-

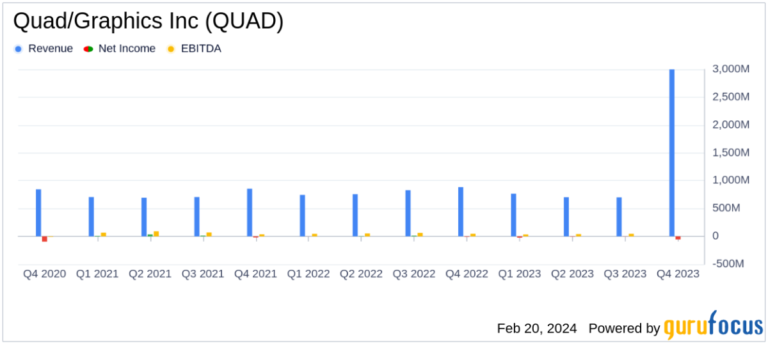

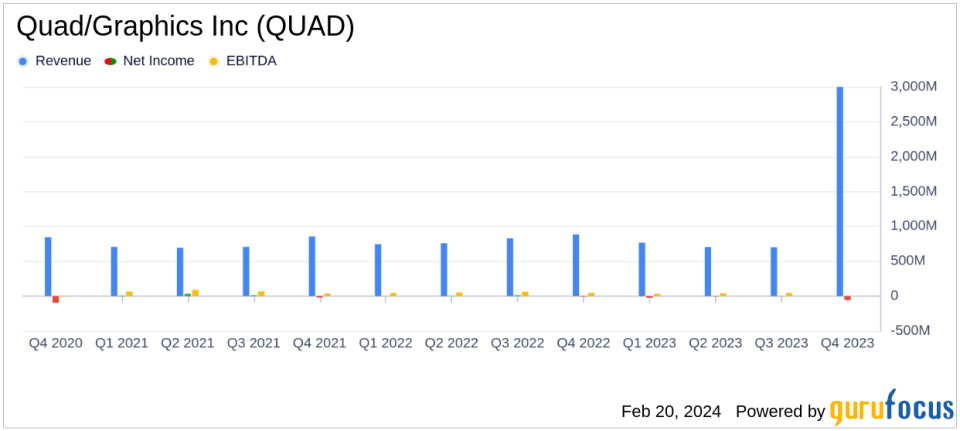

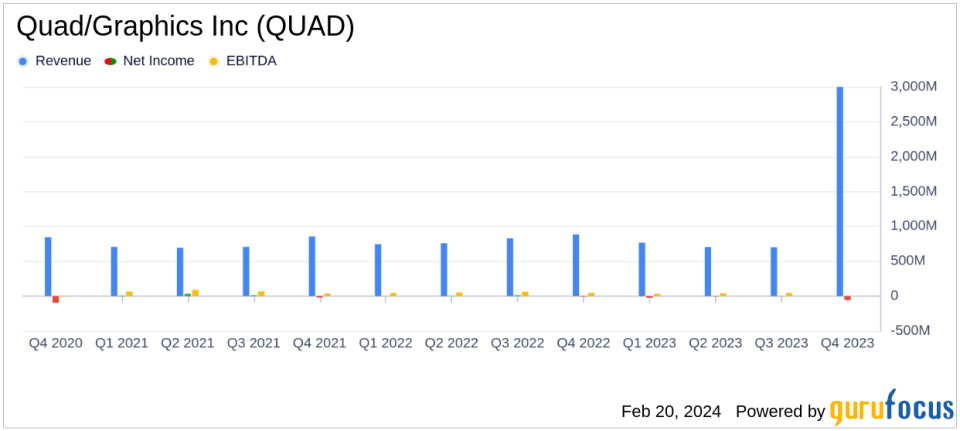

net sales: Reported to decrease from $3.2 billion in 2022 to $3 billion in 2023.

-

net loss: Recognized a net loss of $55 million in 2023 compared to a net income of $9 million in 2022.

-

Adjusted EBITDA: $234 million in 2023, with a margin of 7.9%. Comparatively, in 2022 he made $252 million, a margin of 7.8%.

-

free cash flow: Generated $77 million in 2023, down from $94 million the previous year.

-

Reducing net debt: Reduced net debt by $564 million, or 55%, over the past four years and achieved leverage of 2.0x.

-

shareholder return: Reinstated quarterly dividend of $0.05 per share and repurchased 2.9 million shares in 2023.

-

Guidance for 2024: Net debt leverage is expected to further decline to approximately 1.8x and net sales to decline by 5% to 9%.

February 20, 2024 Quad/Graphics Inc (NYSE:QUAD), a leading global marketing experience company, details its financial results for the fourth quarter and full year ended December 31, 20238 -K The tax return has been released. In its 2023 outlook, the company faced a net loss due to lower sales, higher restructuring costs, and higher interest expense, although debt continued to decline.

Quad/Graphics Inc operates primarily in the commercial sector of the printing industry and provides printing and marketing services. With divisions in the United States, International Markets, and Corporate Operations, the company's revenues are derived primarily from the United States domestic market.

The company's 2023 results reflect the challenges of significant postage increases and economic uncertainty impacting print volumes. Quad/Graphics Inc's commitment to debt reduction is evidenced by lowering its long-term target net debt leverage range from 1.75x to 2.25x. The company's resumption of quarterly dividends and share buybacks demonstrate its continued focus on returning capital to shareholders.

Adjusted EBITDA and margins are relatively stable, highlighting the company's ability to maintain profitability even in a challenging environment. Financial results, particularly in debt reduction and cash generation, are critical to the company's long-term financial health and ability to invest in growth areas such as data and analytics, media and client technology.

Key financial details in the income statement and balance sheet include the decline in net sales and the annual net loss. The cash flow statement shows a decrease in free cash flow, primarily due to increased capital expenditures on automation initiatives. These metrics are important because they provide insight into a company's operational efficiency, liquidity, and financial stability.

“While we achieved solid full-year results primarily due to our strong operating performance, significant increases in postage rates and a negative impact on our print volumes were “This was partially offset by revenue challenges caused by continued economic uncertainty.” of the quad.

Quad/Graphics Inc's 2023 performance, while mixed, shows the company is strategically navigating external pressures. By focusing on cost-cutting measures and strategic investments, such as the acquisition of DART Innovation, the company could revolutionize the shopping experience and strengthen its integrated marketing platform. The 2024 guidance signals a prudent approach in the face of expected headwinds, with a focus on maintaining financial discipline and pursuing growth opportunities.

Investors and stakeholders will be interested to see how Quad/Graphics Inc's strategy unfolds in the coming year, especially in terms of managing print volume declines and leveraging its marketing experience capabilities to drive diversified revenue growth. I'll have to keep a close eye on it.

For more information, see the full 8-K earnings release from Quad/Graphics Inc here.

This article first appeared on GuruFocus.