When Los Angeles voters approved a surcharge on home sales over $5 million last year, officials expected it would generate $700 million a year in revenue to alleviate the city's rampant homelessness crisis.

But a year later, Los Angeles' “mansion tax” has fallen far short of expectations, with only a quarter of the promised revenue coming in and wealthy homeowners paying six-figure taxes. This is probably having a negative impact on luxury home sales as many people continue to live there without paying. tax bill.

“Given the high interest rate environment we're in and the exorbitant taxes we're in right now, why sell if you don't have to?” Luxury Los Angeles Real Estate John Grauman, founder of the firm Grauman Rosenfeld, told Yahoo Finance.

Meanwhile, homelessness worsened.

There is currently a move to repeal LA's mansion tax in November, and similar measures are being taken across the country, with mixed results. Chicago voters recently rejected a mansion tax, but Berkeley has had some success with this policy.

A handful of municipalities across California, New York, Illinois, Connecticut, Maryland, and New Mexico have implemented some form of mansion tax. But what once looked like a promising populist solution to worsening house prices may now be making the problem worse.

read more: The mansion tax is on the ballot. How do they work?

Los Angeles seller retreats from high taxes

The city's mansion tax, known as the United to House LA (ULA) measure, imposes a 4% real estate transfer tax on properties sold between $5 million and $10 million and those sold for more than $10 million. A real estate transfer tax of 5.5% is imposed on real estate transferred. That means a home seller would only pay a one-time $200,000 tax on a $5 million property sale.

The ballot measure passed last April with support from 58% of voters. However, since its introduction, transactions for homes in this price range have plummeted. According to Redfin data, only 230 homes priced over $5 million have been sold in Los Angeles since ULA was enacted, a 60% decrease compared to the 570 homes sold in the previous 12 months.

Demand for housing remains, but sellers' reluctance to list their homes is contributing to the decline. The number of residential listings priced over $5 million has fallen by 27% over the past year to 800 listings.

“Most people just think it's incredibly unfair and unfair,” Grauman said. “I sit in homeowners' living rooms almost every day and explain this to them and explain how this impacts their bottom line.”

“[City officials] “This is a huge disincentive for homeowners to sell,” Grauman added.

To be clear, someone who sells something for less than what they paid for it is still liable to pay taxes.

Eric Sussman, an adjunct professor at the UCLA Anderson School of Management, questions how further taxes could reduce housing affordability, when similar policies have failed in the past.

“This is a terrible rule,” Sussman said, noting that the city had previously provided more than $1 billion in funding to reduce homelessness. “The tax hike is another nail in the coffin. ” he said.

Both experts also questioned the $5 million threshold, arguing that these homes are sometimes luxuries in Los Angeles and are never mansions.

“It's kind of weird and crazy to think that a $5 million home isn't ultra-luxury. It's not,” Sussman said. “In Los Angeles, you can buy a shoebox for a million dollars.”

With current listings, nearly one in five homes listed sell for more than $5 million. According to Realtor.com, the median home sales price is about $1 million for 1,330 square feet.

read more: Why are house prices so high?

City of Berkeley declares rare victory on homelessness

Cities typically set condo tax thresholds higher than the median home value to exempt the average household. Berkeley, California passed a progressive condominium tax in 2018 that adjusts for annual fluctuations in the market. Track and tax the top third of your most expensive transactions.

At Berkeley, there are signs that the effort is working. The city's homeless population fell by 5% for the first time in 2022, according to the latest official count. Condominium tax revenues provide an average of $10 million annually in funding to support services such as permanent housing, improved street conditions and sanitation, and emergency shelter.

One big drawback is that the housing market is volatile and your revenue stream can dry up in a bad year. But Andy Boardman, a local policy analyst at the Institute on Taxation and Economic Policy, remains optimistic.

“If the economy is growing and inequality is rising and the people at the top are doing very well and you can capture that, then a condo tax can be a way to improve the overall balance,” Boardman said. told Yahoo Finance.

Sussman countered that taxing 33% of home sales would be “a disservice to the nation.” Californians already pay some of the highest state taxes in the country, and some people and businesses are leaving California.

“We're still running a deficit,” Sussman said. “We can continue to tax, tax, tax, thinking we can get out of this situation. No, we're not.”

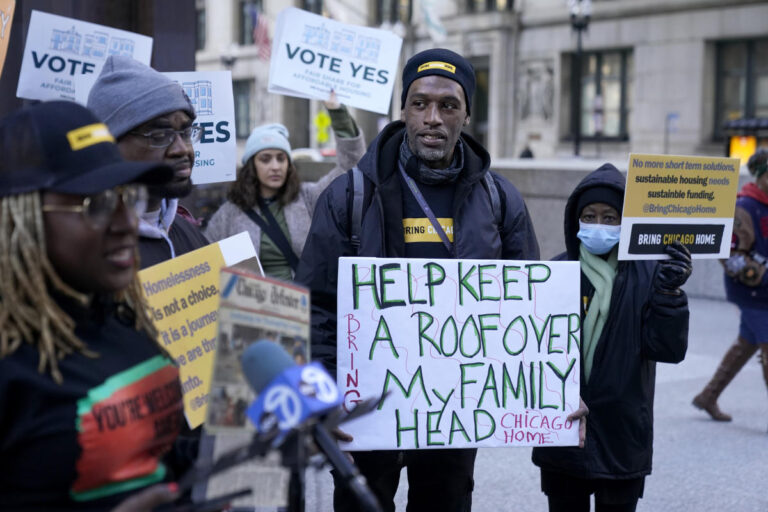

Chicago residents reject referendum

Fourteen U.S. cities have enacted mansion taxes since 2014, an explosive trend compared to six cities over the past 40 years. Several communities in Massachusetts, including Boston, are considering similar implementations.

But just last month, about 53% of Chicago voters rejected the city's proposed real estate transfer tax of 2% on properties valued at $1 million or more and 3% on properties valued at $1.5 million or more.

Many voters were concerned that the new tax would have negative knock-on effects. The extra costs will increase financial stress on commercial real estate, forcing the government to shift the revenue burden onto residents by raising property taxes without solving the city's affordability problem for the middle class. It will disappear.

Chicago City Councilman Bennett Lawson said, “Our concerns about growth, housing stock, and declining supply of affordable housing (which is being built primarily by private developers in my district) resonate with voters.'' “I called,” he told Axios.

Rebecca Chen is a reporter for Yahoo Finance and previously worked as an investment tax certified public accountant (CPA).

Click here for the latest personal finance news to help you invest, pay off debt, buy a home, retire, and more.

Read the latest financial and business news from Yahoo Finance