Most readers would already know that the Trex Gold Resources (TSE:TXG) share price has increased by a hefty 44% over the past three months. Considering the company's impressive performance, we decided to take a closer look at its financial metrics, as a company's financial health over the long term usually drives market results. Specifically, we decided to examine Trex Gold Resources's ROE in this article.

Return on equity or ROE tests how effectively a company is growing its value and managing investors' money. Simply put, it is used to evaluate a company's profitability compared to its equity.

See our latest analysis for Torex Gold Resources.

How do you calculate return on equity?

of ROE calculation formula teeth:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, the ROE for Trex Gold Resources is:

14% = USD 204 million ÷ USD 1.5 billion (based on trailing twelve months to December 2023).

“Return” is the annual profit. That means for every CA$1 a shareholder invests, the company generates CA$0.14 in profit for him.

Why is ROE important for profit growth?

So far, we have learned that ROE is a measure of a company's profitability. We are then able to evaluate a company's future ability to generate profits based on how much of its profits it chooses to reinvest or “retain”. Assuming everything else remains constant, the higher the ROE and profit retention, the higher the company's growth rate compared to companies that don't necessarily have these characteristics.

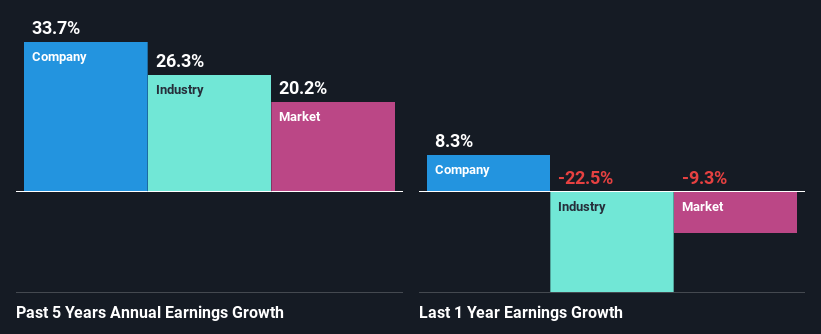

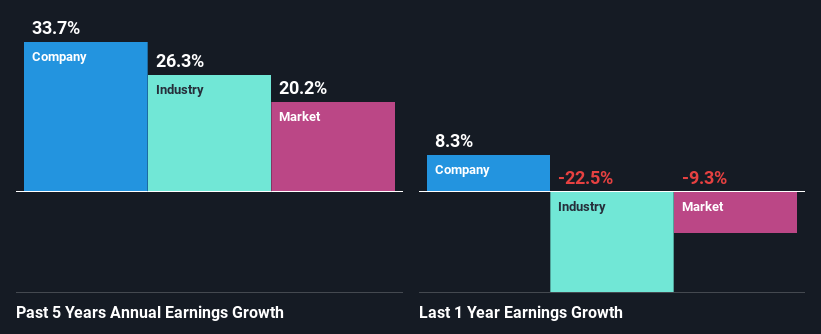

A side-by-side comparison of Torex Gold Resources' earnings growth and ROE of 14%.

First, Torex Gold Resources' ROE looks acceptable. His ROE for the company looks pretty good, especially when compared to the industry average of 8.5%. This probably laid the foundation for Torex Gold Resources' significant 34% net profit growth over the past five years. However, there may be other causes behind this growth. For example, the company's management may have made some good strategic decisions, or the company may have a low dividend payout ratio.

We then compare it to the industry's net income growth rate, which is great to see that Torex Gold Resources has a very high growth rate when compared to the industry average growth rate of 26% over the same period.

The foundations that give a company value have a lot to do with its revenue growth. Investors should check whether expected growth or decline in earnings has been factored in in any case. This will help you determine whether the stock's future is bright or bleak. Is Torex Gold Resources fairly valued compared to other companies? These three valuation metrics may help you decide.

Is Torex Gold Resources effectively utilizing its retained earnings?

Given that Torex Gold Resources does not pay dividends to shareholders, we can assume that the company reinvests all of its profits into growing its business.

conclusion

Overall, we feel that Torex Gold Resources is performing very well. In particular, it's great to see that the company has invested heavily in its business, delivering strong revenue growth along with high rates of return. Having said that, we looked at current analyst forecasts and found that while the company has grown earnings in the past, we are concerned that analysts expect earnings to shrink in the future. Learn more about the company's future revenue growth forecasts here. free Create a report on analyst forecasts to learn more about the company.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.