Grant Feint/Moment (via Getty Images)

KKR Real Estate Finance (New York Stock Exchange:KREF) was forced to cut its quarterly dividend. The commercial real estate lender declared a quarterly dividend of $0.25 per share, a 42% drop from the previous quarter, and an annualized $1 per share, for a forward dividend yield of approximately 10%.when last covered For mortgage REITs, we highlighted poor dividend coverage of just 58% of distributable income in the previous third quarter. Embedded in this previous setup was a decline in book value, making the dividend cut not only necessary but prudent, and concerns about CRE exposure reminiscent of the same period a year ago, when multiple banks went bankrupt, making regional bank This is in response to renewed concerns about the

KKR Real Estate Finance Supplementary Information for the 4th Quarter of FY2023

What's next for KREF after layoffs? There could be further uncertainty surrounding office real estate exposures as this asset class becomes a villain for companies. Sentiment in REIT stocks is focused on the Fed defining the near-term future. The mREIT's fourth-quarter earnings release showed a 10% year-over-year drop in revenue, with Commons down 14% during the day. $50.67 million. KREF also $58.7 million loss, approximately $0.85 per share, on a defaulted senior office loan. Negative feelings were also conveyed to the priority person (NYSE:KREF.PR.A) even though the dividend cut is a good thing from an asset coverage perspective. For both securities, market uncertainty may further increase due to continued market uncertainty surrounding CRE and expectations for an increase in office loan defaults.

Credit quality, credit score, book value

KKR Real Estate Finance Supplementary Information for the 4th Quarter of FY2023

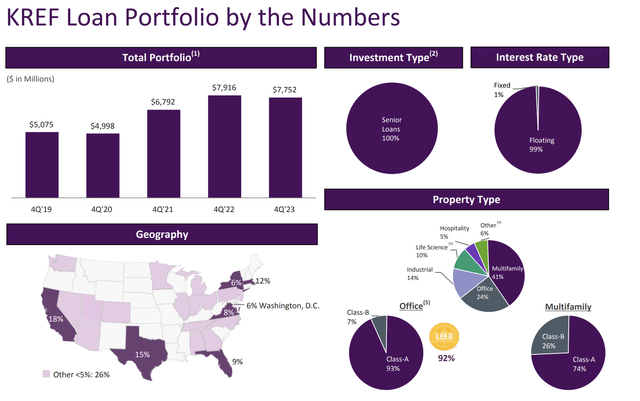

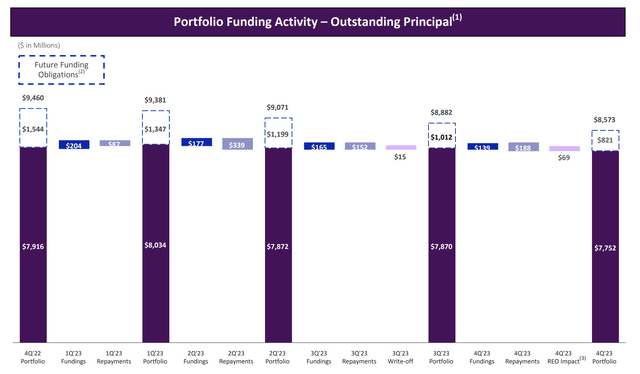

KREF's loan portfolio was $7.75 billion at the end of the fourth quarter, an increase of $118 million quarter-over-quarter due to progress in repayments ahead of origination and charge-offs related to the senior office loan in Philadelphia. Decreased by $1,000,000. The mREIT portfolio has progressively shrunk since the start of FY 2023, and KREF has taken a prudent stance in allowing repayments to occur close to or even ahead of origination against a disruptive macro backdrop. I'm taking it. The mREIT's book value at the end of the fourth quarter was $1.08 billion, or approximately $15.52 per share, down 77 cents from the prior quarter from $16.29 per share at the end of the third quarter. This is also down from $18 per share at the beginning of fiscal 2023. Therefore, it is now important for KREF to take steps to reduce book value declines, and the dividend cut should contribute to this goal.

KKR Real Estate Finance Supplementary Information for the 4th Quarter of FY2023

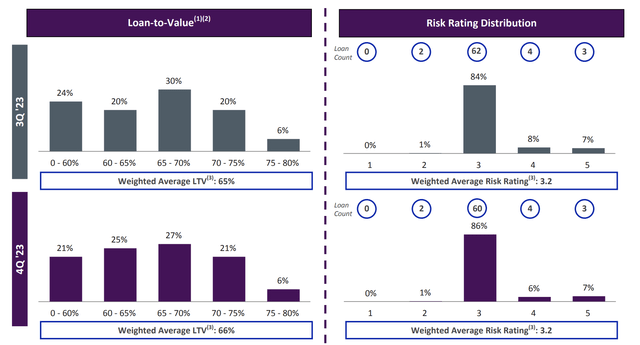

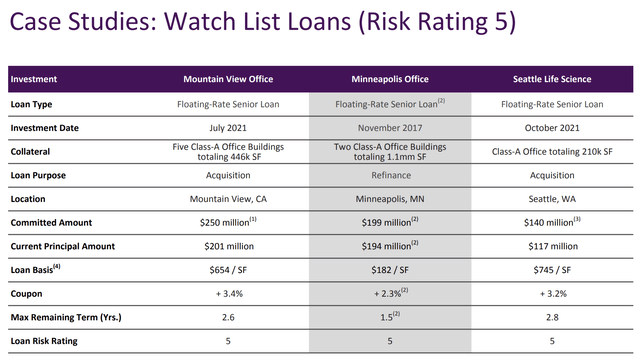

KREF's office real estate exposure is a source of concern in the market, but it accounts for 23% of the company's loan portfolio. While not material, Common stock is currently trading at 36% below book value per share, not at a level that would require a permanent discount. The market is forward-looking and is pricing in continued declines in book value, which will be true unless a suitably sized dividend is instituted that sequentially reduces book value by 18 cents per share. (Annualized annualized rate of approximately $0.72 per share). Approximately 84% of KREF's loans remain rated 3 risk, a slight improvement from 83% in the third quarter. All other risk rating distributions remained approximately the same, with the exception of loans rated 4, which decreased 200 basis points from the prior quarter.

KKR Real Estate Finance Supplementary Information for the 4th Quarter of FY2023

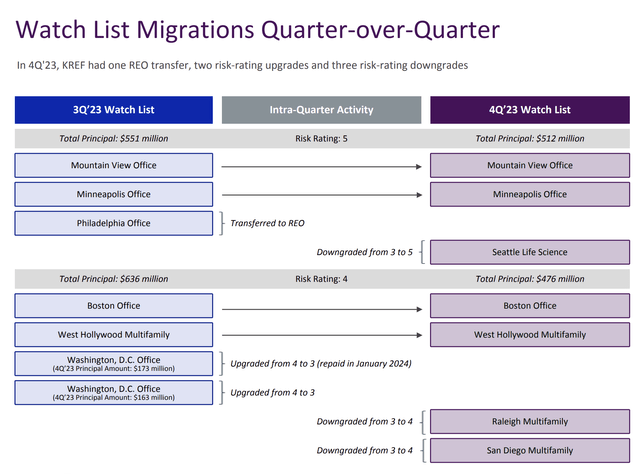

There are approximately three 5-risk loans that defaulted on Philadelphia office loans and were collateralized by KREF. However, the Life Sciences office building in Seattle was downgraded from 3 to 5. Importantly, the default on Philadelphia's office loan, which still has $149.8 million in unpaid principal, is not that large, but considering the market reaction, this represents 1.9% of the mREIT's loan portfolio. equivalent. It may seem too big at first glance, but it is certainly positive. There was an additional $512 million in principal outstanding across watch list loans with a risk rating of 5, with an average maximum remaining term of 2.3 years.

KKR Real Estate Finance Supplementary Information for the 4th Quarter of FY2023

Liquidity and the Fed

Crucially, KREF and REITs will continue to slump. Unless the Fed cuts interest rates. It's a strange feeling to see the market making new highs almost every day as the income race is driven to 52-week lows, but an extended rally would keep sentiment low and the current book value The discount rate will remain fixed.

KKR Real Estate Finance Supplementary Information for the 4th Quarter of FY2023

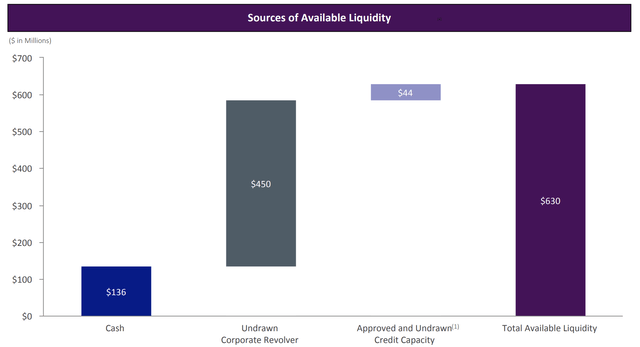

KREF reported a net loss attributable to common stockholders of $18.7 million, or approximately $0.27 per share, in the fourth quarter. This resulted in distributable earnings of $26 million, or approximately $0.37 per share. The mREIT has sufficient liquidity to support its current quarterly common stock distribution of $17 million, with distributable earnings before realized losses of $0.47 per share on Philadelphia office loans. and has proven to be sufficient to cover appropriately sized dividends. However, while I do not own a position in Commons, some opportunities could open up in 2024 if KREF's book value stabilizes.