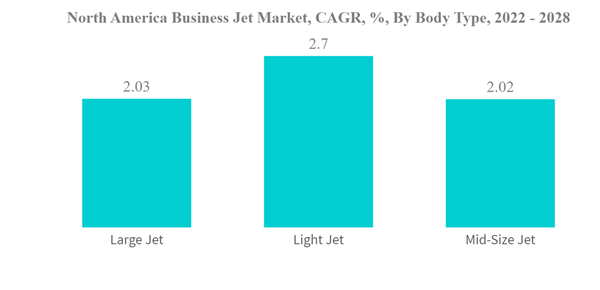

North American business jet market North American business jet market CAGR by aircraft type 2022 2028

DUBLIN, Jan. 25, 2024 (GLOBE NEWSWIRE) — The “North American Business Jet Market Size and Share Analysis – Growth Trends and Forecasts (2023 – 2028)” report has been added. ResearchAndMarkets.com Recruitment.

The North American business jet market size is estimated at USD 12.71 billion in 2023 and is projected to reach USD 14.41 billion by 2028, at a CAGR of 2.54% during the forecast period (2023-2028). grow in

Main highlights

-

Overall aircraft deliveries in the business jet sector were affected by the COVID-19 pandemic, with growth rates declining by 14% from 2019 to 2021. Reductions in economic activity and travel restrictions have affected the availability and procurement of business jets in the region. However, once pandemic restrictions eased and aircraft production resumed in 2021, the North American business jet market began to become agile.

-

The increasing number of high net worth individuals (HNWI) and ultra high net worth individuals (UHNWI) is driving demand for large business jets. Regional air travel and the ability to access remote airports/locations are making light jets more attractive to customers and increasing their demand in the market. Strong economy and purchase and usage of business jets by various sectors/individuals are leading to the growth of the North American business jet market.

North American business jet market trends

-

The North American region accounted for approximately 66% of global business jet deliveries in 2021, making it the world's largest general aviation market.

-

Among all jet aircraft, the small jet aircraft category accounted for the largest share of deliveries in 2021 in the North American region, at over 52%. The increase in flight hours for business travel post-pandemic has created high demand for business jets in the region.

-

During the COVID-19 pandemic, the light jet category was the least affected category of business jets in the region, compared to 35.3% for medium-sized aircraft and 21.5% for large aircraft, respectively. It decreased by 17.8%. This is due to consistent demand for lightweight jets as clients prioritize them over other medium and large jets.

-

During this historic period, Cessna was the leading company with 140 deliveries, and Gulfstream Aerospace was in second place with 78 deliveries. Cirrus Aircraft, Embraer, Bombardier, Honda Group, and Pilatus Aircraft were also major players in the North American business jet market. Most companies are announcing and developing new business jet models to meet the growing demand for business jets during the forecast period.

-

Regarding business jet OEMS, as of July 2022, Cessna accounts for approximately 34% of all business jets, followed by Bombardier and Gulfstream with approximately 21%, and Gulfstream with approximately 14%. In 2021, the business aviation sector saw a 10.7% increase in delivery rates due to the economic recovery. Approximately more than 3,000 of the global jet aircraft demand is expected to come from the North American region during the forecast period.

Some of the companies mentioned in this report include:

For more information on this report, please visit https://www.researchandmarkets.com/r/t7j3ve.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900