(Bloomberg) – New Zealand is in a “fragile” state and needs to get its public finances back on track as a prerequisite to building a stronger economy, Prime Minister Christopher Luxon said in a major speech.

Most Read Articles on Bloomberg

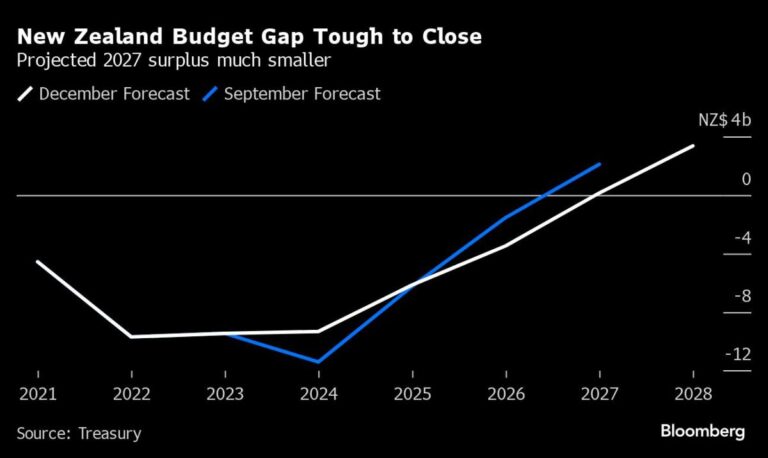

Government spending has increased by 84% since 2017, and debt has increased from NZ$5 billion ($3 billion) to “a staggering projection of well over NZ$100 billion,” Luxon said on Sunday. He made this statement in his first State of the Nation address after taking office. “I have to say, like everyone in New Zealand, the state of this country is fragile.”

The Prime Minister highlighted the NZ$7 billion in savings made by Finance Minister Nicola Willis in December's mini-budget, warning: “All I can say is where more is going to come from.”

The Luxon provincial government, a coalition of three centre-right parties, has vowed to weather the cost of living crisis by ending wasteful spending and refocusing the central bank on price stability. The report argues that fiscal austerity measures will help the Reserve Bank bring inflation back on target and start lowering borrowing costs.

“Of course, strong public finances alone are not enough to have a strong economy, but it is an important prerequisite,” Luxon said. “If you can't trust to borrow money, you can't build infrastructure.”

He called for a “return to austerity orthodoxy” and a determined focus on maintaining or creating a surplus.

“Inflation remains high. The cost of living crisis is not over yet and inflation here is higher than Australia, the UK, the US, Canada, Japan and the EU,” he said.

The speeches, often punctuated by applause, sought to establish a political narrative for the first year of his administration. He aims to push through tough decisions early in the election cycle, betting that gains will be made by the next election.

Mr Luxon spoke at length about welfare reform, highlighting the growing number of New Zealanders receiving long-term benefits as an issue that needs to be addressed.

“It's not popular with everyone now, but it's necessary,” he said. “More spending, more borrowing, and more taxes are not the path to prosperity, but a recipe for creating more of what we have seen over the past few years: rampant inflation, rising interest rates, and Development is not rapid.”

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP