Magellan Financial Group Limited (ASX:MFG) shareholders will be happy to see the share price up 20% in the last month. But that's small consolation in the face of three years of shocking declines. During that time, the stock price melted like a desert snowball, dropping 77%. So it's reassuring for long-term holders to see a little bit of an uptick. Only time will tell whether the company can sustain its turnaround.

Long-term shareholders are still in the red even though the stock price is up 7.8% over the past week, but let's see what the fundamentals tell us.

Check out our latest analysis for Magellan Financial Group.

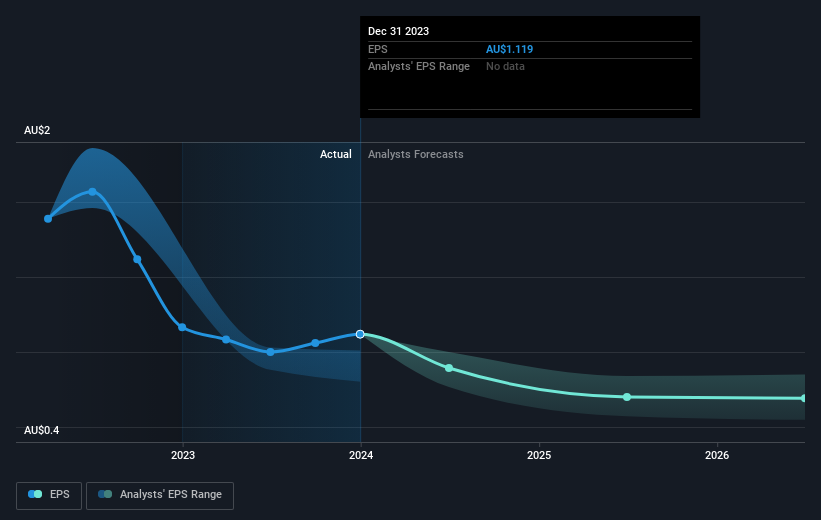

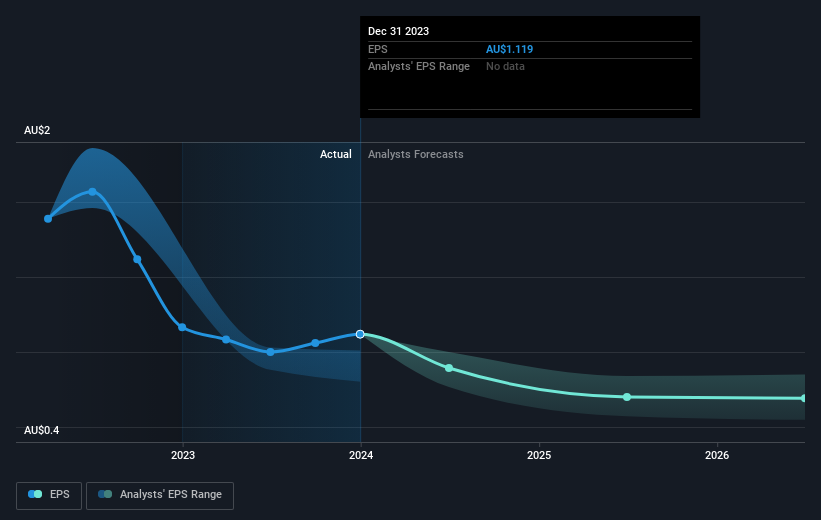

To paraphrase Benjamin Graham, in the short term the market is a voting machine, but in the long term it is a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Magellan Financial Group has seen its EPS decline at an average rate of 20% per year over the last three years. This decline in EPS is slower than the 39% annual decline in the share price. Therefore, it is likely that the decline in EPS has disappointed the market and investors are hesitant to buy. The unfavorable sentiment is reflected in the current P/E ratio of 9.20.

The company's earnings per share (long-term) are depicted in the image below (click to see the exact numbers).

We like to see that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide for a business. Before buying or selling a stock, it's always a good idea to take a closer look at past growth trends. You can get it here.

What will happen to the dividend?

When looking at return on investment, it is important to consider the following differences: Total shareholder return (TSR) and stock price return. Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. For Magellan Financial Group, the TSR for the last 3 years is -70%. This exceeds the stock return mentioned earlier. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

We're pleased to report that Magellan Financial Group shareholders received a total shareholder return of 39% over one year. That includes dividends. Notably, the five-year annualized TSR loss is 10% per year, which compares very unfavorably to recent share price performance. While we typically value long-term performance over short-term performance, recent improvements may signal a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. for that purpose, two warning signs We found Magellan Financial Group (including 1 concerning).

If you want to buy stocks with management, you might like this free List of companies. (Hint: Insiders are buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.