On March 20, 2024, Nicholas Donohoe, Executive Vice President and Chief Business/Strategy Officer of AbbVie, Inc. (NYSE:ABBV) sold 21,082 shares of the company's stock. This transaction has been filed with his SEC and is described in his SEC filing below.

AbbVie Inc is a global, research-driven biopharmaceutical company dedicated to developing innovative, advanced treatments for the world's most complex and serious conditions. The company's portfolio includes therapeutics in areas such as immunology, oncology, virology and neuroscience.

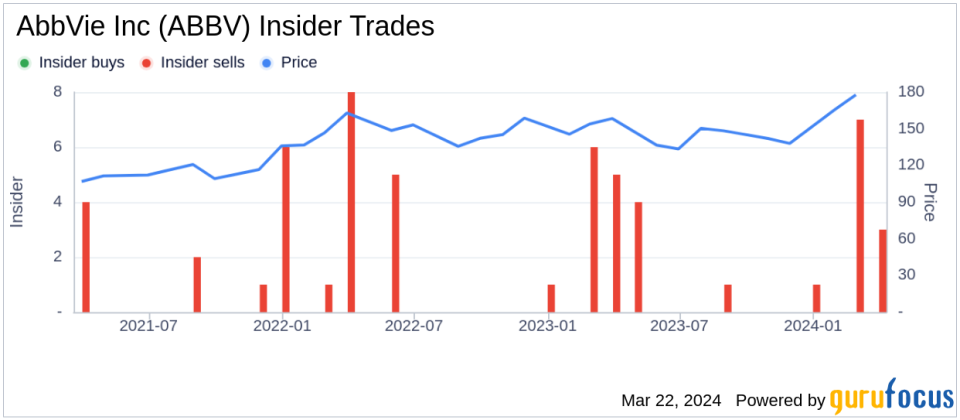

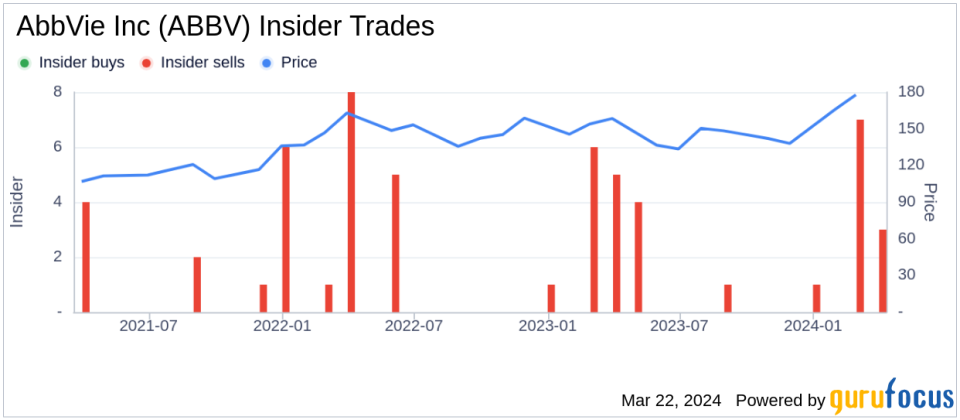

According to the data provided, this insider has been active in the market over the past year and has sold a total of 23,994 shares while not buying any shares. This latest sale continues the trend observed in AbbVie's insider trading history, with 16 insider sales and zero insider buys over the past year.

On the day of the most recent insider sale, AbbVie stock was trading at $176.3, giving the company a market cap of $315.97 billion. The company's price-to-earnings ratio is 65.37x, which is higher than both the industry median of 22.665x and the company's historical median price-to-earnings ratio.

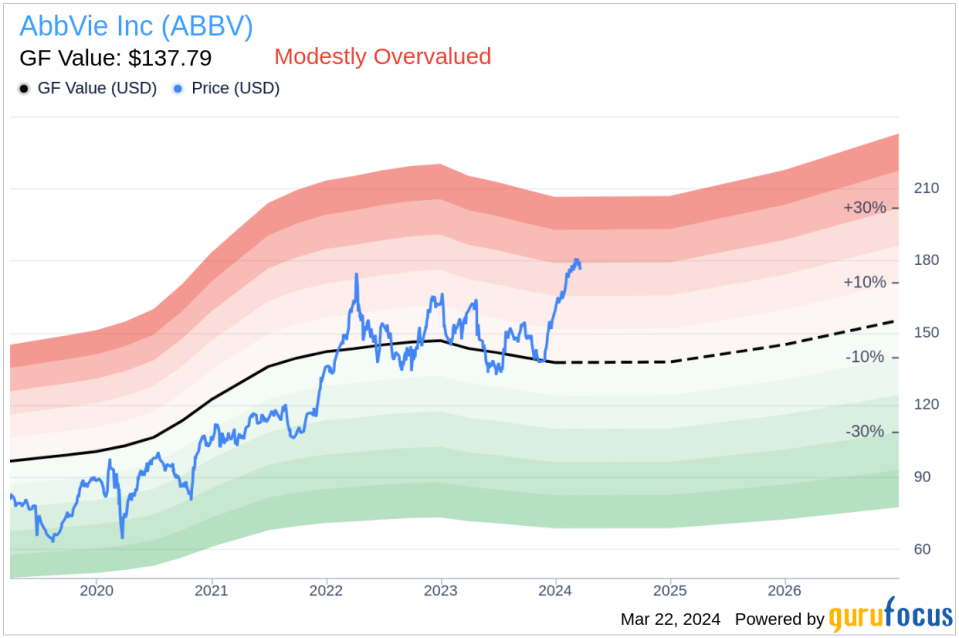

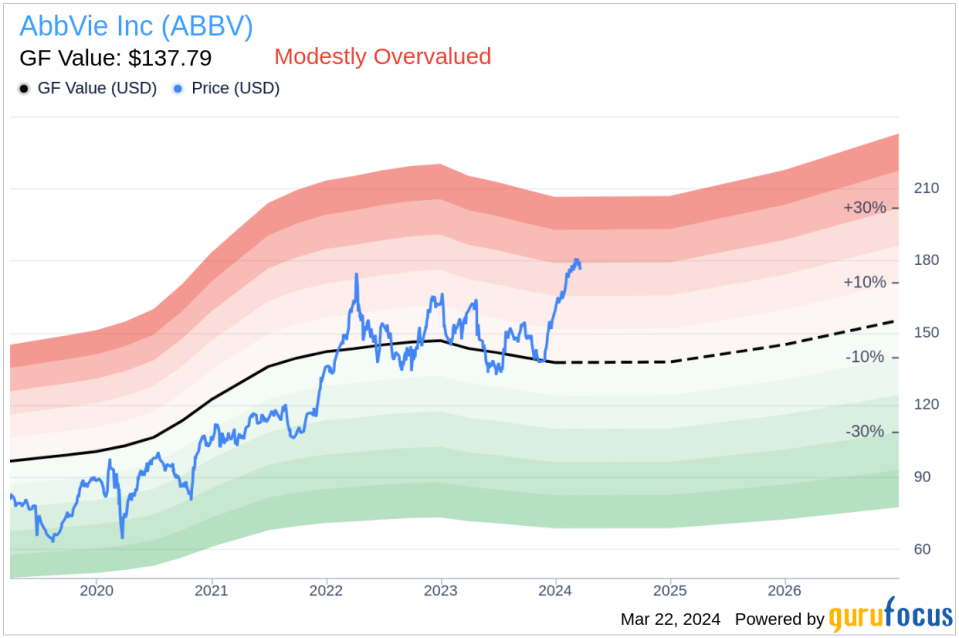

Price to GF value ratio is 1.28, current trading price is $176.3 and GuruFocus value is $137.79. This indicates that AbbVie Inc is considered moderately overvalued based on his GF value.

GF Value is a proprietary intrinsic value estimate by GuruFocus and is calculated using historical trading multiples, GuruFocus adjustment factors based on the company's past performance, and future performance estimates from Morningstar analysts.

The Insider Trends image above is a visual representation of insider buying and selling activity over time.

The GF Value image above provides insight into the stock's valuation compared to GuruFocus' estimated intrinsic value.

For investors who monitor insider activity, consistent selling by insiders, especially senior executives such as vice presidents and chief business/strategy officers, is noteworthy when considering an investment decision in AbbVie Inc. (NYSE:ABBV) It could be a point.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.