golodenkov

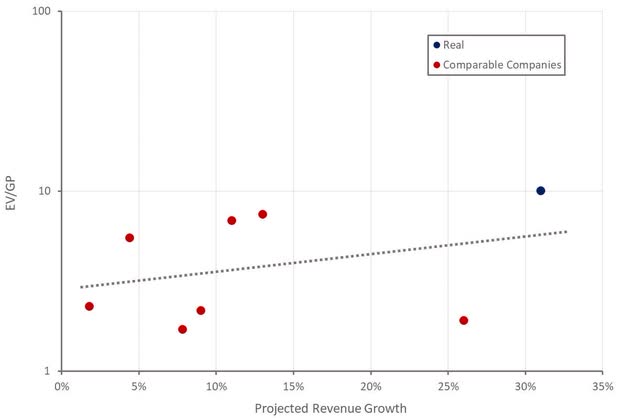

Real Brokerage (NASDAQ:REAX) have utilized various incentives to promote the growth of viral agents with great success. This has contributed to the real's rapid expansion, but the economic situation is not very attractive at the moment.The cost of reals fluctuates widely, so profit margins are unlikely to fluctuate. It improves significantly as the scale increases. The situation could change if Real were able to add higher margin services to real estate transactions, but there are many large companies targeting ancillary services, which could make this difficult.

market

The housing market has been devastated by the recent rise in home prices and the sharp rise in mortgage rates over the past two years. Sellers are unwilling to accept price reductions and buyers cannot afford to pay the current price, causing the market to dry up. Existing home sales are at their lowest level in more than a decade. This is down about 40% from its peak in early 2022.

Housing transaction volumes will eventually recover, and poor market conditions don't seem to matter to Real at the moment. Despite this seemingly positive structure, there are risks to Real's business, including a class action lawsuit against the National Association of Realtors. Although Real is not named as a defendant in any of the lawsuits, its business could be adversely affected. Real believes it can succeed with fee splits and a lower cost structure, but a reduction in overall fees would clearly be a headwind. This problem may be further exacerbated by Real's business model, which explicitly encourages agent growth, which could lead to pressure on fees.

Most of Real's revenue comes from commissions on real estate transactions. The company also earns fees from service contracts with agents and is looking to increase revenue from title and mortgage brokerage, although these businesses are not yet material.

Figure 1: Real’s US TAM (Source: The Real Brokerage)

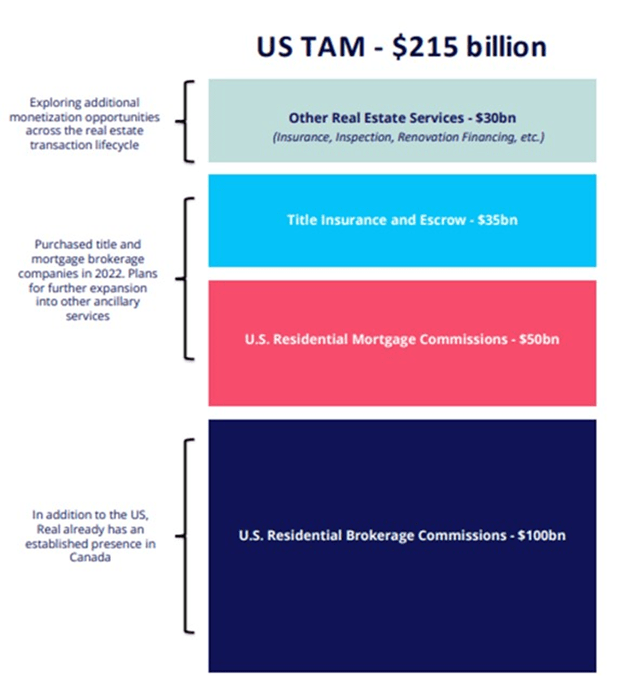

Real is growing rapidly in an environment of weak demand, and its low market share leaves plenty of room for further expansion. Continued market share growth is expected as Real leverages incentives to foster agency growth.

Figure 2: US Agent Market Share (Source: The Real Brokerage)

real brokerage

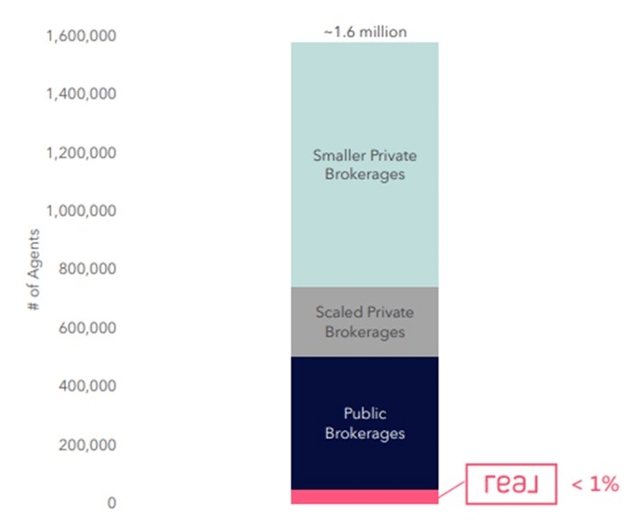

Real operates an asset-light real estate brokerage business that uses incentives to drive viral growth in agent numbers. Agents are offered relatively high commission splits, referral bonuses, support, and a variety of software tools. In the long term, Real plans to expand its agent solutions to include financial services, payments and investment planning tools. Real currently operates in all 50 states of the United States and his four provinces of Canada.

Figure 3: Comparison of business models between The Real and other brokerages (Source: The Real Brokerage)

Real's reZEN software provides agents with a variety of features.

- Transaction management system (lists, document reviews, signatures, etc.)

- Automate back-office processes

- Dashboard

- Personal brand websites and apps with features for customer engagement

- Offline marketing tools (business cards, yard signs, etc.)

- knowledge center

Real also recently introduced Leo 2.0, an AI-powered virtual concierge that aims to increase agent productivity and reduce the resources devoted to supporting agents.

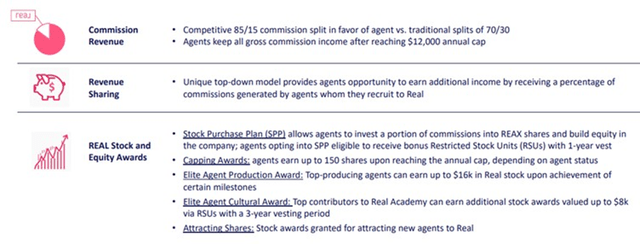

Perhaps the most important part of Real's business is the incentives offered to agents. This includes relatively high commission splits, shares in Real, and revenue sharing arrangements when referring agents to Real. Additionally, if an agent refers more than 5 agents, he will receive a revenue share from the agent's commission brought in by the first referral. Revenue sharing replaces marketing expenses and fuels the growth of Real's viral agency. It also improves retention rates and provides agents with an additional source of income.

Figure 4: Real’s Agent Value Proposition (Source: The Real Brokerage)

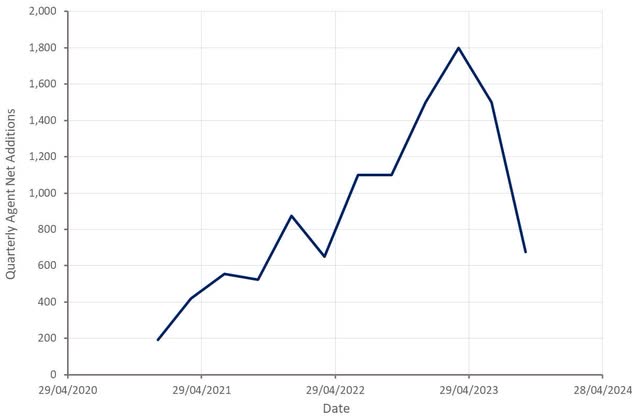

Real's number of agents increased by 81% year-on-year in the third quarter of 2023. However, growth has slowed significantly in recent quarters, which could pose a problem in the next year or two. Real has experienced attrition, and the company believes this is primarily due to agents with low or no productivity.

Real have recently made a number of changes to their incentive system in response to weakness. Real has lowered the hurdle for achieving the second stage of revenue sharing from his 10 agents to his five agents. This is supported by the introduction of Real Retirement, which allows agents who have been with Real for at least the past three years to continue receiving revenue share payments even after they stop representing clients, as long as they maintain a valid license. I am. Real agents will have access to medical benefits consultation resources and benefit from Real's purchasing power. Real also introduced the One Real Impact Fund, which aims to provide tax-free financial assistance to agents during difficult times. These changes may already be having an impact, with Real suggesting it will see an increase in new agents joining in the fourth quarter.

Figure 5: Real Quarterly Agent Net Additions (Source: Created by author using data from The Real Brokerage)

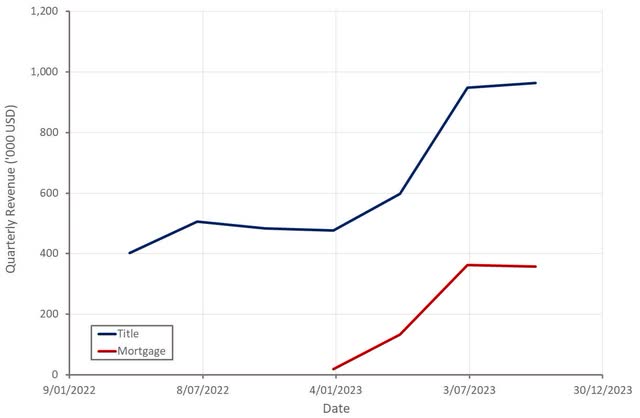

Real is focused on increasing the add-on rate of ancillary services (mortgages, title, etc.) to improve business economics and foster further growth for the agency. Given the marginal economics of the business to date, this is probably more important than agent growth. Real acquired Expetitle and LemonBrew Lending in 2022 to expand its title and mortgage servicing capabilities. Real recently launched an interactive real estate listing portal for consumers aimed at streamlining the home buying experience and increasing the add-on of high-margin ancillary services. Real's title and mortgage business is currently very small, with little evidence of traction so far.

Figure 6: Beneficial ownership and mortgage income (Source: Created by author using data from The Real Brokerage)

financial analysis

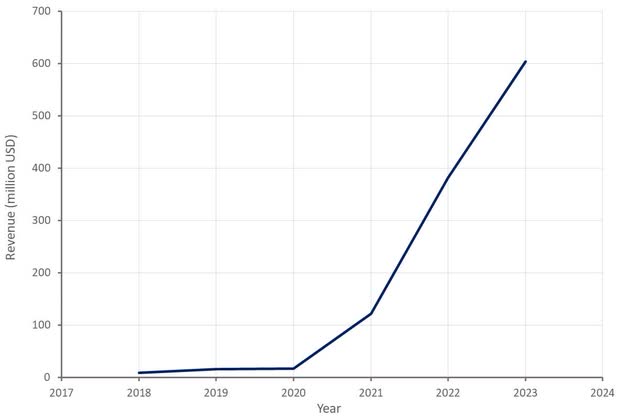

Real's third quarter sales were $215 million, an increase of 92% from the same period last year. This was almost exclusively due to an increase in the number of agents and thus the number of transactions. Fees and other income increased 245% year over year to $3.1 million in the third quarter.

Figure 7: Real Returns (Source: Created by author using data from The Real Brokerage)

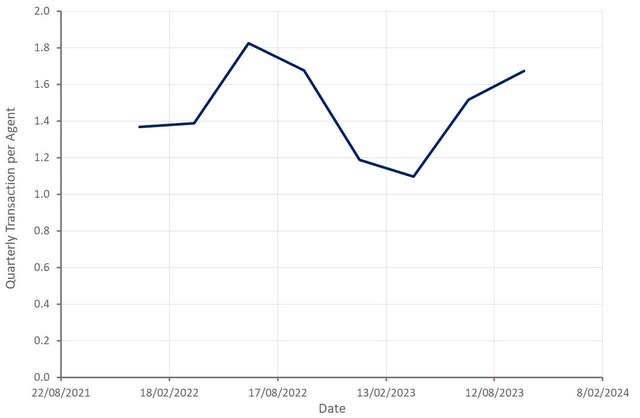

Somewhat surprisingly, Real's business has been less affected by market headwinds. The median sales price of real estate sold by real estate agents has remained almost constant, and the number of deals continues to increase rapidly. From the end of 2022 to the beginning of 2023, the number of transactions per agent decreased, but this metric has since recovered. This is likely due to churn of less productive agents.

Figure 8: Real quarterly trades per agent (Source: Created by author using data from The Real Brokerage)

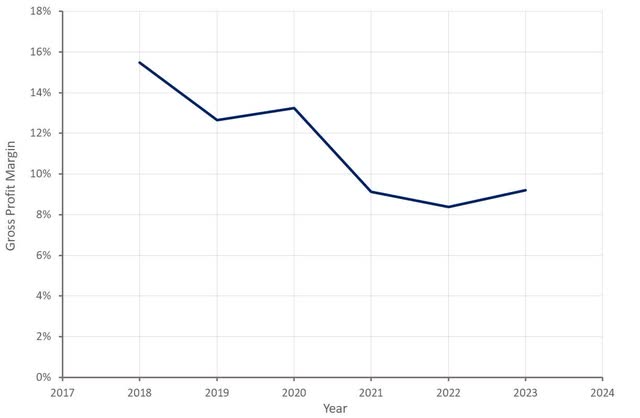

Real's business model distributes the majority of its revenue to agents. Additionally, the company's gross profit margin has shrunk significantly in recent years.

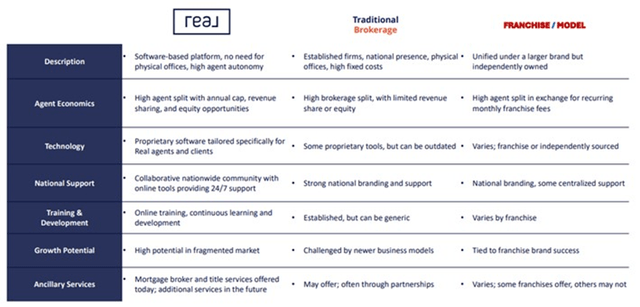

In the long term, Real is targeting a 20% gross profit margin by expanding its title and mortgage businesses, as well as the fintech products it has introduced for agents. Gross margins on mortgages and titles are expected to be in the 60-80% range.

Figure 9: Real Gross Profit Margin (Source: Created by author using data from The Real Brokerage)

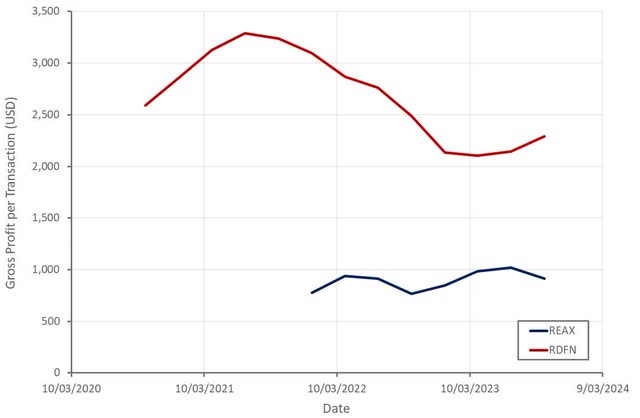

Redfin's (RDFN) employee agent business model contrasts with Real's. Redfin has higher fixed costs and can extract more gross profit per trade, but this creates risk during downturns. However, neither approach is necessarily better, and neither company has yet demonstrated that it can generate profits.

Figure 10: Real gross profit per trade (Source: Created by author using data from The Real Brokerage)

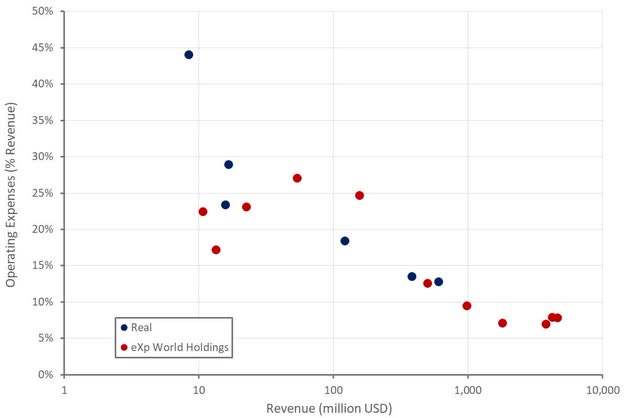

The use of Real's trade management software and agents allows the company to generate large amounts of revenue with very little overhead. For example, Real says its nine-person team processed more than 37,000 transactions in 2022. In the third quarter of 2023, Real had approximately 100 agents per full-time employee (excluding Real Title and One Real Mortgage employees).

Real classifies revenue sharing for incentivizing new agent recruitment as a marketing expense. This is the company's largest operating expense, accounting for approximately 3.7% of its revenue in the third quarter of 2023.

Real's operating expenses probably won't have much room to fall as a percentage of revenue any further, making it difficult to generate decent profit margins. Real needs success in ancillary services to increase gross margins to achieve its 10% EBITDA margin target.

Figure 11: Real operating expenses (Source: Created by author using data from The Real Brokerage)

conclusion

Real is an interesting business because revenue sharing arrangements can be a very effective way to attract agents to the platform. However, this does not necessarily mean that the company creates value for shareholders.

Considering the company's growth rate, Real's valuation is not very high. This is likely due to doubts about the company's ability to generate decent profit margins. Judging from the trends in Real's gross profit margin and operating expenses, the brokerage business appears to have little value. However, it can be a low-cost way to acquire title, mortgage, and insurance customers. If the Real can gain further traction in these areas, it could represent an attractive investment opportunity.

Figure 12: Real Relative Valuation (Source: Created by author using data from Seeking Alpha)