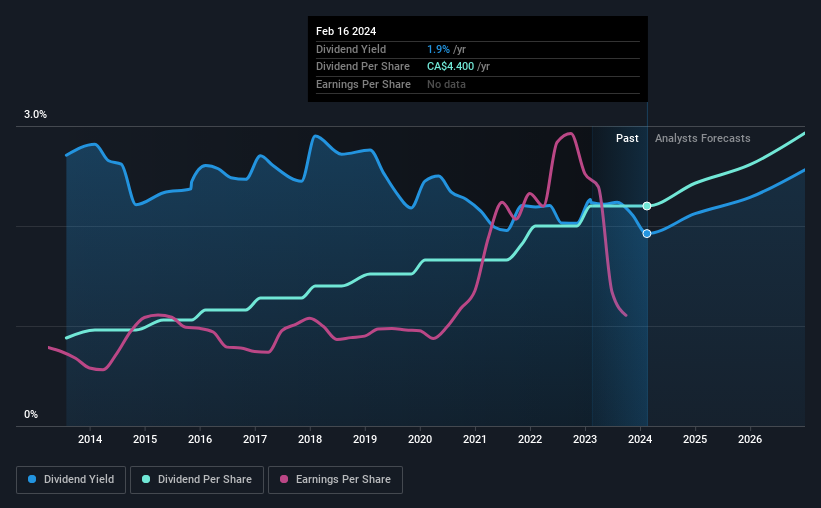

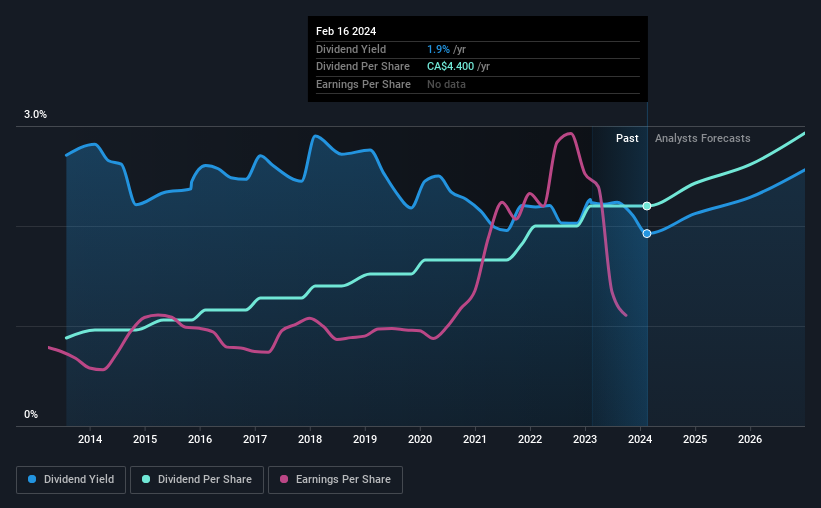

Intact Financial Corporation (TSE:IFC) will increase its dividend to C$1.21 on March 29th. This is 10.0% higher than CAD 1.10 during the same period last year. Although the dividend is high, the yield is only 1.9%, which is below the industry average.

Check out our latest analysis for Intact Financial.

Dividends can easily be covered by intact financial profits

Even if the dividend yield is low, it can become attractive if it continues for many years. The last payment accounted for 73% of the revenue, but the cash flow was much higher. Since dividends only pay out cash to shareholders, we focus on the cash payout ratio, which shows that there is enough money left over to reinvest in the business.

EPS is expected to expand by 157.4% over the next 12 months. Assuming the dividend continues in line with recent trends, the payout ratio could be 33% by next year, which would be well within a sustainable range.

Intact Financial has a proven track record

The company has a long history of paying stable dividends. Over the past 10 years, his annual payments were CAD 1.76 in 2014, and his most recent financial year payment was CAD 4.40. This works out to be a compound annual growth rate (CAGR) of approximately 9.6% over that period. Dividends have grown very well over the years, providing considerable income to shareholders' portfolios.

Dividend increases may be difficult to achieve

Investors may be attracted to a stock based on the quality of its payment history. Earnings per share are growing at an annualized rate of 4.3%. Revenues haven't been growing quickly at all, and the company is paying out most of its profits as dividends. If a company prefers to pay cash to shareholders rather than reinvest it, this can often say a lot about its dividend prospects.

Intact financials make it look like a high dividend stock

Overall, we think this could be an attractive income stock, and this year's dividend increase should make the stock even better. Distributions are easily covered by profits and also converted into cash flow. Considering all these factors, we think this has solid potential as a dividend stock.

Market movements prove how highly valued a consistent dividend policy is compared to a more unpredictable dividend policy. On the other hand, despite the importance of dividends, they are not the only factor that our readers need to know when evaluating a company. For example, we chose 2 warning signs for Intact Financial Investors should consider this.Looking for more high-yield dividend ideas? Try ours A group of people with strong dividends.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.