It's hard to get excited about Logitech International (VTX:LOGN)'s recent performance, with its stock down 11% over the past month. However, a closer look at the company's healthy financials might make you think again. The company is worth keeping an eye on, given that fundamentals usually drive long-term market outcomes. Specifically, we decided to examine his ROE for Logitech International in this article.

Return on equity or ROE is an important factor to be considered by a shareholder as it indicates how effectively their capital is being reinvested. More simply, it measures a company's profitability in relation to shareholder equity.

Check out our latest analysis for Logitech International.

How is ROE calculated?

of ROE calculation formula teeth:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, Logitech International's ROE is:

22% = USD 486 million ÷ USD 2.2 billion (based on trailing twelve months to December 2023).

“Earnings” is the amount of your after-tax earnings over the past 12 months. This means that for every CHF 1 a shareholder invests, the company will generate a profit of CHF 0.22 for him.

Why is ROE important for profit growth?

So far, we have learned that ROE is a measure of a company's profitability. Now we need to evaluate how much profit the company reinvests or “retains” for future growth, which gives us an idea about the company's growth potential. Generally speaking, other things being equal, companies with high return on equity and profit retention will have higher growth rates than companies without these attributes.

Logitech International's earnings growth and ROE of 22%

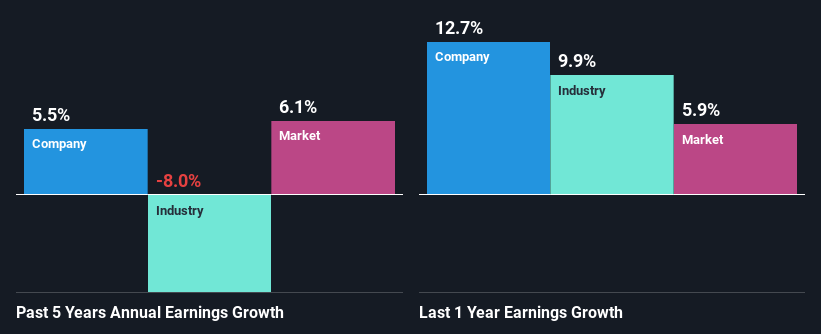

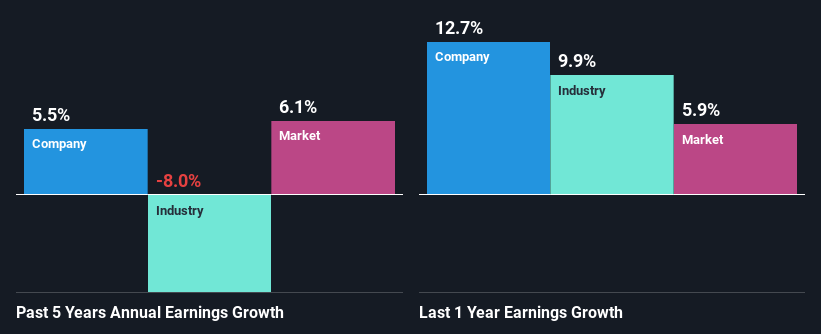

Firstly, Logitech International has a fairly high ROE, which is interesting. Furthermore, the company's ROE is high compared to the industry average of 6.5%, which is quite noteworthy. Perhaps as a result of this, Logitech International has been able to see a decent net income growth of 5.5% over the past five years.

Next, if we compare the industry net income growth rates, we find that the growth figures reported by Logitech International compare very favorably to the industry average, which showed a decrease of 8.0% over the past few years. Ta.

The foundations that give a company value have a lot to do with its revenue growth. The next thing investors need to determine is whether the expected earnings growth is already built into the stock price, or the lack thereof. Doing so will help you determine whether a stock's future is promising or ominous. If you're curious about Logitech International's valuation, check out this gauge of its price-to-earnings ratio compared to its industry.

Is Logitech International using its profits efficiently?

With a three-year median payout ratio of 29% (meaning the company retains 71% of its profits), Logitech International is poised for substantial earnings growth and pays a generous dividend. It seems like they are reinvesting efficiently. Covered.

Additionally, Logitech International is determined to continue sharing its profits with shareholders, as inferred by its long history of paying dividends for at least 10 years. Based on the latest analyst forecasts, we find that the company's future payout ratio over the next three years is expected to remain stable at 29%. Therefore, the company's future ROE is not expected to change much, with analysts forecasting it to be 23%.

conclusion

Overall, we are very satisfied with Logitech International's performance. In particular, we like that the company is reinvesting heavily in its business and has a high rate of return. Unsurprisingly, this led to impressive revenue growth. According to the latest industry analyst forecasts, the company is expected to maintain its current growth rate. Learn more about the company's future revenue growth forecasts here. free Create a report on analyst forecasts to learn more about the company.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.