When third-party cookies die, old marketing techniques are back.

Something similar happened with contextual targeting and direct trading. Now, media mix modeling (MMM), the art of analyzing long-term sales data to determine which marketing tactics drive conversions, may just be making a comeback.

But for MMM to really make a comeback, it needs to become more accessible to mid-level marketers, not just the big-spending brands of yesteryear.

Democratizing MMM was the main idea behind the launch of marketing analytics platform FutureSight.online, founder Marilois Snowman told AdExchanger. The platform's debut, originally developed as a product of advertising agency Mediastruction, is particularly timely because it allows MMM to measure incrementality even in the absence of identifiers such as third-party cookies or alternative IDs.

As brands look for new ways to prove that their online and offline marketing efforts are paying off, Snowman said, “Breadcrumb trailing is becoming obsolete.”

MMM for everyone

But just because cookies are obsolete doesn't mean MMM is back in style.

Joshua Chasin, strategic advisor at FutureSight, says MMM is also benefiting from advances in data science and computing power, allowing it to be deployed at a more granular level. Chasin is the former chief measurability officer at VideoAmp and a member of the Advertising Research Foundation's advisory board.

For example, brands previously looked at aggregate rating points, but now they can more easily differentiate the marketing impact between linear TV and connected TV.

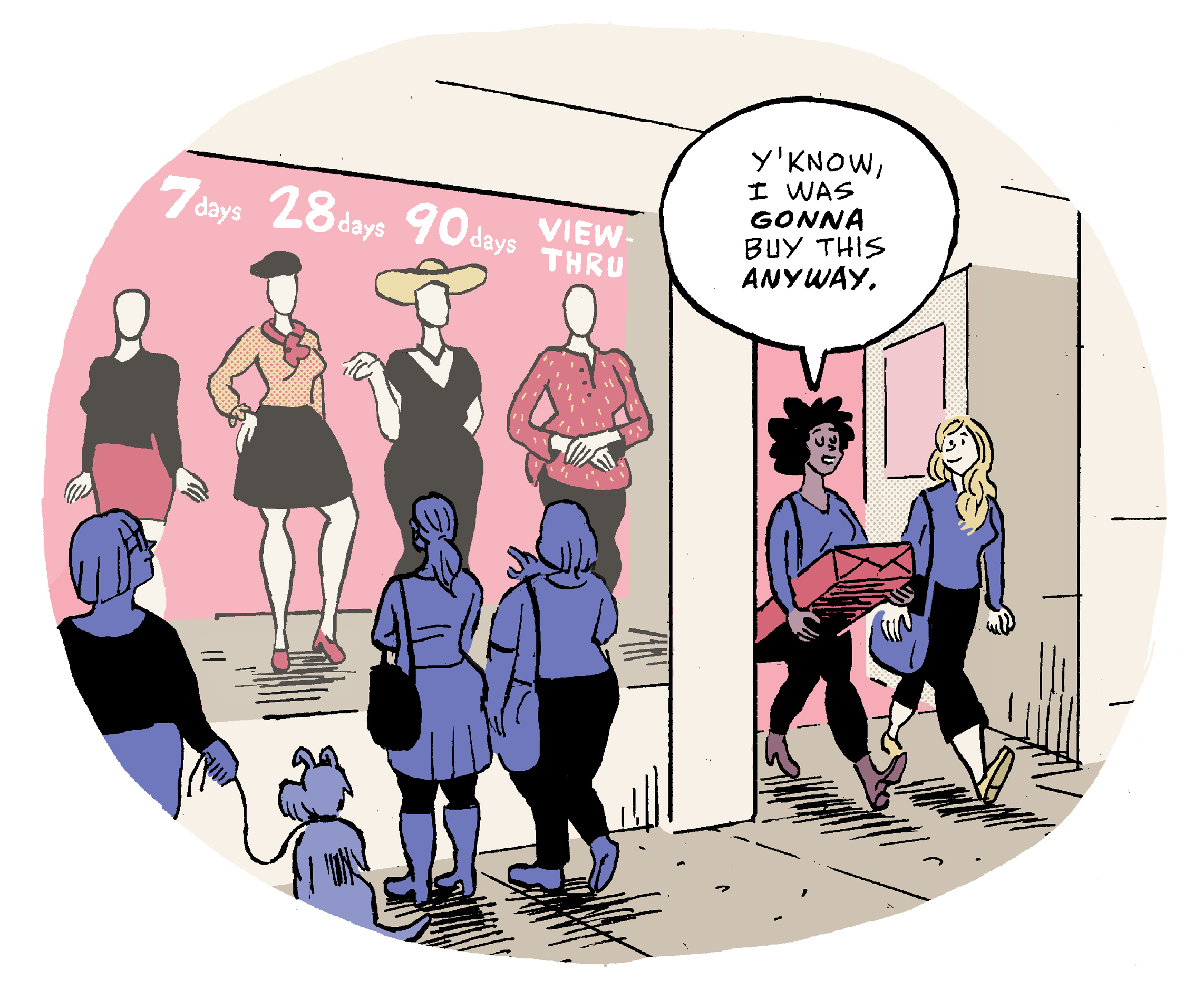

But building a brand-specific MMM can take up to 18 months and cost around $250,000, so this approach is only available to top brands, Snowman said.

Instead, FutureSight sees an opportunity to make MMM a reality for mid-tier advertisers, brands that spend $1 million to $50 million annually on advertising.

subscribe

AdExchanger Daily

Get our editor's roundup delivered to your inbox every weekday.

To be clear, FutureSight can also support large brands, Snowman added. But she sees more opportunity in catering to underserved middle-class customers than in bringing in larger customers.

And Snowman has experience serving mid-market niches. She is also the founder and CEO of Mediastruction, a Boston-based advertising agency founded in 2011 that specializes in mid-market clients.

Snowman initially invested in FutureSight as a way for Mediastruction to differentiate itself from other mid-market agencies that don't have database planning tools. But she saw an opportunity to sell it as a standalone product that Mediastruction's clients and non-clients could access.

This medium-sized customer pool typically includes local banks, local health care providers, local auto dealers, and other brands, and has access to a lot of first-party data, but also the ability to optimize customized campaigns. There are not enough resources to use the data.

Through the MMM platform, a credit union attributed a 2% increase in home equity loans to increased spending on digital advertising. Interestingly, the ad targeted both home loans and car loans. This client realized that online advertising for both types of loans was actually driving conversions for both loans, so they deprioritized some of their print spend to increase digital spend.

How to use

Functionally, the FutureSight platform takes the MMM algorithm that Mediastruction has been building for mid-market clients for the past few years and creates dashboards for them.

This interface helps brands organize all the data from online and offline ad buying platforms in one place. You can also filter ad serving data by cost center or region.

FutureSight evaluates various advertising exposures and marketing strategies and weighs their impact on sales. We then look at the synergies between all these different tactics to determine the best combination of each.

That way, brands can “increase where they're winning and reduce where they're losing,” Snowman said.

Brands can also analyze their marketing efforts against other factors that can impact campaign performance. This context allows you to attribute campaign results in a more effective way than last-click attribution, Snowman said.

For example, a local bank can capture data not only about online media, but also the percentage of account openings in physical branches, interest rates, competitive noise, and brand awareness in a particular region. The platform can analyze the impact of all these different factors using multi-touch attribution output.

FutureSight's in-house machine learning models ingest that data through API integration and upload it to the cloud, updating insights daily so brands can analyze how these factors are impacting media performance. .

All of this modeling is based on the brand's first-party data, without any third-party data layers.

Snowman said the platform does not currently have artificial intelligence (AI) capabilities to operate autonomously based on data analysis. Instead, humans at the brand end must ultimately make all optimization decisions.

building a business

Keeping decision-making in the hands of marketers conflicts with FutureSight's goal of creating martech designed by media professionals.

Over the past year, Snowman has bootstrapped the FutureSight platform into an independent company without any outside funding.

The company currently has six customers, primarily in the financial and health care markets, which Mr. Snowman declined to name due to non-disclosure agreements.

And now we have about a dozen employees. Immediate hiring priorities include adding data architects and increasing support for data engineering and customer success.

But Snowman wants to keep the company's core identity intact while investing in technology resources.

“Analytics platforms are often built by data scientists, but not necessarily by and for media people,” she said. “We know the media and I would say that is a differentiator.”