Written by Medha Singh

(Reuters) – Nvidia shares have more than tripled in value over the past year as investors awaited more details about the company's latest AI chip that is expected to further solidify its industry leadership. However, it fell about 2% on Tuesday.

Shares of the world's third-highest market capitalization company fell to $865, with some analysts saying investors had already priced in the announcement of the B200 Blackwell chip, and the company said it would be more efficient in some tasks. It claims to be 30x faster than its predecessor.

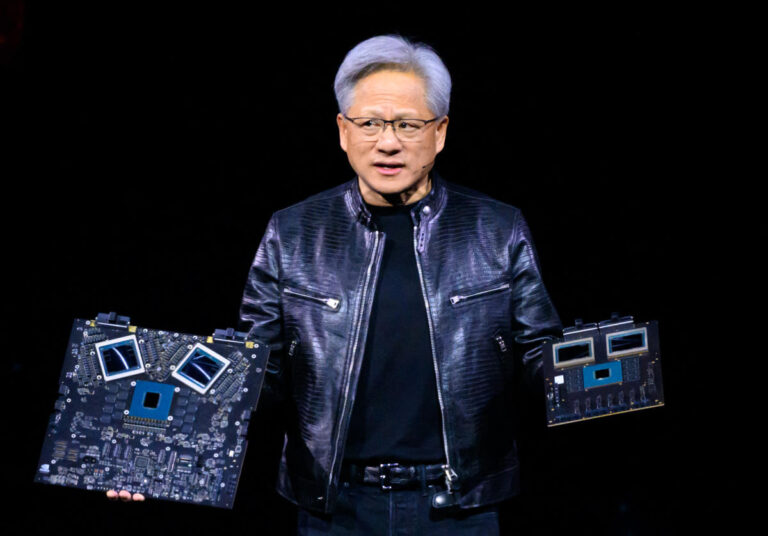

Nvidia CEO Jensen Huang told CNBC that Blackwell chips will cost between $30,000 and $40,000.

The company, which controls 80% of the AI chip market, is expected to announce details in a presentation to financial analysts at 11:30 a.m. ET (3:30 GMT).

“While Blackwell technology shows significant performance improvements over Hopper (the current flagship chip), it will always be difficult to live up to the hype,” said David Wagner, portfolio manager at Aptus Capital Advisors. He added that investors are still digesting about 80 technologies. Year-to-date price jump rate.

Nvidia stock hit an all-time high of $974 just seven sessions ago.

In addition to its Blackwell chips, which combine two squares of silicon the same size as the company's previous products, Nvidia plans to make it easier for developers to sell artificial intelligence models to companies that use its technology. announced details of its new software toolset on Monday.

Nvidia expects its new flagship chip to be used by major customers including Amazon.com, Alphabet's Google, Meta Platforms, Microsoft, OpenAI and Tesla.

The company is also transitioning from selling single chips to selling complete systems.

Analysts at Mornigstar said the company's hardware products will likely remain the “best of breed” in the AI industry, raising their forecasts for Nvidia data center revenue in 2026 and 2028.

“We remain impressed with Nvidia's ability to leverage additional hardware, software, and networking products and platforms,” they said.

The software push makes it easier for Nvidia, whose chips are primarily used to train large-scale language models like Google's Gemini, to adapt the hardware to companies rushing to integrate generative AI into their businesses. It shows what you are trying to do.

Multiple analysts say the market for inference chips that help AI models answer queries or generate images in response to user prompts will ultimately outpace the training chip market, which Nvidia has a firm grip on. It also says it will be much larger.

Many analysts expect Nvidia's market share to decline by a few percentage points this year as competitors launch new products and the company's biggest customers manufacture their own chips, but its dominance remains intact. It is expected that there will be no.

Blackwell is a “chip monster,” but it may take some time to see if it can contribute to Nvidia's bottom line in the same way that chips do now, said Kathleen, director of research at Polish broker XTB. Brooks said.

Shares of other fast-growing chip makers also fell, with the Philadelphia Semiconductor Index down about 2.4%.

Nvidia's forward price-to-earnings ratio (P/E), which is often used as a metric for value stocks, was 34.6 times, lower than the average of 42 times over the past three years.

(Reporting by Medha Singh and Aditya Soni; Editing by Pooja Desai)