stock price super microcomputer (NASDAQ:SMCI) It has grown rapidly over the past year, up 1,180% as of this writing. The main reason for the sharp rise in stock prices is Nvidia's (NASDAQ:NVDA) Artificial intelligence (AI) graphics cards.

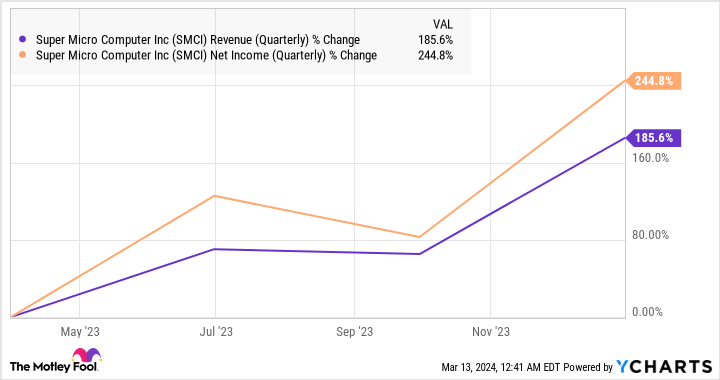

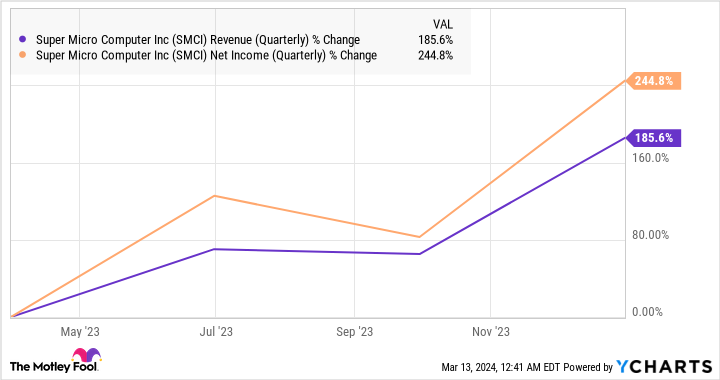

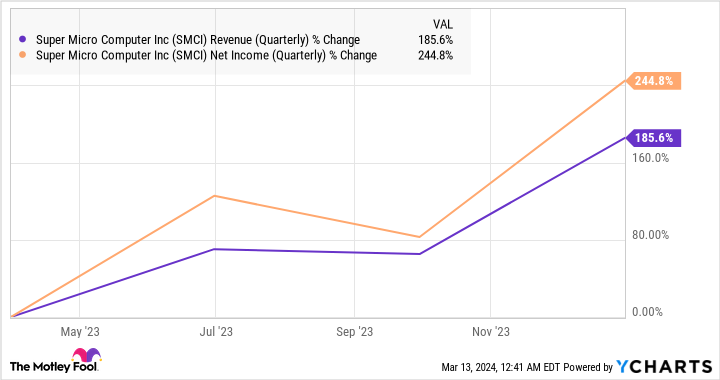

Supermicro's modular server rack-scale systems are used to install AI-related graphics cards from Nvidia and other chipmakers. As demand for Nvidia's cards grew, Supermicro saw a huge spike in demand for its server solutions, leading to rapid growth in the company's top and bottom line.

And now, recent revelations from Nvidia CEO Jensen Huang suggest that Supermicro's impressive growth is here to stay.

Adoption of Nvidia's liquid cooling system should boost super micro computers

Nvidia's current flagship AI graphics card, the H100, reportedly performs well even under air cooling. Additionally, Tom's Hardware says the upcoming H200 processor is expected to deliver optimal performance while being air-cooled. But at an economic summit at Stanford University this week, Huang said one of Nvidia's next-generation computers will be water-cooled.

Nvidia's next-generation AI graphics processing units (GPUs) based on the Blackwell architecture are expected to consume 40% more power than existing products based on the Hopper architecture. According to other claims, Nvidia's next-generation AI chip could even consume twice as much power as its current lineup. This is where water-cooled server systems come into play.

Last year, when Supermicro launched what it claimed was the first liquid-cooled server system for Nvidia's H100 processor, the company said:

Supermicro liquid cooling solutions are estimated to provide data center power savings of 40% compared to air-cooled data centers. Additionally, direct cooling costs can be reduced by up to 86% compared to existing data centers.

A look at third-party research suggests something similar. Liquid cooling is said to consume only 20% of the energy required for air cooling. In other words, liquid cooling is known to significantly reduce energy consumption in data centers while also helping reduce operational costs as it uses less water than air-cooled data centers.

Supermicro appears to have been ahead of the curve last year, as it took the lead in launching a water-cooling solution for Nvidia's AI chips. The company is currently working on increasing its manufacturing capacity for water-cooled server racks. “By this June quarter, we will have dedicated capacity to manufacture high-volume 100-kilowatt to 120-kilowatt racks with liquid cooling, DLC, “We plan to offer direct liquid cooling rack capacity.” With a production capacity of up to 1,500 racks per month, by then our total rack production capacity will be up to 5,000 racks per month. ”

The company's focus on increasing the capacity of its liquid-cooled servers will not only allow it to take advantage of Nvidia's power-hungry AI chips, but also allow it to tap into the burgeoning overall liquid-cooled data center market. The water-cooled data center market is expected to reach $40 billion in annual revenue in 2033, up from just $4.5 billion in annual revenue last year, registering an annual growth rate of 24% over the next decade .

So it's no surprise that Supermicro will maintain a healthy growth pace for a long time to come.

Stock valuation makes buying easy

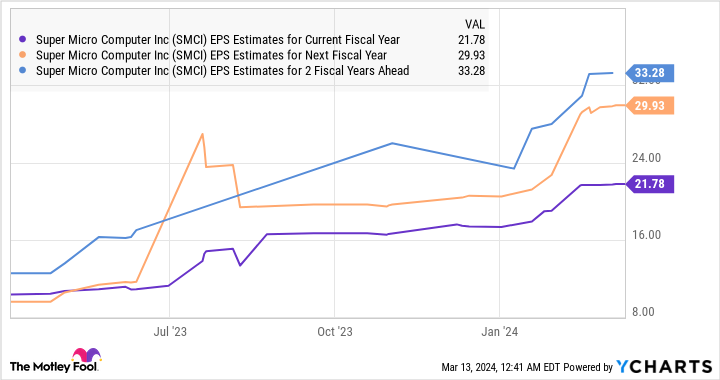

Supermicro has suffered a big drop in the stock market over the past year, but its sales multiple remains at just 6.7 times. This is lower than the Technology sector's price-to-sales ratio of 7.1. Additionally, Supermicro's forward earnings multiple of 36x represents a significant increase in earnings when factoring in its trailing earnings multiple of 84x.

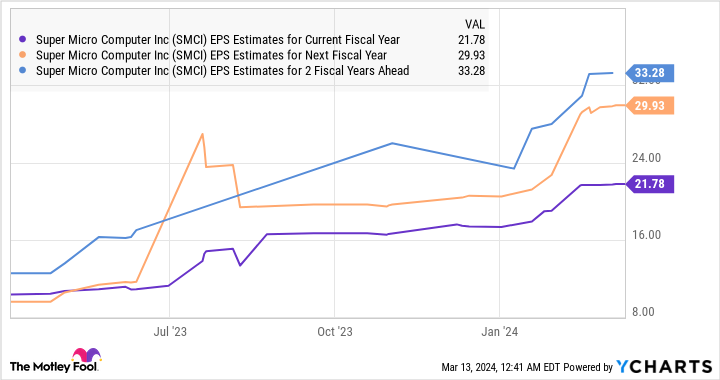

As the following graph shows, Supermicro's earnings are expected to increase significantly from $11.81 per share in the prior year.

It's also worth noting that analysts have raised their earnings growth estimates for the company, and there's a good chance they will continue to do so given additional factors such as growing demand for water cooling systems. That's why now is a good time for investors to buy this AI stock. That's because this AI stock looks poised to sustain impressive gains over the long term.

Should you invest $1,000 in a super micro computer right now?

Before buying Super Micro Computer stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors could buy right now…and super micro computers weren't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia Announces Great News for Super Micro Computer Stocks Originally published by The Motley Fool