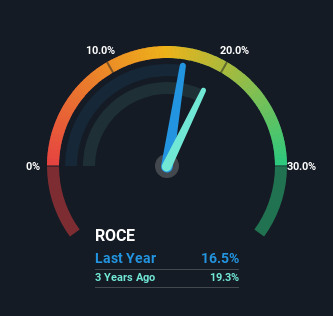

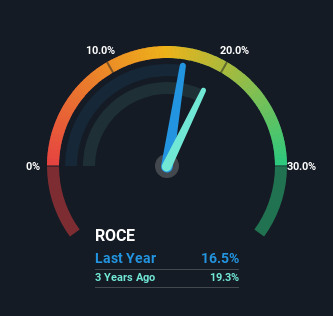

What trends should you look for to identify stocks with the potential to increase in value over the long term? In particular, we'd like to look at two things.First, grow return The first is capital employed (ROCE) and the second is the company's capital growth. amount of capital employed. After all, this shows that this is a business that is increasing its profitability and reinvesting its profits. So, I did a quick search and found that Moneymax Financial Services (Catalog: 5WJ) ROCE Trend, we were pretty happy with what we saw.

Return on Capital Employed (ROCE): What is it?

For those who have never used ROCE before, it measures the “return” (pre-tax profit) that a company generates from the capital employed in its business. The formula for this calculation in MoneyMax Financial Services is:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.16 = S$46 million ÷ (S$666 million – S$385 million) (Based on the previous 12 months to June 2023).

therefore, MoneyMax Financial Services has an ROCE of 16%. While this is a standard return in itself, it is much better than the 12% that the specialty retail industry generates.

Check out our latest analysis for MoneyMax Financial Services.

Past performance is a great starting point when researching a stock. So, above you can see his ROCE metric for MoneyMax Financial Services' past returns. Check out other metrics for MoneyMax Financial Services' past performance. free A graph of historical earnings, revenue and cash flow for MoneyMax Financial Services.

What are the return trends like?

Return on capital is good, but hasn't changed much. Over the past five years, the ROCE has remained relatively flat at around 16%, with 269% more capital invested in operating the business. However, 16% is a middling ROCE for him, so it's good that the company can continue to reinvest at such a decent rate of return. Over the long term, such returns may not be as attractive, but if they are consistent, they can pay off in terms of stock returns.

Another thing to note is that even though ROCE has remained relatively flat over the past five years, current liabilities have decreased to 58% of total assets, which is good from a business owner's perspective. This allows companies to eliminate some of the risks inherent in their business operations, as they have fewer outstanding obligations to suppliers and short-term creditors than before. However, the current level is still quite high, so we hope that this trend will continue.

What we can learn from MoneyMax Financial Services' ROCE

In summary, MoneyMax Financial Services is just steadily reinvesting capital at a decent rate of return. On top of that, the stock has returned an impressive 149% to shareholders over the past five years. So even if this stock is now more “expensive” than it was before, we believe its strong fundamentals make this stock worthy of further research.

We are aware that MoneyMax Financial Services has some risks 5 warning signs (and two that you shouldn't ignore) that I think you should know about.

MoneyMax Financial Services isn't the most profitable, but check this out. free A list of companies with strong balance sheets and high return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.