hispanoristic

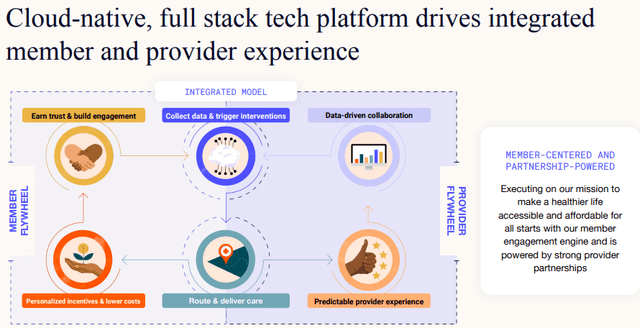

Oscar Health (New York Stock Exchange:OSCR) provides an innovative health insurance platform that is influencing industry trends such as consumerization, digitalization, and value-based care.

We use AI and big data to help members navigate the byzantine world of U.S. health care and match plans. individual situation. We offer many services such as: investmentpedia:

These plans offer free physician on-call services, free care team services, 24/7 access to providers, and no referrals are required to see a specialist as long as you're in-network. Oscar members also receive cash. The app can be linked to many smart pedometers and watches, giving you an incentive (up to $100 per year) to keep up with your daily step count.

The platform uses AI and care teams to match members to the best caregiver based on their individual circumstances. It is also driven by high cost. and quality algorithms.

The data generated further powers the algorithms and strengthens the cycle of trust by improving quality of care, reducing costs, and increasing member trust.

OSCR IR presentation

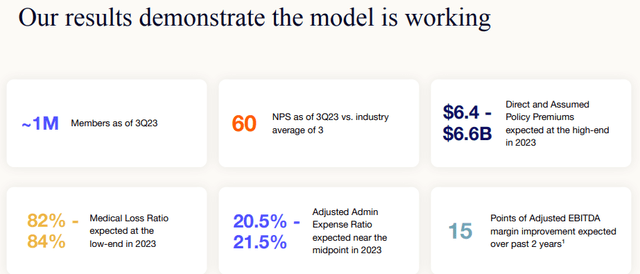

These are all great words and intentions, but do they work? Here are the signs:

OSCR IR presentation

Until recently, this model had been successful in rapidly increasing membership numbers, but as a result of “portfolio shaping” efforts (focusing on activities that generate high returns), that growth has stalled and the company even retreated from entire states (like Florida). temporary, California).

So, while rapid membership growth is no longer a sign of a customer-friendly business model, at least a year ago, the industry-leading NPS (Net Promoter Score) score rose to 60, and competitors' scores was far below that.

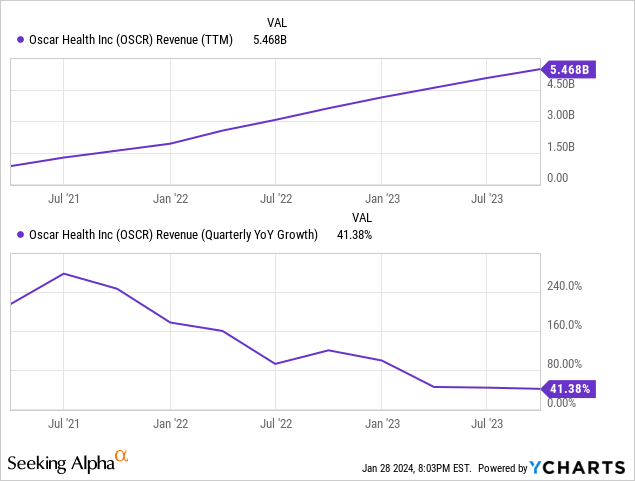

But they can grow without adding new members. The growth rate may have come down quite a bit to “only” 41.3%, but it's still very strong.

However, as discussed below, the main drivers of its growth (reducing premiums ceded to reinsurance and risk adjustment) and efficiency gains are facing declining profits.

In other words, in order for the company to continue to grow, it needs to recover its membership growth and continue to grow. This is a little difficult to predict given the changing economic climate at the state level. The company has even suspended new memberships in states such as Florida and California.

However, management believes it can grow membership again, and they have to commend the flexibility of the company's business model, which has allowed for strong momentum even during periods of stagnant membership.

The driving force behind growth

OSCR IR presentation

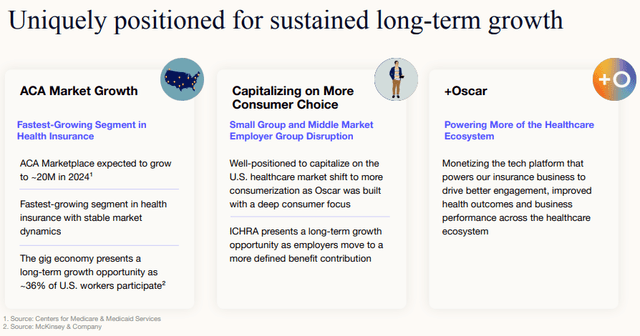

- ACA growth

- growth of members

- Expanding in existing markets and/or entering new markets

- new program

- Direct premium and deemed premium

The company is present in 18 states, two fewer than a year ago, and is not expanding into any new states at this time. The company announced his FY24 expansion plan in his PR in October 2023. We are planning to expand our footprint in existing states (PR).

Starting in 2024, Oscar will have a presence in 18 states and 512 counties and will also expand its presence in Arizona, Florida, Georgia, Illinois, Iowa, Kansas, Missouri, North Carolina, Ohio, Oklahoma, Tennessee, Texas and Virginia . This expansion will improve access to care in underserved and rural markets through Oscar's consumer-focused technology platform.

Other new initiatives include:

- HolaOscar, a Spanish-speaking program, represents a portion of ACA's growth.

- We also plan to introduce new individual and family plans in 2024, including the recently introduced Breathe Easy program for members suffering from COPD and asthma, and an enhanced diabetes plan.

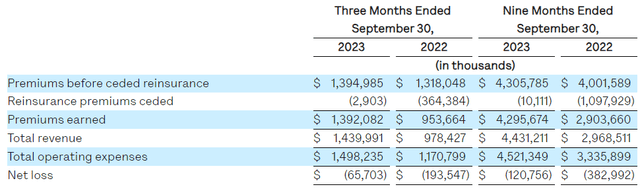

Premium growth was driven by retention, new members and premium growth, which decreased 5% to $1.6 billion in the third quarter. This decline was driven by a decline in membership, which was only partially offset by an increase in premiums (Revenue PR).

Premiums written for the quarter increased 46% compared to the prior year period primarily due to the impact of deposit accounting on quota share reinsurance contracts and lower risk transfer per member as a percentage of premiums.

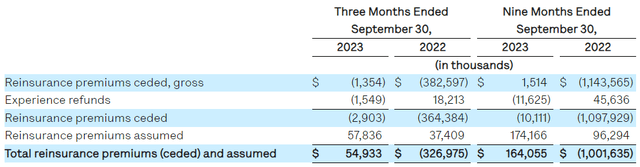

Quota shares are negotiated between insurance and reinsurance companies. Accounting can get a little more complicated, but the basic fundamentals remain the same.

However, the company has traditionally had a healthier and younger membership than the market average (due to its Internet savvy), which required it to pay higher amounts into its risk adjustment program.

However, this risk adjustment decreases as members approach the average ACA population profile (Q3CC).

Before ceding, our premiums (including the impact of low risk adjustment transfers) increased 6% from the prior year period to $1.4 billion.

Oscar also recognized $27 million in related risk-adjusted benefits in 2023 as risk trended toward average ACA and expected lower risk transfer going forward.

But nearly all of the revenue growth came from recording more insurance policies on the books rather than simply transferring them to reinsurance companies.

OSCR revenue PR

Almost all of the revenue increase was due to very few policy transfers to reinsurance, with a value of just $2.9 million, compared to $364 million in the March 2022 quarter and 9 The monthly decline was even more dramatic. In fact, the company has moved to net underwriting of insurance policies from reinsurance companies, rather than transferring them to reinsurance companies.

OSCR revenue PR

+Oscar

+Oscar is a business line that monetizes technology platforms to healthcare providers and payers, or at least some of its modules, particularly the Campaign Builder (10-K).

Campaign Builder is an engagement and automation platform that enables scalable, personalized interventions and automates workflows, designed to drive growth, deliver best-in-class clinical outcomes, and optimize administrative operations. Masu.

Two customers already serve 500,000 people (one is Cigna), and a third was added in the third quarter in the form of Stanford Health Plan. The company is incorporating more OpenAI solutions into +Oscar (and its insurance business).

finance

OSCR IR presentation

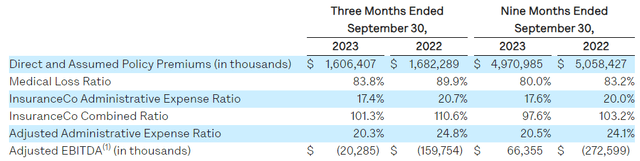

Two related ratios capture a company's efficiency

- MLR or Medical Loss Ratio (the percentage of total health insurance premiums spent on health insurance claims and efforts to improve the quality of health care). For ACA, MLR must be maintained at 80% or higher.

- AER or Administrative Expense Ratio.

Both ratios have improved, with MLR improving by 610bp year-on-year to 83.3% (Q3):

Due to our disciplined pricing and total cost approach

AER improved 330bp YoY to 17.4% (3rd quarter):

This is facilitated by lower risk transfer per member and optimization of distribution as a percentage of premium.

This represents a combined 935bp improvement in Q3 (560bp year-to-date). Further boost will come from interest earned on his $2.6 billion cash reserves (he earned $44 million in the third quarter), which he held primarily in short-term financial instruments to take advantage of the rising interest rate environment.

Reserves were quite high a quarter ago due to the annual risk adjustment transfer payment in the third quarter.

No wonder AEBITDA continues to improve in a very comprehensive way.

- The company was able to increase its AEBITDA margin by an average of 800bp per year over the past three years, providing significant operating leverage even in the absence of member growth.

- AEBITDA improved by $140 million in the third quarter, resulting in an insurance company loss of just $20 million, and a company-wide improvement of $340 million, resulting in an AEBITDA profit of $66 million.

However, consider the following:

OSCR revenue PR

Year-to-date MLR has already reached the minimum required level of 80%. This means that no further improvement is possible (and in any case, most of the improvement comes from reduced risk-adjusted payments, and Oscar's population profile is closer to the world average). ACA, further gains are even more difficult).

guidance

From Revenue PR:

- Direct premiums and estimated premiums are at the high end of the $6.4 billion to $6.6 billion range.

- Medical loss rates are at the lower end of the range of 82% to 84%

- InsuranceCo's management expense ratio is in the middle of the range of 17% to 18%.

- InsuranceCo Adjusted EBITDA(1) The deal is $155 million to $165 million, above the previous range of $20 million to $120 million.

- Adjusted management expense ratio is near the middle of the range of 20.5% to 21.5%

- Adjusted EBITDA(1) (loss of $60 million to $50 million), above the upper end of the traditional range ($175 million to $75 million)

evaluation

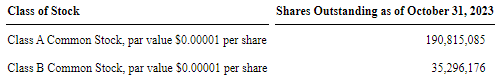

From 10-Q:

OSCR10-Q

Regarding the latter, we need to understand (10-Q).

Our Class B common stock carries 20 votes per share and our Class A common stock carries 1 vote per share. As of September 30, 2023, the holders of our outstanding Class B common stock, consisting of Thrive Capital and our co-founders, beneficially owned 21.3% of our outstanding capital stock. , owns 81.8% of the voting power of the Company's outstanding capital stock. (assuming the exercise of all options to acquire shares of Class B common stock beneficially owned as of September 30, 2023 and conversion of the 2031 Notes, in each case).

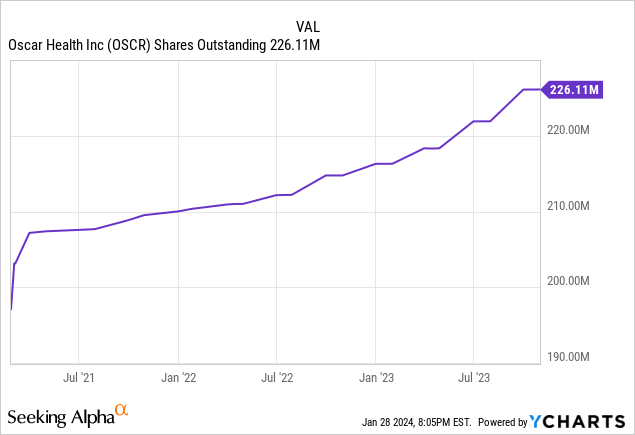

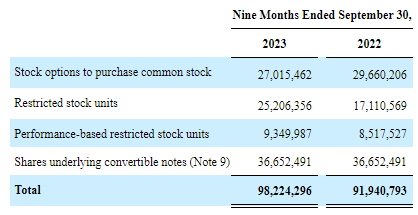

From 10-Q onward, there has been further dilution.

OSCR10-Q

At full dilution, there would be 324.3 million shares outstanding, a market cap of $3.89 billion (at $11 per share), and an EV of just $1 billion. We're hesitant to base our EV valuation on it, as the $2.6 million in cash and investment balances primarily support the case.

Based on expected fiscal year 2023 revenues of $5.9 billion, the stock looks cheap to us at 0.66x P/S, even if the company is still losing money, and insiders have also seen a Apparently he agrees, since he purchased 10,000 shares.

One thing to keep in mind is that there are many moving parts that affect a company's growth and finances, and they can move in unexpected ways.

conclusion

The results that Oscar Health continues to produce are impressive. However, three of this year's revenue growth and operating leverage drivers are facing declining profits, and one of them (policy transfers) is already considered zero.

- Almost all of the revenue growth was due to a dramatic reduction in cedings to reinsurers, which have reduced to almost zero and cannot drive future growth.

- The AEBITDA improvement continues to be impressive, but given the fact that by law it can't go below 80%, I'm not sure about the remaining mileage, especially in the MLR improvement. Economies of scale and the increased use of AI are likely to continue to generate operating leverage, but perhaps not to the extent that investors are accustomed to.

- Risk adjustment is another factor that causes marginal returns to begin to decline.

Basically, the company needs to expand its membership to continue growing, but it has been stagnant for a year. Management expects membership growth to occur in his late teens and premium growth to occur in his early 20s.

If they can achieve that (and recent insider buying suggests management has considerable confidence in these forecasts), this would still produce attractive growth (even if If not the 50% growth the company has achieved this year).

But it provided few details about how it would accomplish that, other than expanding into rural areas of the state where it already has a presence. We believe this is not too difficult and that they can achieve this, given their attractive value proposition for customers and the all-digital and consumer-centric benefits of their rural business model. thinking about.

It is also likely that there is still additional operating leverage, primarily through platform economies of scale and the use of AI, which they are deploying quite aggressively, but with less profit margins when it comes to improving AER, especially MLR. Decrease may have begun.

So we think there's reason to be optimistic, and given the stock's low price, we hope investors keep in mind that while the company has an impressive production track record, things can change quickly. We believe you can still buy it for less than $11 as long as you like. Continue to improve regardless of the situation.