Philadelphia Fed President Patrick Harker said Thursday that the Fed may be “getting close” to when it can start cutting rates, while Fed Vice Chairman Philip Jefferson said the rate cuts won't happen until “later this year.” I expected it to be.

The new guidance from two senior Federal Reserve officials comes as investors try to gauge how quickly the central bank will begin easing monetary policy following its most aggressive inflation-control measures since the 1980s. Ta.

Markets had been betting since the beginning of the year that interest rate cuts would begin in March, but cautious comments from Fed Chairman Jerome Powell and other Fed officials, as well as tougher-than-expected expectations for inflation and job growth, led to As a result, interest rate cuts will return in June.

Speaking in Delaware on Thursday, Mr. Harker was significantly more optimistic than Mr. Jefferson about early rate cuts, saying during a question-and-answer session that he would “keep May off the table,” while also saying that a rate cut would happen in 2020. I expected it. Later this year.

“I think negotiations are close. I would like to have a few meetings,” he added, setting a June meeting as a possible starting point.

Mr. Harker does not have a vote on the Fed's rate-setting committee this year, but Mr. Jefferson does.

“I believe we may be nearing the point where we can adjust the policy rate downward,'' Harker said in a speech.

Still, Harker stressed that the central bank does not want to cut rates too soon and reignite inflation.

“I would caution anyone not to look for it right now,” he said, adding: “We have time to get this right.”

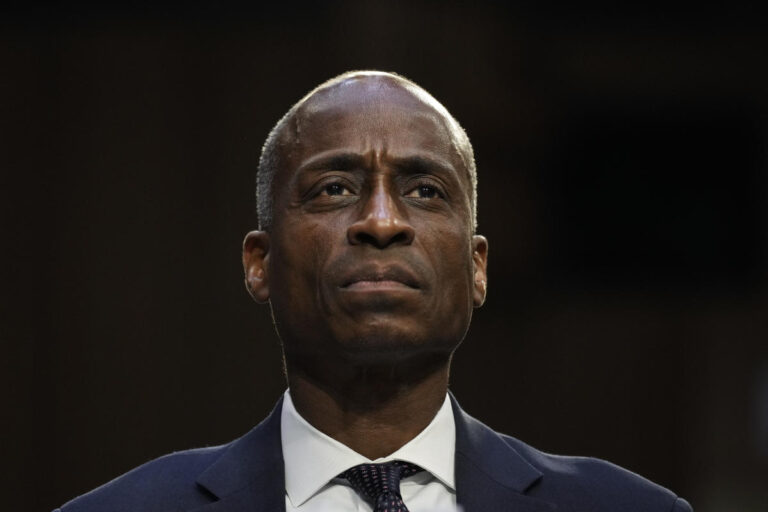

Mr. Jefferson sounded more cautious Thursday about when those cuts would begin.

“If the economy progresses broadly as expected, it would be appropriate to begin tapering policy restraints later this year,” Mr. Jefferson said in a speech at the Peterson Institute for International Economics in Washington.

Mr. Jefferson became the latest Fed official to describe the Fed's schedule as “later this year.” This expression has also recently been used by Boston Fed President Susan Collins and Cleveland Fed President Loretta Mester.

Atlanta Fed President Rafael Bostic last week predicted that daylight saving time would occur in the third quarter of this year, using the term “daylight saving time.”

Two other Fed directors, Lisa Cook and Christopher Waller, called for patience in their speeches Thursday.

“We'll need to see at least a few more months of inflation data to determine whether January's high inflation was a speed increase or a hole,” Waller said. He still expects the rate cut to occur “later this year,” but said the rate-setting committee “could wait a little longer.”

“Why are you in such a hurry?” he asked.

In his speech, Cook said he wanted to be more confident that inflation was converging to 2% before starting to cut rates.

“At some point, there will be greater confidence that deflation is underway and sustainable, and a change in the outlook will justify a change in policy rates,” Cook said.

'bumpy'

At its last meeting in January, the Federal Reserve's Federal Open Market Committee decided to keep the benchmark interest rate unchanged, at the highest level since 2001.

Minutes from the January policy meeting show that most officials “noted the risks of acting too hastily to ease the policy stance, and asked whether inflation had fallen sustainably to 2%. “We emphasized the importance of carefully evaluating future data when making decisions.”

A series of new indicators on inflation and the U.S. economy came in better than expected, reinforcing the Fed's cautious stance.

The latest sign came Friday when the Labor Department said the producer price index, which tracks the prices businesses pay to make goods and services, rose more than expected from December to January.

The consumer price index in January also exceeded economists' expectations.

Last week's disappointing CPI numbers don't seem to derail Mr. Jefferson's outlook. Fed officials said they emphasized that lowering inflation is likely to be a “difficult” process.

“My FOMC colleagues and I believe that our policy rates have likely reached the peak of this tightening cycle,” added Mr. Jefferson.

Harker used similar language, calling the recent heat on consumer prices “difficult.”

“I just want to get data for a few more months, at least March,” he said during a question-and-answer session.

“I don't know why they would do anything in March. I'm not going to take May off the table. It's a possibility.”

For the latest stock market news and in-depth analysis of price-moving events, click here.

Read the latest financial and business news from Yahoo Finance