2024. The company doesn't even have a presence in 17 states, but there are still plenty of opportunities to fill in the states it is currently in. I think the company will eventually be able to support his 1,500 to 2,000 locations in the United States. In California alone, I think he could increase the number of stores by eight times based on the number of In-N-Out Burgers in the state.

Technology and kiosks were another area I pointed to as a driver in the original article, and the company is delivering on that front. We have kiosks at almost all of our locations. This improved margins by 400 basis points last quarter.

Strengthening marketing in the restaurant industry is a major theme heading into 2024, and SHAK is no exception.

Speaking at Morgan Stanley's conference last month, CEO Randall Garutti said:

“The challenge is we're not big enough to have a Shake Shack TV commercial on the Super Bowl. We don't have enough doors to recoup that investment. But we need to do more marketing. are geographically widely dispersed, and many people do not know about them. [SHAK]. One of the things that always surprises us in certain places is that we know there is a lot of work to do to build true brand awareness and trial. There are more people out there than we think who don't know what Shake Shack is, or who stick to local customs, burgers, etc. So what has been most successful and what are we currently focused on? First, we will increase marketing funds. Expect to see that throughout this year and next. It will happen across as many personalized marketing channels as possible. Really powerful performance marketing and return on advertising spend. We are getting very good returns there. …and from time to time I might try a connected TV or a local location. If there are regions of the country where you know you need to increase your brand awareness, you might want to try implementing directed performance marketing or personalized marketing in earnest. So you'll see more of the ways you need to elevate your brand across our channels and across all digital channels. So I think you should look ahead over the next 3-5 years and consider continuing to increase your marketing spend in smart ways that will pay off. ”

This seems like a smart plan. While SHAK has great brand recognition in regions such as New York, where it was first founded, there are other regions where the brand is less well known. Companies like rival McDonald's (MCD) have long been masters of marketing, and given their size, there's no reason SHAK can't compete with marketing demands.

evaluation

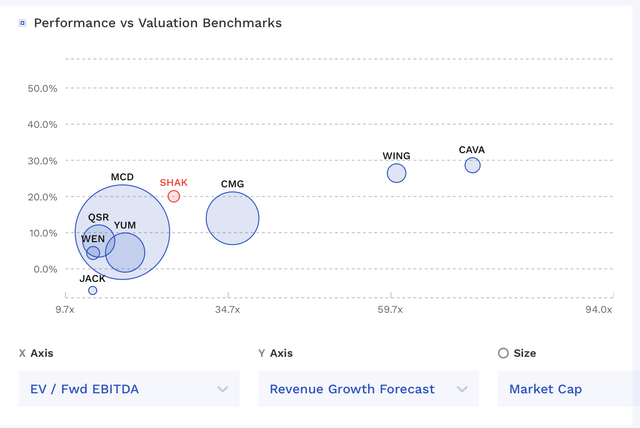

SHAK stock trades at approximately 23 times the 2024 EBITDA consensus of $153.7 million and approximately 19 times the 2025 EBITDA consensus of $186.1 million.

From an EBITDAR perspective, it trades at around 15x in 2023 and around 12.5x in 2024.

Revenue is expected to grow 15% this year and next.

SHAK trades at a premium to traditional burger chains, but at a discount to fast-growing QSRs.

SHAK evaluation vs. peers (fin box)

Considering that growth, I value the company at about 15x 2025 EBITDAR, or about $276 million. That will be about $95.

conclusion

Although SHAK faces headwinds from beef costs and minimum wage, I still think it has one of the best expansion stories in the quick-service industry. With the help of investment in kiosks, the company is doing a good job in terms of profits, and I think there is room to attract more customers through marketing.

The company plans to search for a new CEO this year, but current CEO Randy Garutti will stay on until someone is found to help with the transition. It's an attractive job, so I hope the company will hire talented people.

Given my positive long-term outlook, I'm upgrading the stock to Buy with a $95 price target.