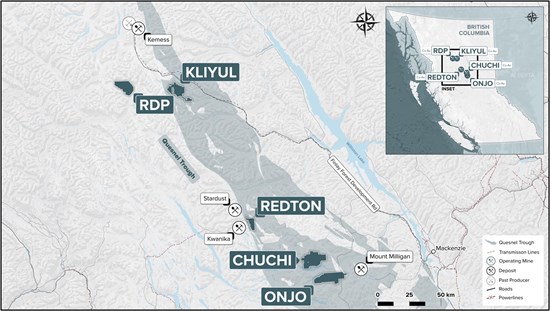

Vancouver, British Columbia–(Newsfile Corp. – March 4, 2024) – Pacific Ridge Exploration Ltd. (TSXV: PEX) (OTCQB: PEXZF) (FSE: PQWN) (“Pacific Ridge” or the “Company”) I'm satisfied. Due to strong investor demand, the Company's wholly owned Kriyul Copper-Gold Project (“Kriyul” or “Kriyul” or the “Project”) is located in the rich producing Quesnel Terrane of north-central British Columbia. (see Figure 1).

Figure 1

Kuriyuru location

To view an expanded version of Figure 1, please visit:

https://images.newsfilecorp.com/files/5460/200355_4d89e4e534583ad8_001full.jpg

financing

Pacific Ridge has offered up to 13,131,250 units (the “Units”) at a price of $0.08 per unit and 6,310,540 flow-through units (the “FT Units”) at a price of $0.095 per FT Unit in a gross non-brokered private placement. We are planning to publish it. Earnings up to $1,650,500 (“Financing”). Each Unit consists of one common share of the Company and one common share purchase warrant (a “Warrant”). Each FT Unit consists of one common share of the Company (each a “FT Share”) and one warrant issued as a “flow-through share” within the meaning of the Canadian Income Tax Act. Each warrant is exercisable to purchase one additional non-flow-through common share for a period of 24 months at an exercise price of $0.12.

The proceeds from the sale of FT Shares will result in the incurrence of “Canadian exploration expenses” as defined in section 66.1(6) of the Income Tax Act and “flows from mining expenditure” as defined in section 127(9) of the Income Tax Act. is used for the occurrence of . Such proceeds will be forfeited to Subscribers with an effective date of December 31, 2024, in an amount not less than the aggregate gross proceeds raised from the issuance of FT Shares.

Proceeds from this financing will be used for general working capital, exploration at Pacific Ridge's flagship Kriyul copper-gold project, and exploration at the company's other projects in British Columbia. . Pacific Ridge may pay a 6% cash finder's fee on some financings. Financing and payment of finder fees are subject to approval by the TSX Venture Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws, and are not registered within or within the United States except as follows: It may not be provided or sold to anyone. We are registered under the United States Securities Act and applicable state securities laws, or exemptions from such registration are available.

About Kriyul

Pacific Ridge owns over 90 km of Kriyul2 It is large in size and located in a productive Quesnel landscape close to existing infrastructure. The project includes a number of attractive exploration targets, including the Kriyur Main Zone (“KMZ”), which has been the Company's focus since 2020. Pacific Ridge has completed over 17,500 meters of diamond drilling in the KMZ, expanding the area of known mineralization. 760 meters east to west, maximum north to south 600 meters, maximum vertical depth 650 meters.

The final two holes of the 2023 diamond drilling program, KLI-23-068 and KLI-23-069, offer some of the best mineralized intervals ever reported from the KMZ, with higher-grade A vector to the porphyry center was provided.

-

Drill hole KLI-23-068, KMZ West collared, 110.0 m of 0.97% copper equivalent (“CuEq”)* or 1.44 g/t gold equivalent (“AuEq”)** (0.27% copper, 1.03 g /t) intersecting 0.43% CuEq* or 0.63 g/t AuEq** (0.17% copper, 0.37 g/t gold, and 0.93 g/t silver) within 455.8 meters (news release dated January 9) ), 2024) (see Figure 2).

-

0.58% CuEq* or 0.86 g/t AuEq** (0.38% copper, 0.28 g/t gold, and 2.20 g/t silver) within 570.0 m of 45.0 m from KMZ North collared drill hole KLI-23-069 ) was returned. 0.27% CuEq* or 0.40 g/t AuEq** (0.14% copper, 0.18 g/t gold, 0.99 g/t silver). The 45-m interval with a downhole depth of 584 m is the deepest mineralized interval ever encountered at Kriyul and provides a down-plunge vector to the high-grade porphyry center of the KMZ (dated January 9, 2024 (see Figure 3).

Click on the link below to view the results of previous drill holes completed by Pacific Ridge at Kriyul.

https://pacificridgeexploration.com/site/assets/files/5969/kliyul-assay-summary-for-holes-36-66.pdf

The KMZ remains open in all directions, and Pacific Ridge plans further exploration work this year, including ZTEM and MT surveys, targeting higher-grade mineralization west of the KMZ and a porphyry center north of the KMZ. We plan to narrow it down.

Figure 2

KMZ TDR Footprint Model

To view an expanded version of Figure 2, please visit:

https://images.newsfilecorp.com/files/5460/200355_4d89e4e534583ad8_002full.jpg

Figure 3

A 400 m thick east-west section (6265860 N) with deep-view MVI voxel model suggests a west-dipping system above the underlying source pluton

To view an expanded version of Figure 3, please visit:

https://images.newsfilecorp.com/files/5460/200355_4d89e4e534583ad8_003full.jpg

About Pacific Ridge

Our goal is to become British Columbia's leading copper and gold exploration company. Pacific Ridge's flagship asset is his wholly owned Kriyul copper-gold project located in the Quesnel Terrane close to existing infrastructure. In addition to Kliyul, the company's project portfolio includes the RDP copper-gold project (an option to Antofagasta Minerals), the Nakaike copper-gold project, the Onjo copper-gold project, and the Redton copper-gold project. All of these are based in the UK. Columbia. Pacific Ridge recognizes that its BC Project is located on the traditional, ancestral, and unceded territories of the Gitsan Nation, McLeod Lake Indian Band, Nakasudri Witten, Takla Nation, and Tsai Kay Dene Nation. I would like to acknowledge the position.

On behalf of the Board of Directors,

“Blaine Monaghan”

Blaine Monaghan

President and CEO

Pacific Ridge Exploration Limited

Public relations activities for investors:

Phone number: (604) 687-4951

Email: ir@pacificridgeexploration.com

Website: www.pacificridgeexploration.com

LinkedIn: https://www.linkedin.com/company/pacific-ridge-exploration-ltd-pex-/

twitter: https://twitter.com/PacRidge_PEX

*CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x AuR/CuR x $Au x 0.032151) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151) ) / ($Cu x 22.0462).

**AuEq = ((Au(g/t) x $Au x 0.032151) + ((Cu%) x CuR/AuR x $Cu x 22.0462) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Au x 0.032151).

Product price: $Cu = US$3.25/lb, $Au = US$1,800/oz, Ag = US$20.00/oz.

No metallurgical tests have been conducted for Kliyul or RDP mineralization. We estimate copper recovery (CuR) to be 84%, gold recovery (AuR) to 70% and silver recovery (AgR) to be 65% based on average recoveries from KUG, Mt Milligan and Red Chris. I am.

Factors: 22.0462 = Cu% to lbs/ton, 0.032151 = Au g/t to troy ounces/ton, 0.032151 = Ag g/t to troy ounces/ton.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The technical information contained in this news release has been reviewed and approved by Gerald G. Carlson, Ph.D., P.Eng., Pacific Ridge's Executive Chairman and a Qualified Person as defined by National Instrument 43-101 Policy .

Forward-looking information: This release contains certain statements that may be considered “forward-looking statements.” All statements in this release, other than statements of historical fact that refer to exploration drilling and other activities and events or developments that Pacific Ridge Exploration Limited (“Pacific Ridge”) expects to occur, are These are forward-looking statements. Forward-looking statements in this news release include statements regarding further exploration efforts and financing to target higher-grade mineralization in the KMZ West and KMZ North porphyry centers. Although Pacific Ridge believes that the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and may differ from actual results. results and developments may differ materially from those forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploration success, the continued availability of capital and financing and general economic, market or Contains business context. These statements are based on a number of assumptions, including assumptions regarding general business and economic conditions, the exercise of one of the options, and the ability of Pacific Ridge and other parties to meet securities exchange and other regulatory requirements. I am. the availability of financing on reasonable terms for Pacific Ridge's proposed programs and the ability of third party service providers to provide services in a timely manner. Investors are cautioned that such statements are not guarantees of future performance and actual results or developments may differ materially from those anticipated in the forward-looking statements. Pacific Ridge undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Not intended for distribution to or dissemination within the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/200355.