For many people, the main purpose of investing in the stock market is to achieve impressive profits. The best companies are hard to find, but they can generate huge profits over the long term. In other words, mr cooper group (NASDAQ:COOP) stock has soared 642% in five years. If that doesn't make you think about long-term investing, we don't know what will. On top of that, the stock price is up 14% in about a quarter. However, this move may have been driven by a moderately active market (up 7.8% in 90 days). If you've enjoyed this rewarding ride, you'll probably want to talk about it.

On the back of a solid seven-day performance, let's take a look at how the company's fundamentals have played a role in driving long-term shareholder returns.

Check out our latest analysis for Mr Cooper Group.

in his essay Graham & Doddsville SuperInvestors Warren Buffett has said that stock prices do not always rationally reflect the value of a company. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Mr Cooper Group's earnings per share have fallen 20% annually despite five years of strong share price performance.

This means the market is unlikely to be valuing the company based on its earnings growth. Earnings per share don't seem to match the share price, so let's look at other metrics instead.

We're not particularly impressed by the 2.1% annual compound return increase over five years. So it seems we need to take a closer look at earnings and revenue trends to see how they impact the share price.

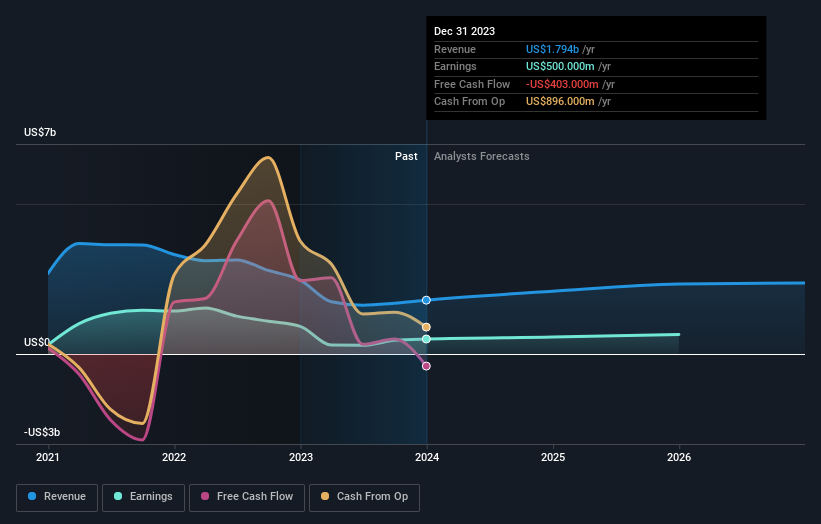

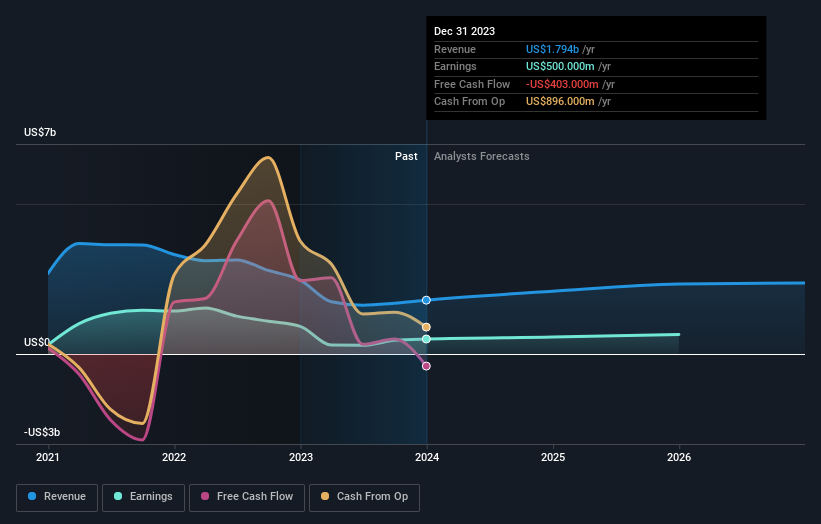

The company's earnings and revenue (long-term) are depicted in the image below (click to see the exact numbers).

Perhaps worth noting is that we saw significant insider buying in the last quarter, which we consider a positive. Having said that, we think earnings and revenue growth trends are even more important factors to consider. Find out what analysts are predicting for Mr Cooper Group in this article. interaction Graph of future profit forecast.

different perspective

We're pleased to report that Mr. Cooper Group shareholders have delivered a total shareholder return of 94% over one year. The 1-year TSR is better than his 5-year TSR (the latter at 49% per annum), so it looks like the stock has been performing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock to make sure you don't miss out. I think it's very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. For example, consider the ever-present fear of investment risk. We've identified 1 warning sign Working with and understanding Mr. Cooper Group should be part of your investment process.

Mr. Cooper Group isn't the only stock that insiders are buying.For people who like searching succeed in investing this free This list of growing companies with recent insider purchasing may be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.