- Rachel, 35, followed in her father's footsteps and became a financial expert.

- She frequently shares money budgeting tips online

- Recently, she revealed the 5 habits you should develop to save money

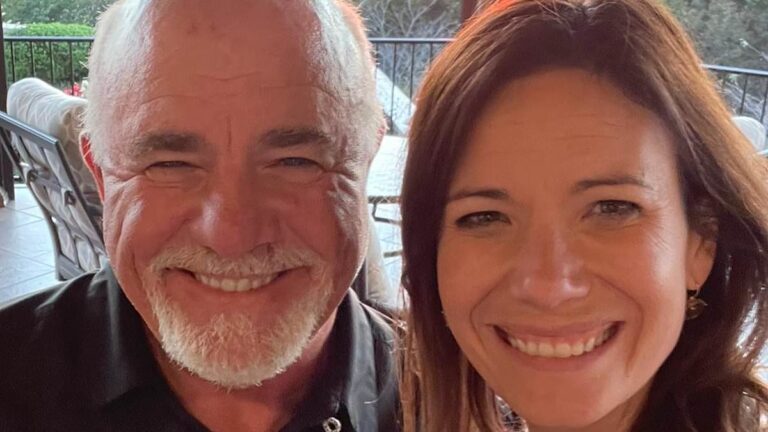

Financial guru Dave Ramsey's daughter Rachel has revealed five frugal habits that will help her cut her 'spending in half', from not eating out to canceling subscriptions.

The 35-year-old worked alongside her father as a financial expert and followed in his footsteps as a money and budgeting expert.

And just like her 63-year-old father, Rachel also takes to social media to give out her best financial tips for keeping your bank account in the best possible shape.

Tennessee experts recently revealed that comparing yourself to others or only looking at one store when preparing to make a big purchase can lead to a hard time, lowering costs. I have clarified the method.

Rachel shared various 'frugal' habits to work on in her YouTube short.

At the beginning of the video, she says, “Here are 5 frugal habits that will help you cut your spending in half.”

“First and foremost, it's subscriptions. The average Millennial has 17 subscriptions. If you want to save money, stop subscribing.”

She then advised viewers to shop around before making big purchases.

She explained that you shouldn't buy something before checking the price at multiple stores.

Rachel always tells people on the web to “compare prices.”

“The third thing is going out to eat. This is a little heartbreaking,” she said.

Rachel said she loves eating out, but it's much cheaper to buy groceries and cook.

For her fourth tip, Rachel told viewers to stop buying “extra” things.

She said she loves picking up “lipsticks and hair clips,” but they aren't necessary and end up piling up.

Her last tip was more about “heart problems.” “It's about comparison. We all compare naturally, but don't let other people's lives dictate what you buy,” she said at the end of the video.

Previously, Rachel talked about how people should plan ahead for rising costs of living.

With rising costs and no end in sight to the inflation crisis, Ramsey's team continued to emphasize the importance of creating and maintaining a personal budget.

Rachel said: “You're saying, okay, I'm going to plan ahead, I'm not going to let this sneak up on me.”

“So budgeting is a huge thing when it comes to this…so be diligent and be honest with your friends and family too. For example, if inflation hits and you have a tough end of the year this month or next month. If so, just be honest about it and say, “Christmas could be different.” ”