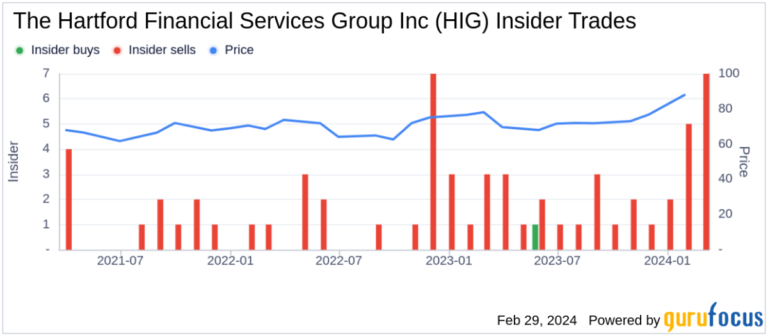

Hartford Financial Services Group (NYSE:HIG), a major investment and insurance company, reported insider sales, according to a recent SEC filing. Beth Costello, Executive Vice President and Chief Financial Officer, sold 38,915 shares of the company's stock on February 27, 2024. Beth Costello has been active in the market over the past year, selling a total of 77,830 shares and having no purchases. The most recent transaction took place at a price of $95.42, giving Hartford Financial Services Group a market cap of $28.498 billion. Hartford Financial Services Group's insider trading history shows a pattern of more insider selling than buying of the stock. Last year, there were 29 insider sells and only one buy.

From a valuation perspective, Hartford Financial Services Group's price-to-earnings ratio of 11.99x is lower than both the industry median of 12.37x and the company's historical median price-to-earnings ratio. This suggests a low valuation relative to its peers and its own historical metrics. The stock's current price of $95.42 is roughly in line with its GuruFocus Value (GF) of $88.40, indicating that the stock is fairly valued at its price relative to his GF. The value ratio is 1.08.

GF Value is determined by considering historical trading multiples, GuruFocus adjustment factors based on the company's past performance, and future performance estimates provided by Morningstar analysts. Insurance products such as non-life insurance, group welfare benefits, and investment trusts. The company is known for its commitment to sustainability and ethical business practices. For more detailed information, investors and analysts are encouraged to review his entire SEC filing. SEC filings

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.