-

Grant income: Fiscal year 2023 was reported at $1.4 million, an increase from $0 in the prior year.

-

Research and development expenses: This amount increased to $21.3 million from $900,000 the previous year.

-

Net loss: Net loss for fiscal 2022 was $10.8 million, or $(0.08) per share, while earnings increased to $46.5 million, or $(0.17) per share.

-

Cash position: Cash and cash equivalents at year-end were $9.2 million, down from $21 million a year earlier.

-

Shareholders' equity: This amount increased from $54.6 million at the end of the previous fiscal year to $75.2 million.

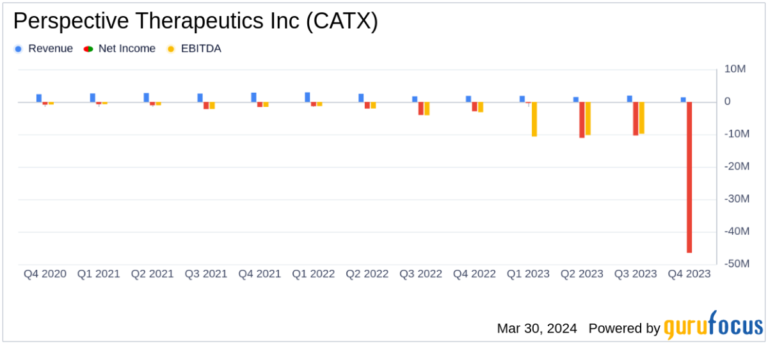

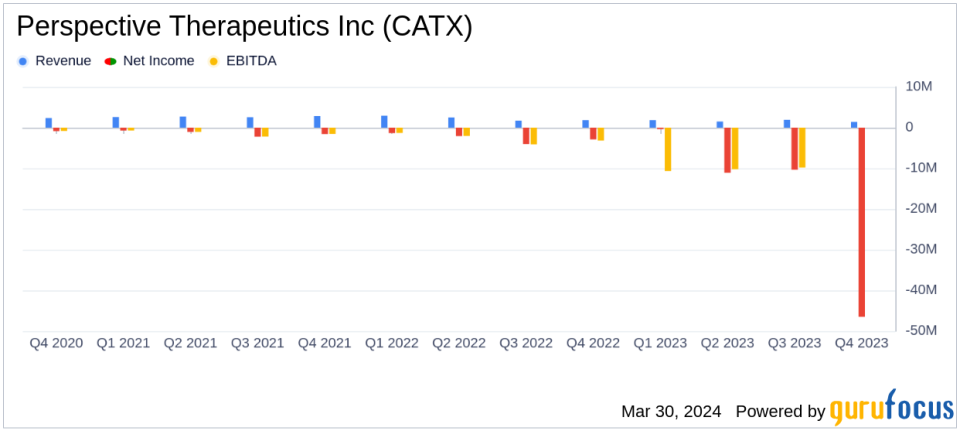

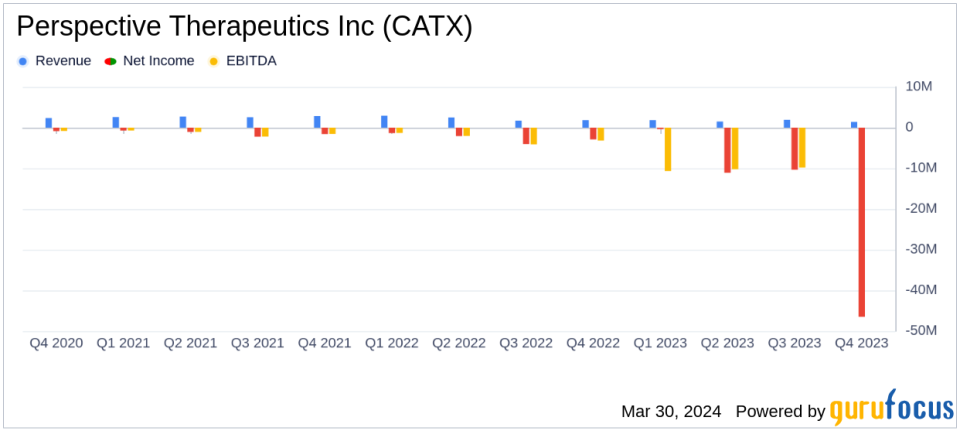

Perspective Therapeutics, Inc. (CATX), a pioneering radiopharmaceutical company focused on advanced cancer treatments, announced its 2023 financial results on March 28, 2024. The company primarily reported significant progress in its clinical programs and strategic partnerships despite an increase in net losses. This is due to significant investment in research and development. Further details of our financial results are included in our 8-K filing.

Company Profile

Perspective Therapeutics Inc is a medical technology and radiopharmaceutical company operating in two segments: Pharmaceuticals and Brachytherapy. With the recent sale of its brachytherapy division, the company is focused on developing cutting-edge treatments for a variety of cancers using its proprietary radiopharmaceuticals and complementary imaging diagnostics.

Financial performance and challenges

The Company's fiscal year 2023 financial performance was characterized by an increase in grant income of $1.4 million, an improvement from the prior year in which no grant income was recorded. However, it was overshadowed by a significant increase in research and development expenses, which skyrocketed to $21.3 million from just $900,000 the previous year. This research and development investment, which is critical to advancing the company's clinical programs, resulted in a net loss of $46.5 million, or $0.17 per share, compared to a net loss of $10.8 million, or $0.08 per share. This led to significant losses ($). In 2022.

The increase in net loss included $40.1 million from continuing operations and $9.1 million from discontinued operations, partially offset by a deferred income tax benefit of $2.7 million. The company's cash position also decreased, with cash and cash equivalents at year-end of $9.2 million, down from $21 million at the end of the prior fiscal year. However, Perspective Therapeutics believes he can raise significant capital through a private placement and public offering in the first quarter of 2024 and sustain the business through 2026.

Financial performance and materiality

Despite the challenges, Perspective Therapeutics' financial results include securing grant income and funding from year-end financial activities. These results are of great importance to companies in the medical device and equipment industry, as they provide the necessary resources to continue developing innovative treatments and potentially bring them to market.

Analysis of financial statements

An analysis of the income statement shows that the increase in grant income contrasts sharply with the increase in operating expenses, leading to an increase in operating losses. The balance sheet shows strong shareholder equity, suggesting a strong capital structure to support future growth. However, the cash flow statement indicates a burn rate that requires additional capital injections, as evidenced by successful financing activities in early 2024.

Thijs Spoor, CEO of Perspective Therapeutics, said, “In 2023, we will make significant progress in building a fully integrated radiopharmaceutical company dedicated to advancing potentially best-in-class or first-in-class alpha therapy.” ” he said.

The company's strategic focus on advancing its clinical programs is evidenced by its significant investment in research and development, which is essential to the development of its proprietary radiopharmaceuticals. The acquisition of a radiopharmaceutical manufacturing facility and the establishment of a strategic partnership highlight the company's commitment to innovation and its potential to revolutionize cancer treatment.

conclusion

Perspective Therapeutics Inc (CATX) faces a typical challenge in the biotechnology industry: balancing high research and development costs with the potential for breakthrough medical advances. Our fiscal year 2023 financial results reflect this dynamic, and the company is positioning itself for future success through strategic investments and partnerships. Investors and stakeholders will be watching closely as the company moves forward with clinical trials and attempts to translate its research and development efforts into viable cancer treatments.

For more information on Perspective Therapeutics Inc's financial results and business updates, please refer to its official financial results releases and filings.

For more information, see Perspective Therapeutics Inc's full 8-K earnings release here.

This article first appeared on GuruFocus.