If you're not sure where to start when looking for your next multibagger, there are some important trends to look out for. First, let's take a look at the proven results. return One is growing capital employed (ROCE) and second is growing. base of capital employed. Simply put, this type of business is a compound interest machine, meaning you are continually reinvesting your earnings at an ever-higher rate of return. Taking this into consideration, I found that maid tech group (LON:MTEC) and its ROCE trend, we weren't too excited.

What is return on capital employed (ROCE)?

For those who aren't sure what ROCE is, it measures the amount of pre-tax profit a company can generate from the capital employed in its business. Analysts use the following formula to calculate Made Tech Group's earnings.

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

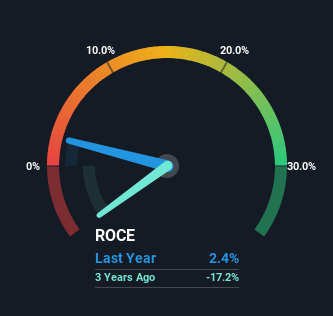

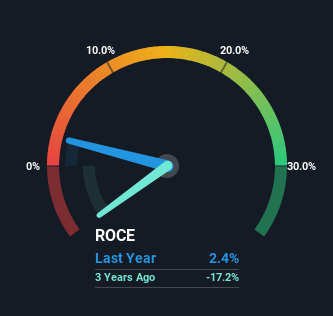

0.024 = 359,000 British Pounds ÷ (20 million British Pounds – 5.2 million British Pounds) (Based on the previous 12 months to November 2023).

So, Made Tech Group's ROCE is 2.4%. In absolute terms, this is a poor return, even below the IT industry average of 18%.

Check out our latest analysis for Made Tech Group.

In the chart above, we measured Made Tech Group's previous ROCE against its previous performance, but the future is probably more important. If you're interested, take a look at our analyst forecasts. free Made Tech Group Analyst Report.

What are the return trends like?

When it comes to Made Tech Group's historical ROCE movement, it's not great. About four years ago, the return on capital was 26%, but since then it has fallen to 2.4%. On the other hand, the company is deploying more capital without seeing any improvement in sales over the last year, which could suggest that these investments are a long-term strategy. It could be some time before the company starts to see a change in returns from these investments.

Relatedly, Made Tech Group reduced its current liabilities to 26% of total assets. So we can attribute some of this to his decreasing ROCE. Additionally, the company's suppliers and short-term creditors are less likely to fund the company's operations, which may reduce some of the risks to the business. Because companies are now self-funding more of their operations, some argue that this makes them less efficient at generating ROCE.

What we can learn from Made Tech Group's ROCE

In conclusion, we see that although Made Tech Group is reinvesting in the business, its profits are declining. Investors appear to have little hope that these trends will improve any further, which may have contributed to the stock's 75% decline last year. Overall, we're not too influenced by the underlying trend and think you're more likely to find multibaggers elsewhere.

Made Tech Group is aware of some risks 3 warning signs (and two important ones) that I think you should know about.

Made Tech Group may not be the most profitable, but check this out. free A list of companies with strong balance sheets and high return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.