-

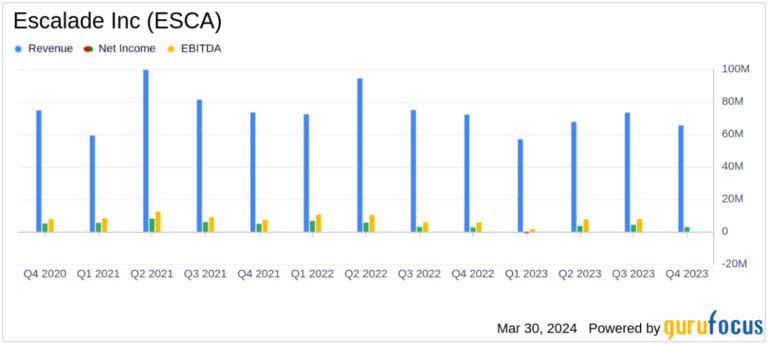

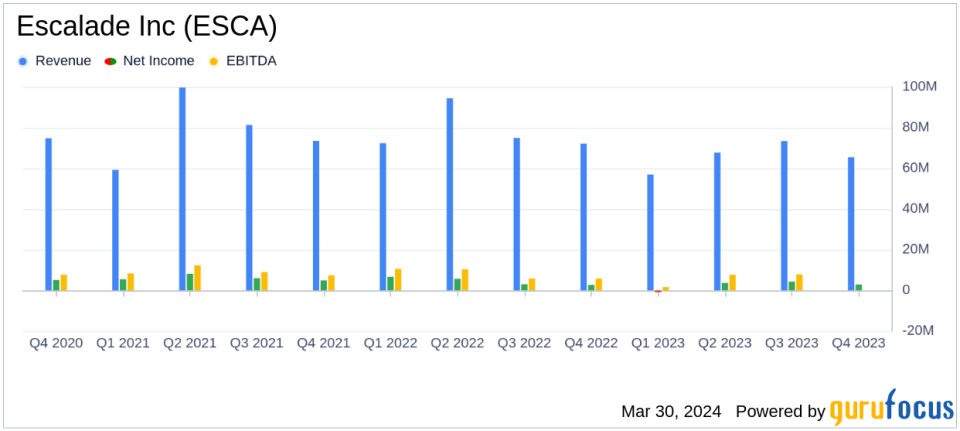

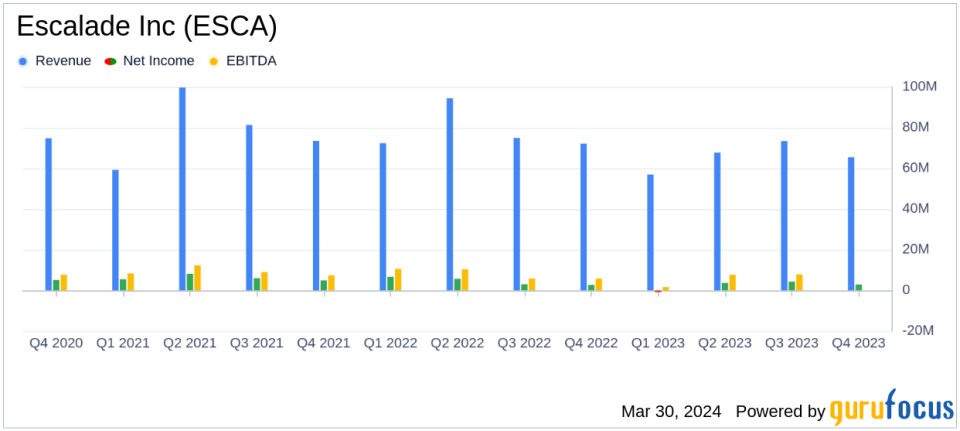

Net sales: Sales decreased by 9.2% in the fourth quarter and by 16.0% for the full year.

-

Gross profit: Despite a full-year decline of 3 basis points, it improved by 192 basis points in the fourth quarter.

-

Operating income: It increased by 1.6% in the fourth quarter, but decreased by 32.3% for the year.

-

Net income: Net income for the fourth quarter increased to $2.9 million from $2.7 million in the year-ago period.

-

Cash flow: Cash provided by operating activities jumped from $14.3 million to $20.6 million in the fourth quarter.

-

Debt reduction: We reduced debt by $21.1 million in the fourth quarter, lowering our net debt to EBITDA ratio to 2.2x.

-

dividend: A quarterly dividend of $0.15 per share has been declared and is expected to be paid on April 22, 2024.

On March 29, 2024, Escalade Corporation (NASDAQ:ESCA) released its 8-K report, disclosing its fourth quarter and full year 2023 financial results. The company is a prominent manufacturer and distributor of sporting goods and indoor/outdoor recreational products. In the fourth quarter, net sales decreased, but gross margin and operating cash flow improved.

Escalade Inc operates primarily in North America and Europe and offers a wide range of products under well-known brand names. Despite facing weak consumer demand in most product categories, the company was able to improve its gross profit margin by 192 basis points to 24.3% in the fourth quarter. This is due to price discipline, good sales mix, and reduced transportation and storage costs.

Financial highlights and challenges

Net sales for the quarter were down 9.2% to $65.5 million and for the full year down 16% to $263.6 million, but Escalade's focus on inventory reduction and cost control resulted in lower operating income and EBITDA for the quarter. has increased significantly. . The company's fourth-quarter net income was $2.9 million, or $0.21 per diluted share, up slightly from $2.7 million, or $0.20 per diluted share, in the year-ago period.

Escalade Inc's fourth quarter operating cash flow was particularly strong, increasing over 43.9% to $20.6 million. This financial result is very important for the company as it allows it to reduce debt and strengthen its balance sheet. In fact, the company reduced its debt by $21.1 million in the fourth quarter, resulting in a 12-month net debt to EBITDA ratio of 2.2x, compared to its 2.8x at the end of 2022. Improved.

Management's strategic response to market conditions

President and CEO Walter P. Glaser Jr. commented on the company's performance:

We ended the year on a strong note, highlighted by improved gross margins, strong cash generation and significantly reduced net leverage. As consumer demand softens due to changes in discretionary spending, we have successfully maintained price discipline for inline products while clearing excess inventory created during COVID-19 supply chain disruptions. , we were able to reduce both fixed and variable costs and continue to drive sales. A more favorable sales mix resulted in higher earnings per share and cash flow in the fourth quarter despite lower sales.

The company's strategic focus on working capital discipline resulted in a nearly $13 million reduction in total inventory and improved working capital efficiency. Glaser also emphasized that the company will wind down most of its operations and incur severance and other closing costs when it exits Mexico.

Escalade remains optimistic about value creation in the coming year, with a strong portfolio of recreational brands to navigate the current macroeconomic environment.

Information for investors and future outlook

Escalade Inc plans to hold a conference call on April 1, 2024 to review financial results and discuss recent events. The company also reconciled GAAP net income and Non-GAAP EBITDA in its earnings release, emphasizing the importance of non-GAAP measures as a supplement to U.S. GAAP performance measures.

Investors and interested parties are encouraged to view the complete financial details on the earnings call and participate in the upcoming conference call to gain further insight into Escalade Inc's financial performance and strategic initiatives.

For more information, please see the full 8-K earnings release from Escalade Inc here.

This article first appeared on GuruFocus.