(Bloomberg) – With China's deflation at its worst in 15 years, the stock market volatile and bank interest rates too low for her liking, 18-year-old Tina Hong is pinning her financial security on gold beans. ing.

Most Read Articles on Bloomberg

Weighing just one gram, beans and other gold ornaments are increasingly seen as the safest investment for young Chinese in times of economic instability. This is part of a larger consumption trend for gold in general, from bullion to beans to bracelets, that is sweeping the mainland.

“It's basically impossible to buy gold and lose money,” said Hong, a first-year university student studying computer science in Fujian Province. It was inferred that he had started purchasing red beans in January because of his purchase of red beans. She has more than 2 grams of beans and will continue to buy them as long as the cost is lower than international gold prices, she said.

Branded as an investment gateway for young consumers, the beans come in glass bottles and are the latest hot-selling item in Chinese jewelry stores. According to the 2023 China Jewelry Consumption Trends Report by Chow Tai Fook Jewelery Group Ltd., Gen Z consumers, plagued by high youth unemployment and the country's slide into deflation, are now the world's second-largest group of consumers. China is one of the top consumers of gold accessories in the world's largest economy. Gold's appeal comes as people hold back on purchases amid months of disappointing growth.

China's gold rush

A lack of trust in traditional investments is fueling this new Chinese gold rush.

The country's stock market has fallen since reopening from the pandemic, with one key index falling to levels last seen in 2018. The country's middle class is bearing the brunt of the real estate decline, prompting the central bank to cut key interest rates. This is the fourth time since December 2021, putting pressure on the profits of wealth management products.

Nikos Kavalis, managing director of London-based consultancy Metals Focus, said young people are skipping “pleasure consumption” and instead opting for “asset jewellery” such as gold beans as ornaments and He said he was buying it as an investment.

However, he warns that it makes no sense to invest in gold beans and other gold products as their prices are often 10-30% higher than the commodity's spot price. He said investors would be better served by keeping their money in gold ETFs.

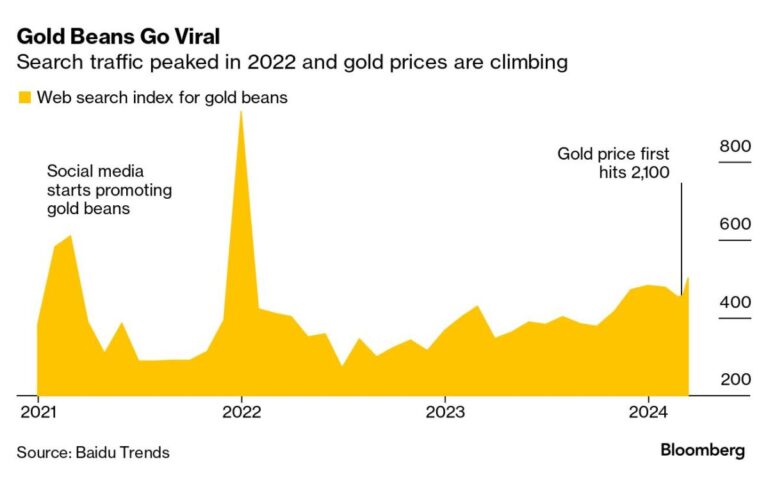

Still, interest in gold is widespread across social media. On Weibo, China's equivalent of X (formerly Twitter), the hashtag “Why are young people so obsessed with buying gold?'' had 91 million hits. A lively debate about the enduring value of gold is dominating social media sites, with popular posts including: “Buy gold and you'll stay out of trouble.”

According to the World Gold Council's 2021 report, three-quarters of gold consumers are now estimated to be between the ages of 25 and 35, and many believe that investing in gold is low risk. That's what I think. That belief is further strengthened by the fact that gold prices have hit multiple historic highs since December. Gold bullion breached the $2,100 per ounce mark for the first time this month.

Sales of gold, silver and jewelery reached a six-year high in December, rising 29.4% from a year earlier, government data showed. Precious metals are now one of the fastest growing consumer markets in China.

Purchases of gold beans for gifts and investments also peaked during the Chinese New Year, said a spokesperson for Chinese jeweler Lufu Holding International Co., Ltd.

Banks have also joined traditional gold retailers in selling gold beans. For example, China Merchants Bank introduced a product line of gold bean sets in July 2023.

“Despite the recent surge in gold prices in China, consumers continue to show strong preference for gold,” said Cindy Yong, Chairman and Managing Director of Emperor Watch and Jewelry. Ta. Like other major jewelry retailers, Emperor is talking about gold on social media. and e-commerce platforms.

impure beans

Experts say consumers of gold beans and other gold products who don't know the difference between real and fake gold are at risk.

Lily Chen, a 26-year-old office worker in Shanghai, recently discovered that almost all the gold beans she bought were contaminated with iron, zinc and copper when she tried to exchange them for a gold bracelet.

“I have never cut corners by buying gold super cheap and always made sure to buy from starred web stores. But this can still happen,” she said. Told.

Nevertheless, the frenzy over all things gold continues on social media. College students post diary-like entries about their gold purchases, couples share how they mended strained relationships with the gift of gold, and metal resellers and collectors offer gold investment advice. .

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP