-

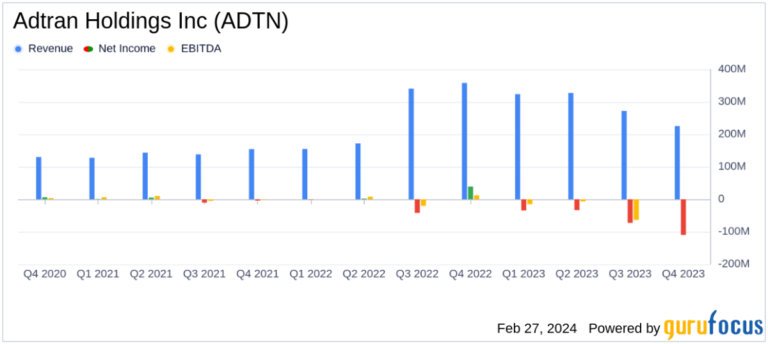

revenue: Fourth quarter revenue reached $225.5 million, matching interim guidance.

-

gross profit: GAAP gross margin improved significantly to 34.8% and non-GAAP gross margin increased to 41.9%.

-

Operating expenses: GAAP operating expenses decreased 7.6% sequentially and non-GAAP operating expenses decreased 15.1%.

-

net loss: GAAP net loss attributable to the company was $109.9 million, or diluted loss per share of $1.40.

-

Cost improvement measures: The company is implementing measures to become more streamlined and efficient.

On February 26, 2024, Adtran Holdings, Inc. (NASDAQ:ADTN) released an 8-K filing detailing preliminary unaudited financial results for the fourth quarter of 2023. The company is a provider of networking and communications platforms, software, and services and is divided into two segments: Network Solutions and Services & Support, which serve the broadband access market.

Despite a difficult macroeconomic environment and increased customer inventory, Adtran Holdings (NASDAQ:ADTN) reported preliminary fourth quarter sales of $225.5 million, meeting the midpoint of guidance. The company experienced sequential improvement in both GAAP and non-GAAP operating expenses, with GAAP operating expenses decreasing 7.6% and non-GAAP operating expenses decreasing 15.1%, respectively.

Financial highlights and challenges

Adtran Holdings Inc (NASDAQ:ADTN) saw notable improvement in gross margin, with preliminary GAAP gross margin of 34.8% for the quarter, an increase of 483 basis points (bps) year-over-year and 483 basis points sequentially. Points (bps) increased. 754bps increase. This was primarily due to lower purchasing and transportation costs, as well as lower acquisition-related expenses, amortization and adjustments. Non-GAAP gross margin also increased to 41.9%, driven by favorable customer and product mix.

However, the company faced a preliminary GAAP operating margin of -16.7% due to lower revenue and acquisition-related costs. Non-GAAP operating margin was -1.4%, at the high end of the guidance range. His GAAP net loss attributable to the company for the fourth quarter was $109.9 million, and his diluted loss per share was $1.40. Non-GAAP net loss was $85.9 million, and non-GAAP diluted loss per share was $1.09.

Tom Stanton, Chairman and Chief Executive Officer of ADTRAN Holdings, said, “Preliminary fourth quarter revenue was in line with expectations, with non-GAAP profitability in line with guidance due to continued gross margin improvement and operating expense reductions. “We have reached the upper limit. Sales remain in a difficult situation; however, sales remain in a difficult situation.” We believe that the fundamental demand situation will remain unchanged due to the macroeconomic environment and increased customer inventory. Service providers continue to pursue the same goals of expanding fiber footprint and increasing bandwidth, which requires the creation of a global infrastructure. With the continued implementation of our cost improvement measures, we believe we are transforming into a more streamlined and efficient company. , we expect our company to have an advantage.”

I'm looking forward to

Adtran Holdings Inc (NASDAQ:ADTN) is actively implementing cost improvement measures to transform itself into a more streamlined and efficient company. This strategic move is expected to position the company well when spending returns to normal levels. The company plans to hold a conference call to discuss preliminary fourth quarter results on February 27, 2024.

Investors and analysts interested in further information can access the conference call webcast through our Investor Relations site at investors.adtran.com. Replays and transcripts of the calls will also be available on the site.

For more detailed financial information and analysis, visit GuruFocus.com for comprehensive coverage and expert insights on Adtran Holdings Inc (NASDAQ:ADTN)'s performance and future outlook.

For more information, please see the full 8-K earnings release from Adtran Holdings Inc. here.

This article first appeared on GuruFocus.