Many companies choose to create their own large-scale language learning models (LLMs). This reduces costs by providing customization and personalization, control over refinement, and the ability to appropriately size models according to specific requirements.

But how do custom-built LLMs measure up against big corporate powerhouses? Established companies like Mistral AI, Silo AI, and Stability AI offer European alternatives to existing LLMs. I'm creating an alternative, A small startup has developed a model that outperforms its predecessors in AI predictions.

AssetFloow is a Lisbon-based company with a team of eight that develops sensorless behavioral AI software for retailers and FMCG (fast moving consumer goods). The company's predictive AI provides accurate metrics about shoppers' movements and in-store behavior 99% of the time, without the need for cameras or other sensors. Correct answer rate.

From customer intelligence to merchandising, this enables retailers to eliminate waste, make informed data-driven decisions and increase operational efficiency while prioritizing customer privacy. , can drive increased sales.

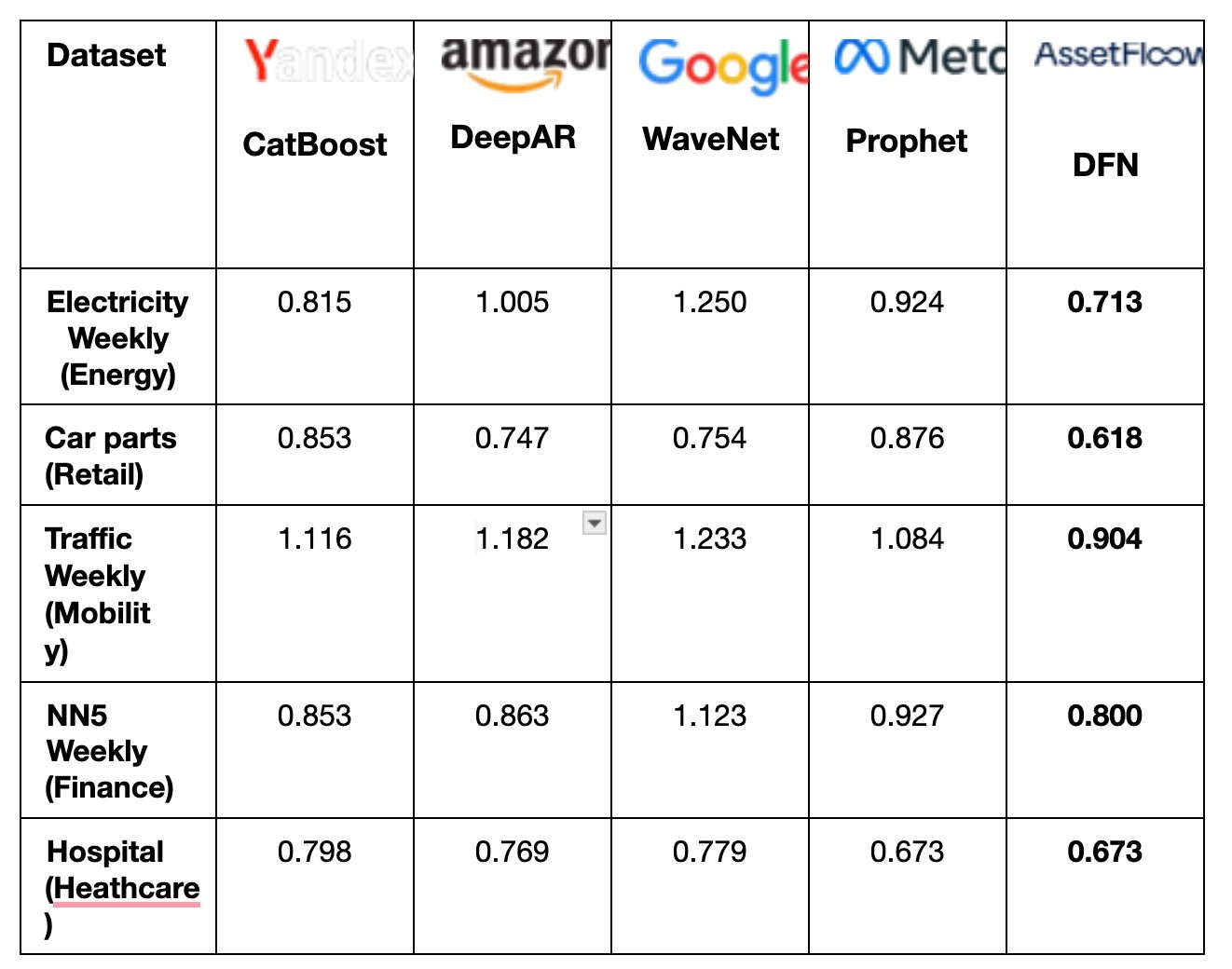

The company has developed a new AI architecture, Dynamic Flow Network (DFN).by taking advantage of Monash RepositoryDFN demonstrated more than 20 percent improvement in accuracy compared to previous versions while using 50 percent less data for training.

This outperforms established models such as Google's WaveNet (2016), Yandex's CatBoost (2017), Meta's Prophet (2017), and Amazon's DeepAR (2018).

Ricardo Santos, co-founder and CTO of AssetFlow, led the creation of DFN, which learns causal relationships in data over time without the need for feature engineering.

Commenting on this achievement, Mr. Santos said:

“To date, no predictive model has outperformed all dataset categories at once. Now, second-generation DFNs are leaders in all categories, demonstrating their versatility in being able to be trained on any type of dataset. .This model is a game changer.”

In 2022, Ricardo conducted a test run of the first generation DFN model for stock portfolio optimization. The model demonstrated the ability to identify optimal stock selections from the NASDAQ and suggest when to 'buy'/'sell'.

According to eToro, the model's strategy yielded a lower risk score than the world's top three traders, achieving 79 percent of the weeks where other traders made gains of 40 to 45 percent.

AssetFlow secured a €1.5 million investment in March 2023 to power AI models applied to the retail industry to address the $1.5 trillion inventory problem known as the ghost economy.

This issue primarily occurs due to inappropriate predictive models used by retailers. This greatly contributes to food loss. Leading retail giants such as EDEKA, Schwarz Group, REWE Group, ALDI and Norma have pledged to reduce food waste by 30% by 2025, with an even more ambitious goal of halving food waste by 2030. Aiming for the goal.

Ricardo Santos explained:

“We started with retail because the current approach of selling surplus food near its expiration date at a lower price is merely a band-aid solution.

The real solution lies in accurate and explainable predictive models to eliminate stockouts and overstocks. ”

Earlier this year, AssetFloow announced that it would be releasing its DFN solution as an API, allowing other companies to leverage DFN's predictive capabilities in entirely different markets beyond retail. ”

Lead image: Ricardo Santos, co-founder and CTO of AssetFlow. Photo: No credit.