Written by Satoshi Kajimoto

TOKYO (Reuters) – Japan's finance minister issued his strongest warning yet on the weaker yen, warning authorities to take “decisive action” after the currency fell to a 34-year low against the dollar. This was a phrase previously used before the intervention.

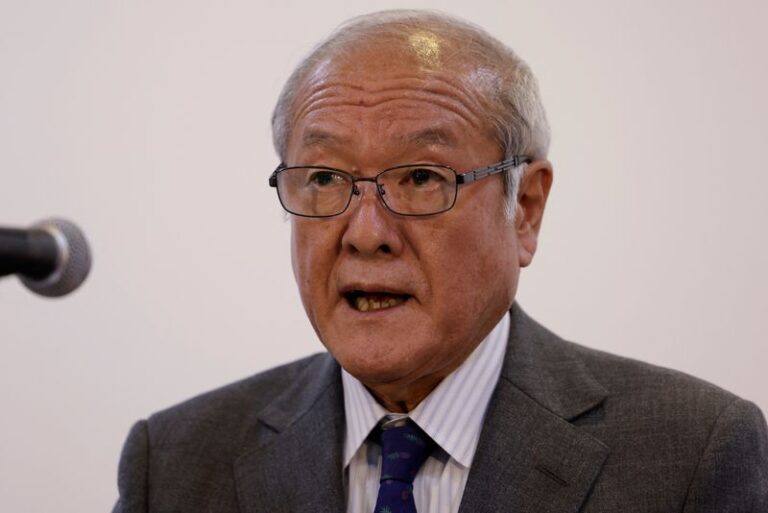

Shunichi Suzuki previously used the term “decisive measures” in the fall of 2022, when Japan last intervened in the market to stem a devaluation of the currency.

Suzuki made the remarks on Wednesday, shortly after the dollar soared on positive U.S. data, pushing the Japanese yen to a 34-year low and to levels that will prompt formal market intervention in 2022.

The yen was trading at 151.97 yen to the dollar in Asian trading hours, a decline of about 0.2% and weaker than the 151.94 yen level at which Japanese authorities intervened to buy the yen in October 2022. became.

This was the lowest level since the mid-1990s, when Japan's asset bubble burst.

“I think the market is cautiously testing where the boundaries are for Tokyo,” said Christopher Wong, currency strategist at OCBC in Singapore. “This is a new cycle high, so I think the risk of intervention is quite high. And given the warnings so far, if Tokyo doesn't act, it will encourage people to push (dollar/yen) higher. ”) will rise significantly in the coming days. ”

Suzuki said that the government is closely monitoring market movements with a high sense of crisis in response to the yen's depreciation.

Bank of Japan Governor Kazuo Ueda said that the Bank of Japan will also closely monitor exchange rate movements and their impact on economic and price developments.

In response to a question about the recent sharp decline in the yen, Ueda said in parliament, “Forex movements are one of the factors that have a major impact on the economy and prices.''

A weaker yen makes imports more expensive, fueling inflation and making exports from the world's fourth-largest economy cheaper.

The yen has continued to fall since Japan last week raised interest rates for the first time since 2007, making a historic shift in monetary policy.

One factor weighing on the yen is its use in carry trades, where investors borrow in low-interest currencies and invest the proceeds in higher-yielding currencies. Japanese investors could also deprive the yen of support from repatriation and reap much larger profits overseas.

In the current quarter, which ends this weekend, the yen has fallen more than 7% against the dollar, making it the worst performer among major currencies.

(Reporting by Satoshi Kajimoto in Tokyo; Additional reporting by Lei Wee in Singapore; Writing by Lincoln Feast; Editing by Kim Cogill and Sam Holmes)