-

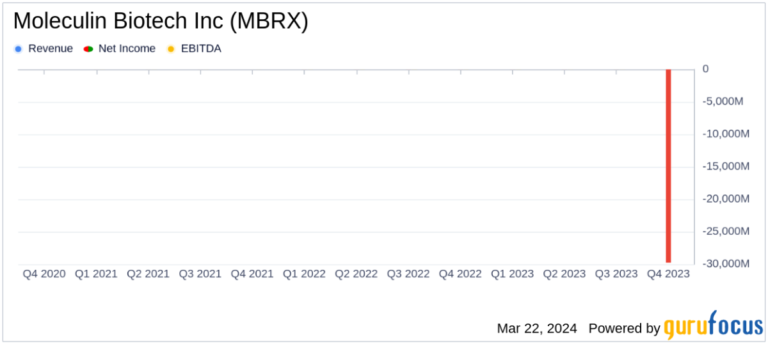

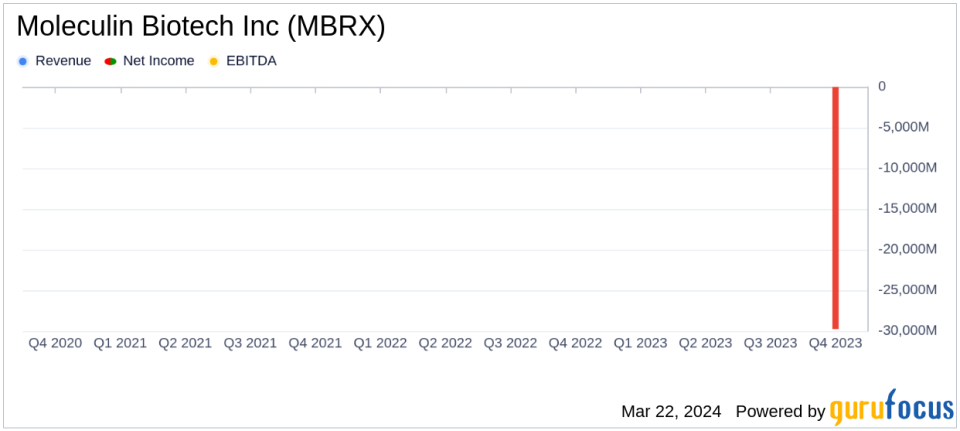

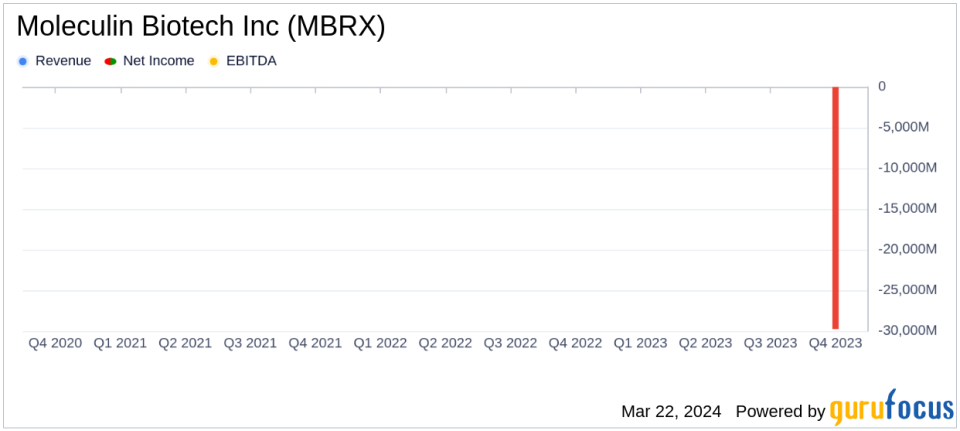

net loss:Reported a net loss of $29.8 million for the year ended December 31, 2023.

-

Research and development expenses: A slight increase of $19.5 million from $19 million the previous year.

-

General and administrative expenses:Decrease from $11.5 million to $10 million in 2022.

-

cash position: At December 31, 2023, cash and cash equivalents were $23.6 million.

-

revenue: It remained at $0, in line with analysts' expectations.

-

Earnings per share: Net loss per share significantly exceeded expectations of -0.16.

Moleculin Biotech Inc (NASDAQ:MBRX) published an 8-K filing on March 22, 2024 detailing its financial results for the fiscal year ended December 31, 2023. This clinical-stage pharmaceutical company is known for its focus on treating advanced disorders. A net loss of $29.8 million per year was reported due to the impact of resistant cancers and viruses. This was due to increased research and development (R&D) expenses, which totaled $19.5 million, up from $19 million a year ago. Despite these challenges, the company was able to reduce general and administrative expenses (G&A) in 2022 from $11.5 million to $10 million.

Company profile and financial highlights

Moleculin Biotech Inc is at the forefront of developing innovative treatments for difficult-to-treat tumors and viruses. Its lead program, anamycin, is a next-generation anthracycline designed to circumvent multidrug resistance mechanisms and is currently being used in the treatment of acute myeloid leukemia (AML) and soft tissue sarcoma (STS) lung metastases. It is being developed for. The company's portfolio also includes WP1066, an immune/transcriptional modulator, and WP1122, an antimetabolite with potential applications in COVID-19 and cancer therapy.

The 2023 financial results reflect a year of strategic investments in research and development, with a modest increase in costs attributable to the reacquisition of the company's intellectual property rights in certain regions. This was partially offset by lower general and administrative expenses due to lower regulatory, legal and consulting costs. Net loss for the year included $1.0 million of non-cash losses on warrants and approximately $2.0 million of stock-based compensation expense compared to prior year earnings.

For the future

With a cash position of $23.6 million as of December 31, 2023, Moleculin Biotech believes it has sufficient capital to support its operations through the fourth quarter of 2024. The company remains focused on advancing its priority pipeline programs and achieving key clinical and regulatory milestones. . Recent highlights include positive interim data from ongoing European Phase 1B/2 clinical trial evaluating anamycin for the treatment of AML, highlighting the company's commitment to value creation for all stakeholders are doing.

As Moleculin Biotech Inc navigates the challenges and opportunities ahead, its financial performance and strategic initiatives will be closely watched by investors and industry observers alike. The company's efforts to develop effective treatments for some of the most difficult-to-treat cancers and viruses promise significant advances in medicine and patient care.

For more information about Moleculin Biotech Inc.'s financial results and future outlook, interested parties should join the conference call and webcast on March 25, 2024 at 8:30 a.m. ET. recommend to.

For more information, see Moleculin Biotech Inc's full 8-K earnings release here.

This article first appeared on GuruFocus.